Hurricane Willa’s minimum central pressure has now risen as the storm has weakened slightly, which puts Mexico’s World Bank supported IBRD / FONDEN 2017 catastrophe bond in the clear as the storm will now not be sufficiently intense when it enters the parametric box to trigger any payout.

Yesterday hurricane Willa intensified to a Category 5 storm with sustained winds of 160 mph and a minimum central pressure that dropped to 925 mb, which put the storm as sufficiently intense to breach the parametric trigger for the $110 million Class C Pacific named storm notes of the Fonden 2017 catastrophe bond and cause a payout to be made.

But overnight forecasters have proved correct and hurricane Willa has weakened back to 140 mph winds and the minimum central pressure has now risen to 942 mb, which is above the levels required for any of the stepped percentage payouts to be made.

This $110 million tranche of Class C notes, issued through this latest incarnation of the MultiCat Mexico catastrophe bond that was distributed as IBRD catastrophe-linked Capital At Risk notes by the World Bank, offer Mexico a source of insurance and reinsurance protection against Pacific named storm or hurricane impacts.

The notes are structured with a parametric trigger, so it is the location, intensity and any other payout factors related to a Pacific hurricane that can trigger a payment and ultimately loss of principal for the investors and ILS funds backing the catastrophe bond tranche.

In order for a payout to have been triggered and due, the central pressure of hurricane Willa needed to be calculated as low enough when it entered or crossed into the relevant named storm parametric box or area.

Yesterday, with hurricane Willa reaching Category 5 strength and the pressure dropping further to 925 mb, a payout looked possible. But now that the pressure has risen to 942 mb, that is no longer the case and investors will consider these notes safe.

For hurricane Willa, based on where the storm is likely to make landfall, a 25% payout of principal could have occurred if the central pressure was between 935 mb and 933 mb when the storm entered the parametric box. Central pressure of 932 mb down to 921 mb could have triggered a 50% payout, which was where the hurricane sat last night. While a central pressure that fell to 920 mb or below could have caused a 100% payout of the principal associated with the catastrophe bond tranche.

So the Fonden 2017 catastrophe bond tranche is now safe, as hurricane Willa is not forecast to reintensify before it makes landfall later on today.

But, with sustained winds still of 140 mph and higher gusts, hurricane Willa is likely to have a devastating impact on the coastal populations of Mexico where it makes landfall from storm surge and wind damage.

The NHC explained:

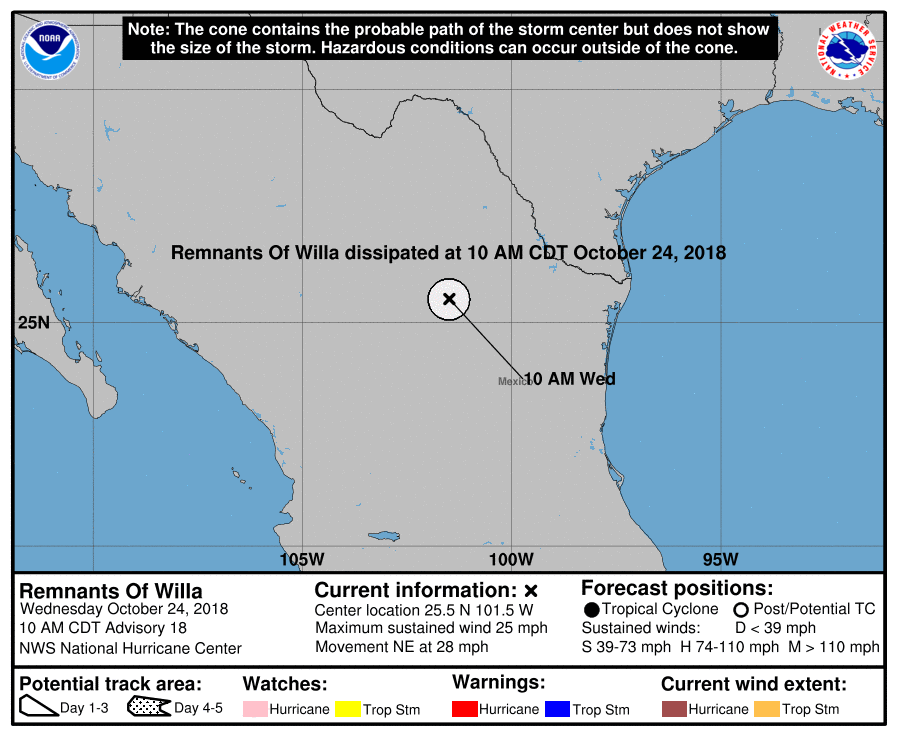

Maximum sustained winds have decreased to near 140 mph (225 km/h) with higher gusts. Willa is an extremely dangerous category 4 hurricane on the Saffir-Simpson Hurricane Wind Scale. While gradual weakening is forecast today, Willa is expected to be a dangerous major hurricane when it reaches the coast of Mexico. Rapid weakening is expected after landfall tonight and Wednesday.

Hurricane-force winds extend outward up to 35 miles (55 km) from the center and tropical-storm-force winds extend outward up to 125 miles (205 km).

The estimated minimum central pressure is 942 mb (27.82 inches).

The hurricane center warns of “an extremely dangerous storm surge” for coastal regions near the landfall of the eye of hurricane Willa, particularly for portions of the coast of southwestern Mexico in southern Sinaloa and Nayarit, as well as rainfall accumulations of up to 12 inches.

As Willa is expected to maintain its major status, so Category 3 hurricane winds or greater, it still suggests a storm that could cause significant damage in the landfall area, as well as losses to insurance and perhaps some reinsurance interests.

A major category hurricane Willa landfall will cause wider insurance and reinsurance market losses. Exposure for the ILS market, beyond this cat bond, is likely to be relatively limited though.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Hurricane Willa modeled intensity guidance (from TropicalTidbits.com)