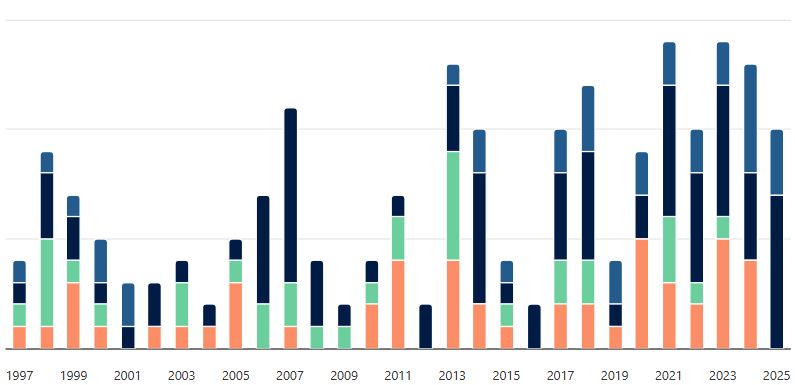

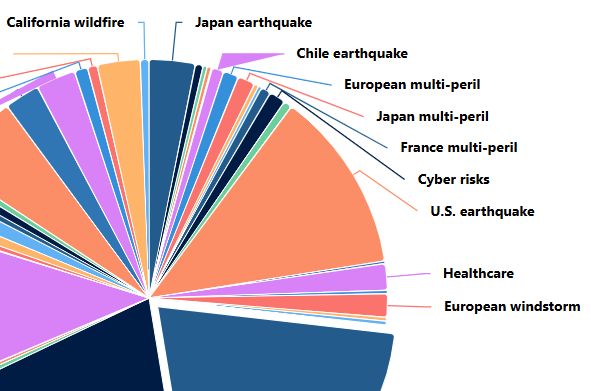

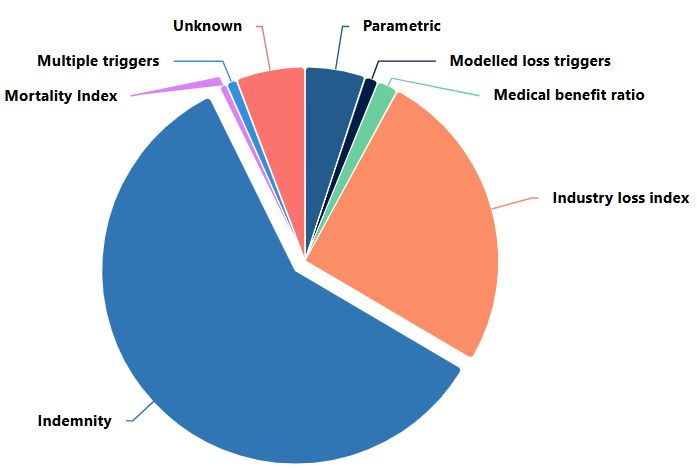

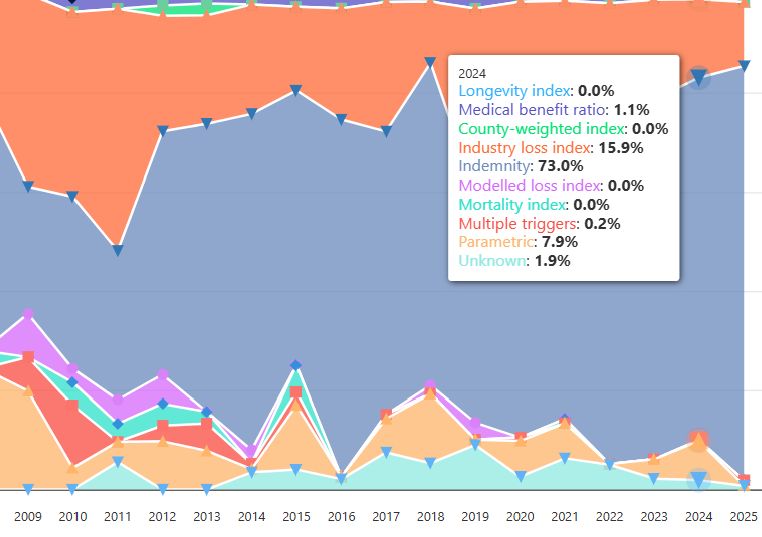

Our catastrophe bond and insurance-linked securities (ILS) charts:

