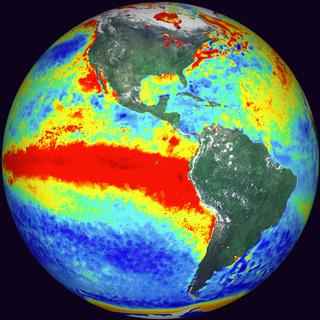

It’s been widely reported in the last few weeks that an El Nino weather pattern is developing in the Pacific. The phenomenon causes a warming of the Pacific ocean which in turn affects weather patterns globally, although the worst affected are those surrounding the Pacific. El Nino conditions are thought to cause a weaker monsoon in India than normal with lower rainfall levels than are required to irrigate land and crops. It also impacts India’s supply of electricity as a lot of their electricity production comes from hydropower plants and these are currently running below 40% capacity.

It’s been widely reported in the last few weeks that an El Nino weather pattern is developing in the Pacific. The phenomenon causes a warming of the Pacific ocean which in turn affects weather patterns globally, although the worst affected are those surrounding the Pacific. El Nino conditions are thought to cause a weaker monsoon in India than normal with lower rainfall levels than are required to irrigate land and crops. It also impacts India’s supply of electricity as a lot of their electricity production comes from hydropower plants and these are currently running below 40% capacity.

The biggest and most obvious impact of El Nino in India is of course the impact to farmers as crops will fail and sadly people can starve due to a weaker monsoon season. That’s where index based crop weather insurance comes into it’s own.

Most of the index based weather products available through microfinance schemes pay out both for too much and for too little rain. In the case of a weak monsoon claims could potentially run into the region of a 100%+ claims ratio for the first time, making this an unprofitable venture. That’s the concerning factor in India; microinsurance schemes are highly subsidised in order to attract reinsurers to these markets and if the profitability becomes even less likely then we may see some of the larger players pull out.

Of course, the savvy global reinsurers will have a portfolio of weather risk products themselves to hedge the risks of the microinsurance schemes going south, and while that may help some to stay interested, somewhere the loss will catch up with somebody. Climate change and patterns of weather such as El Nino make it extremely difficult to attempt to ‘yield’ manage weather insurance, some other solution needs to be found to provide a backstop to those running these schemes. An answer could be found by utilising instruments such as cat bonds as the final backstop for a bucket of reinsurers microinsurance policies, allowing investors to take the final risk in return for a healthy interest on their coupon.

More on this from the Hindu Business Line.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.