At the mid-year reinsurance renewals, US property catastrophe risk-adjusted rate increases were on average the highest in 17 years, with even loss-free accounts generally up by +20% to +50%, according to broker Guy Carpenter.

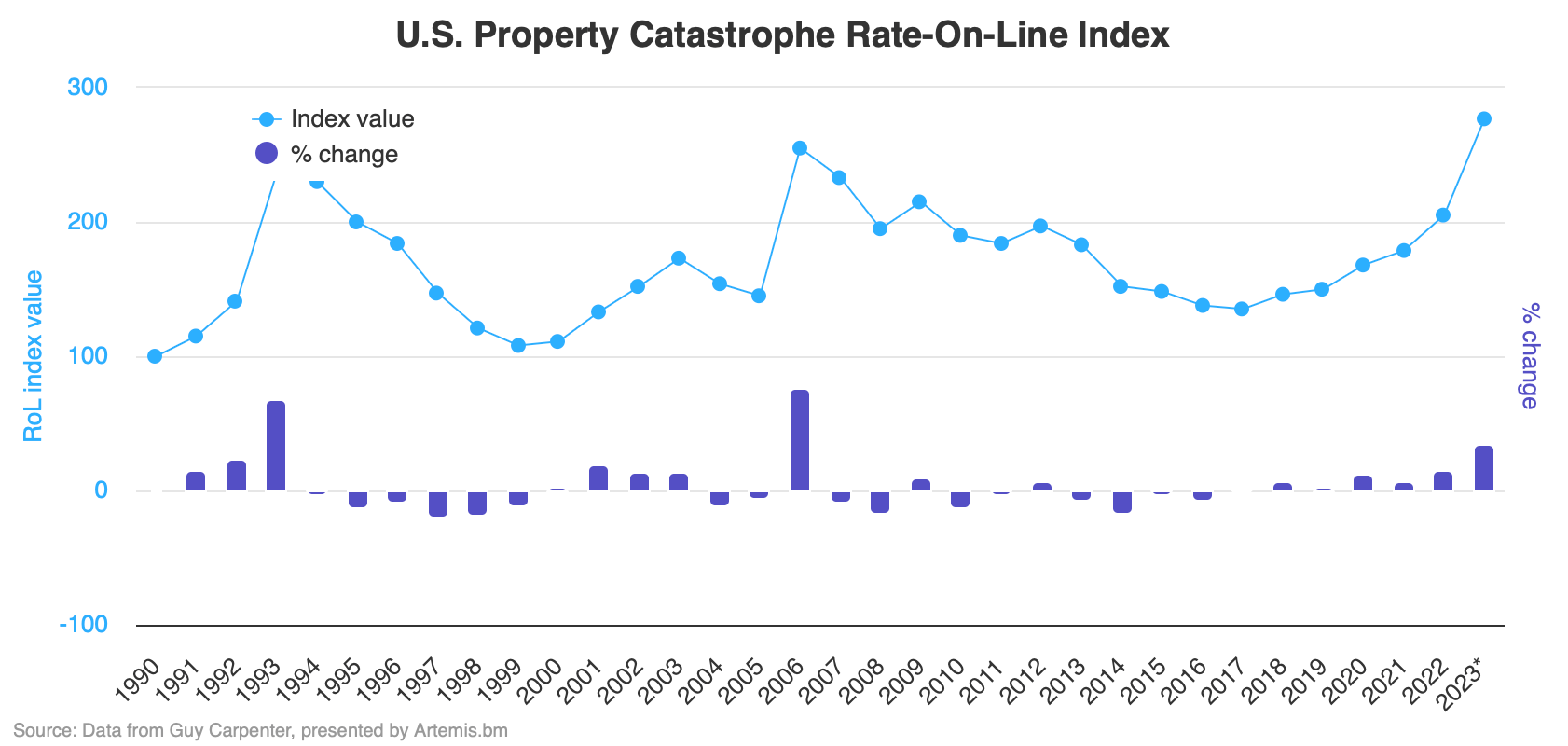

As a result, the Guy Carpenter U.S. Property Catastrophe Rate-On-Line Index has risen by 35% for January through July 2023 renewals, data you can now analyse using our interactive chart.

Guy Carpenter’s Rate-On-Line Index for US property catastrophe reinsurance is an alternative measure of price change, incorporating the impact of structural adjustments and current views of risk on actual dollars paid.

You can view the Index below. Click the image to access the interactive version.

Commenting on the mid-year 2023 reinsurance renewals, Guy Carpenter explained that market conditions have become somewhat less challenging, although overall reinsurance continues to “recalibrate.”

Broader market trends seen at the January 1/1 renewal did continue at the mid-years, but with improved timing and concurrence around terms and conditions, the broker explained.

Property pricing saw continued risk-adjusted rate increases in many segments, but the average change moderated from January 1.

Noting “additional capacity and increased appetite” while this helped, the capacity remained disciplined around attachment points, pricing and coverage, Guy Carpenter continued.

There was strong demand for property reinsurance capacity at the mid-year renewals, the broker further explained, but added that “market corrections have rebalanced the supply/demand disparity faced by many regions a year ago.”

Pricing remains firm, but there is a wide range of risk-adjusted rate changes seen throughout individual layers.

Global property catastrophe reinsurance risk-adjusted rate increases ranged from +10% to +50%, with loss-impacted clients often seeing higher pricing, according to the broker.

While, in the US, property catastrophe reinsurance risk-adjusted rate increases even on loss-free accounts were generally up +20% to +50%.

Capacity levels rebounded somewhat, helped by the insurance-linked securities (ILS) market, Guy Carpenter said.

Often cedents have chosen to retain more risk, rather than accepting unfavorable reinsurance terms and so lower-layer capacity and aggregates remain highly constrained, but the “new capital raised by existing market participants and growing appetite by other established reinsurers saw overall capacity levels rebound.”

In retrocession, capacity was less scarce than seen earlier in the year, but generally the pricing trends continued at the mid-year, Guy Carpenter said.

But the main driver of the better capacity environment, appears to have been more linked to reductions in demand, due to higher pricing, than a recovery of any significant kind.

Dean Klisura, President & CEO of Guy Carpenter, commented, “Price adequacy across lines and supportable structures are expected to continue to drive sufficient capacity levels. For cedents, higher levels of retained risk across the business in 2023 will most likely impact volatility in 2024, necessitating strategic portfolio management.”

“Amid the capacity rebound, a highly viable and revitalized insurance-linked securities market has emerged with a flurry of activity occurring in the first half of 2023. At Guy Carpenter, we are committed to enabling our clients to anticipate and navigate this ever-changing marketplace,” added David Priebe, Chairman, Guy Carpenter.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.