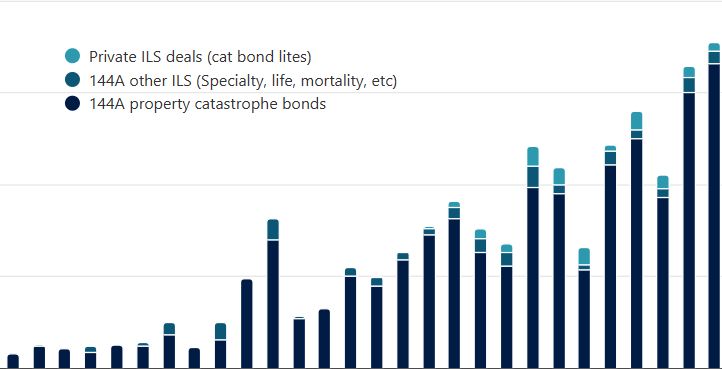

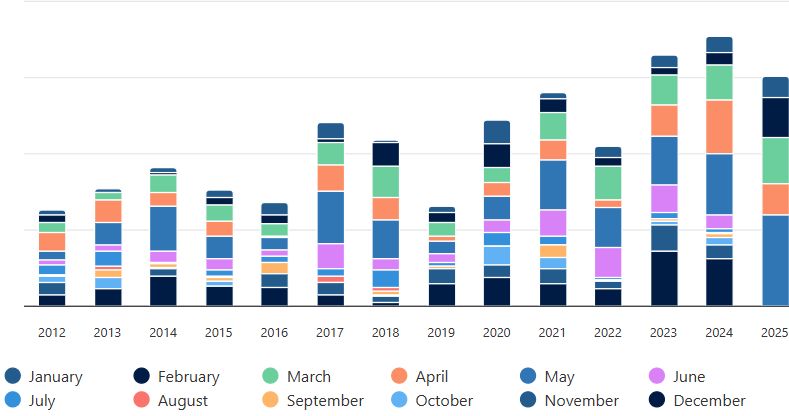

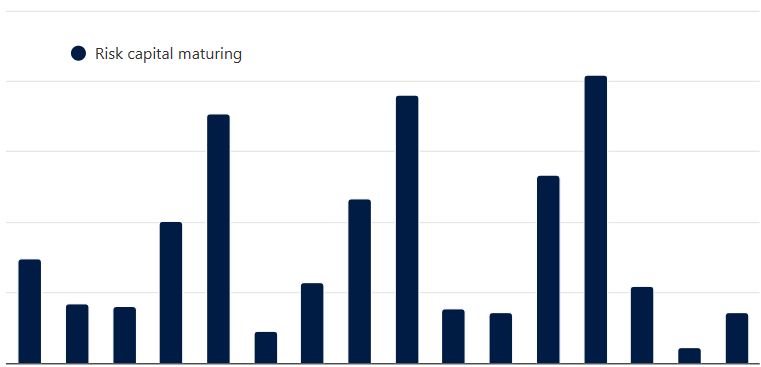

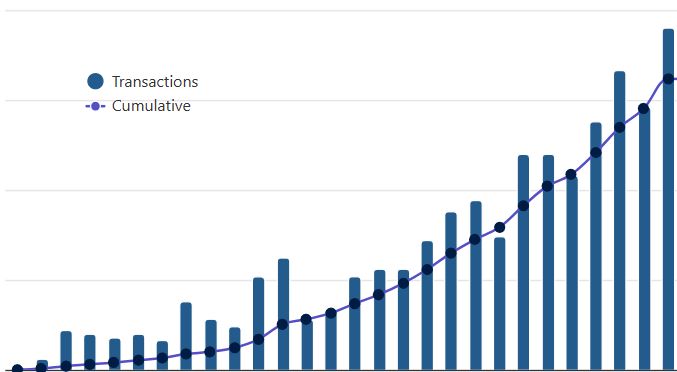

The data to create these charts is taken from the insurance-linked securities (ILS) issuance we’ve tracked in our Artemis Deal Directory. The majority of these charts are based on data from: pure 144a catastrophe bond deals; other cat bond like deals featuring specialty, life, mortality risk, etc; private cat bond lites or private ILS deals.

