April 2022 saw insurance-linked securities (ILS) fund strategies deliver a third month in a row of relatively muted performance, with pure catastrophe bond fund strategies suffering the price related effects of spread widening in the marketplace.

The average return of insurance-linked securities (ILS) funds was -0.04% return for April 2022, according to the Eurekahedge ILS Advisers Index.

The average return of insurance-linked securities (ILS) funds was -0.04% return for April 2022, according to the Eurekahedge ILS Advisers Index.

It was catastrophe bonds that dragged the Index to negative performance in April, while private ILS strategies, so those focused more on collateralised reinsurance and retrocession linked investments, fared much better in the period with a relatively benign month catastrophe wise.

ILS Advisers explained that as the mid-year reinsurance renewals were approaching, a substantial increase in premiums is being seen, in the range of +20% to +30%.

“This higher premium level on new issuances also led to an upward adjustment of the spreads of existing issues in the liquid part of the ILS market,” ILS Advisers said, which has impacted catastrophe bond performance during the month of April.

“Cat bond spreads widened further in April. Cat bond prices lost – 0.46% in April, resulting in a +0.06% total return for the Swiss Re Global Cat Bond Index,” the investment manager and advisory noted.

As a result, pure catastrophe bond funds tracked by ILS Advisers and Eurekahedge were down by -0.39% in April.

Conversely, the subgroup of ILS funds whose strategies include private ILS and collateralised reinsurance deals were up 0.22%.

Across the ILS funds tracked by ILS Advisers, 11 reported positive returns for the month of April 2022, while 13 fell to a negative return for the month.

There was a wide range in performance as well, ranging from -2.5% to +0.9%.

May is again likely to see price related effects for catastrophe bond funds, as the spread widening has continued to affect that marketplace.

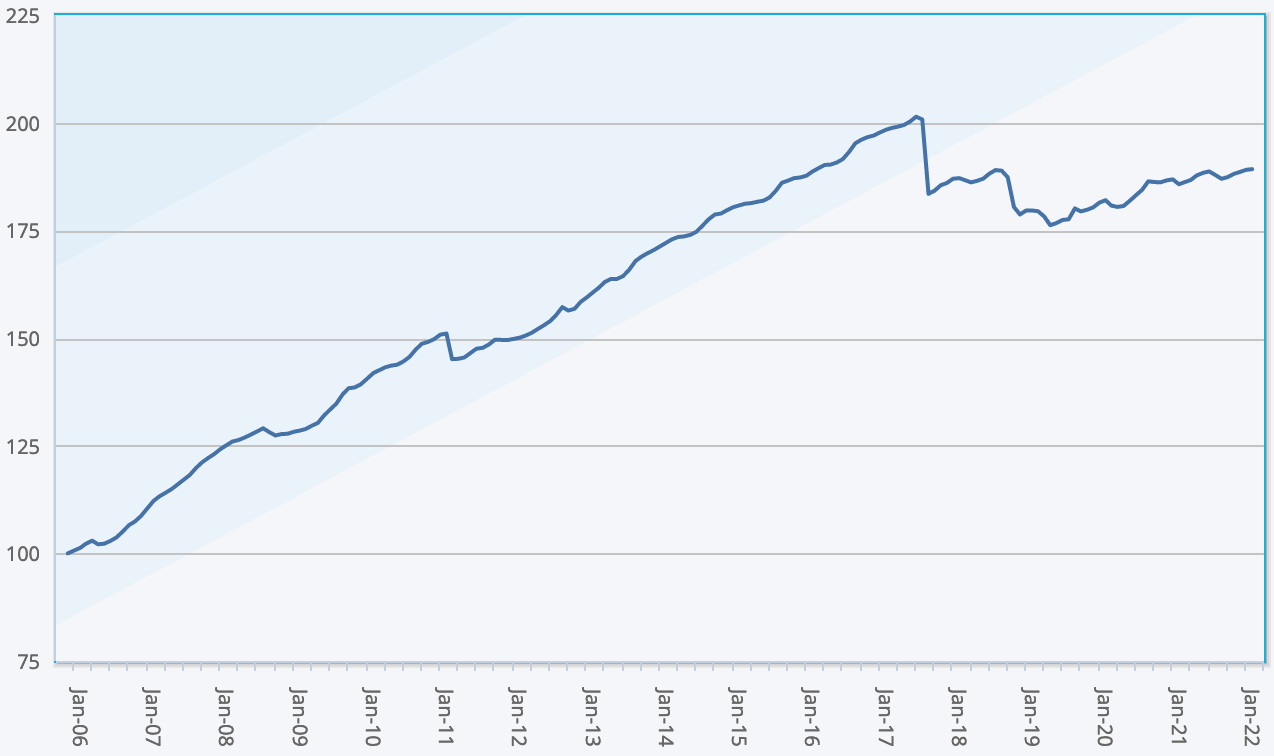

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 28 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.