We’ve split our interactive cat bond market charts into the categories below:

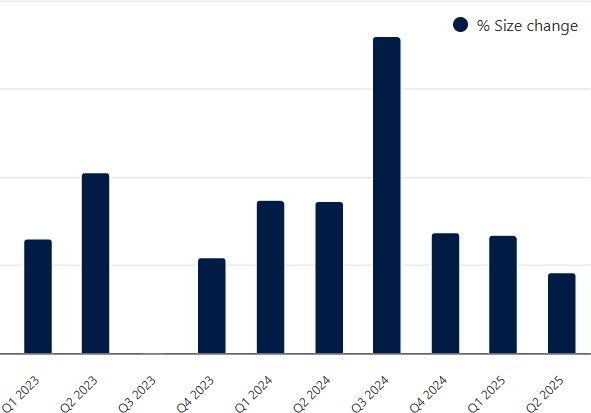

- Catastrophe bond issuance charts and visualisations

- Catastrophe bond sponsor leaderboard and first-time cat bond sponsors

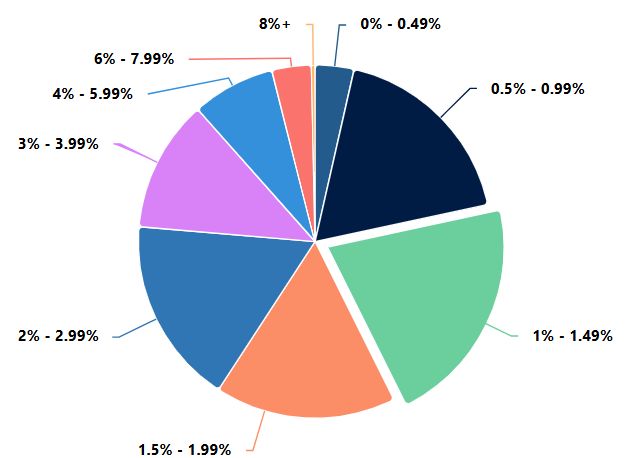

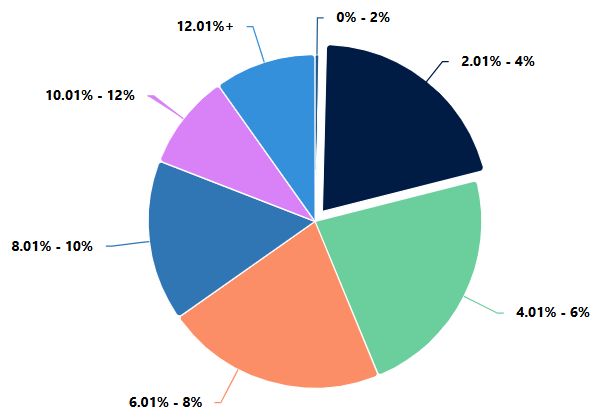

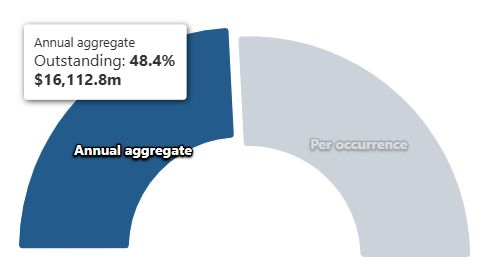

- Charts and visualisations breaking down the catastrophe bond market

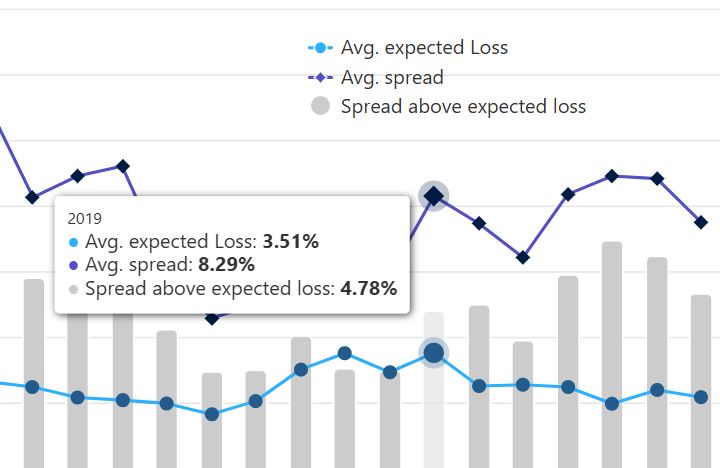

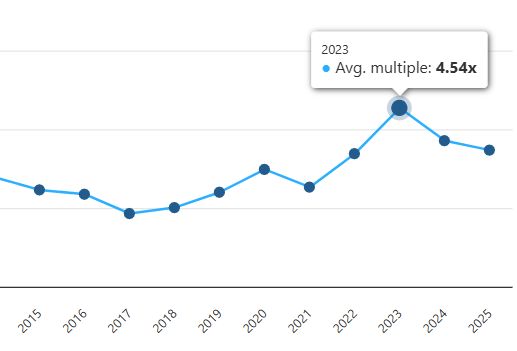

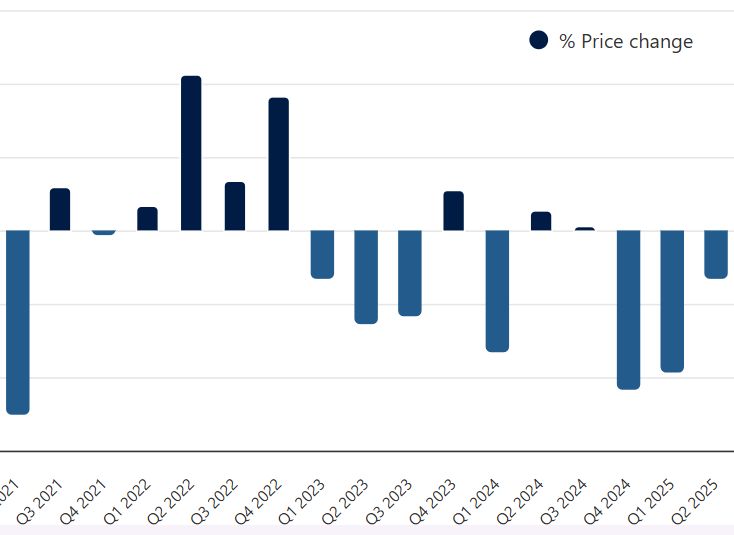

- Catastrophe bond pricing at issuance charts and visualisations

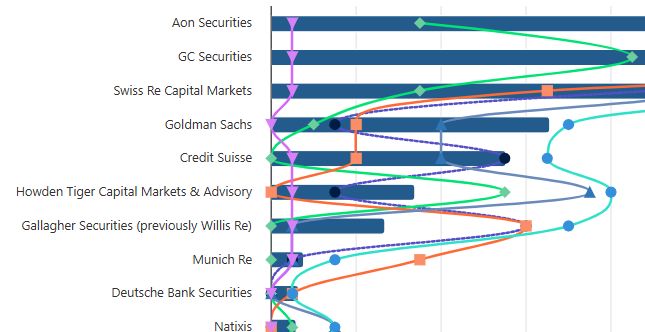

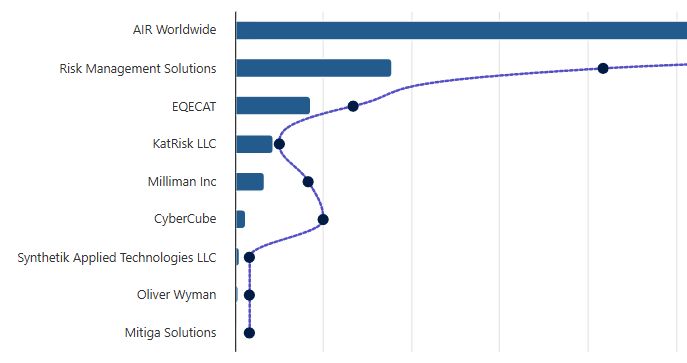

- Catastrophe bond market service provider leaderboards

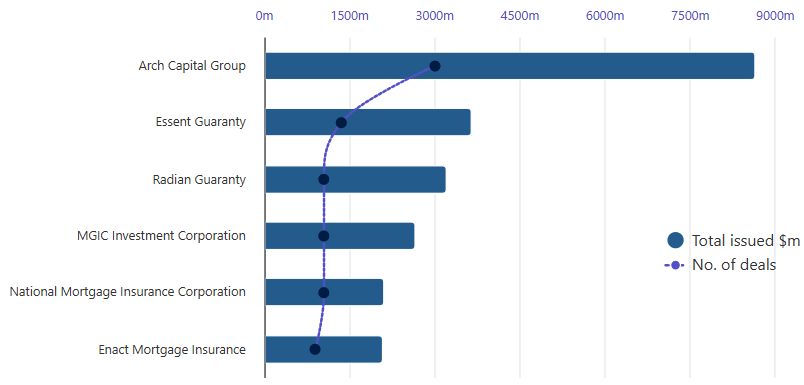

Charts specific to mortgage insurance-linked securities (ILS) can be found here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.