According to data from AM Best, just $850 million of catastrophe bonds and other insurance-linked securities (ILS) are held by US insurers in their investment portfolios, a surprising low number given the evident diversification they can offer.

AM Best has analyse US insurers’ investments to identify where they hold catastrophe bonds or other ILS structures in their portfolios and the results is that very little investing really goes on.

AM Best has analyse US insurers’ investments to identify where they hold catastrophe bonds or other ILS structures in their portfolios and the results is that very little investing really goes on.

“US insurers hold only about $850 million of the roughly $33 billion outstanding cat bonds, despite the generally higher returns cat bonds offer, given insurers’ continual search for yield and the low correlation of the asset class with the broader capital markets, which provides diversification.

“Correlation with catastrophe risk in their underwriting books could be a concern with regard to asset allocation,” AM Best explained.

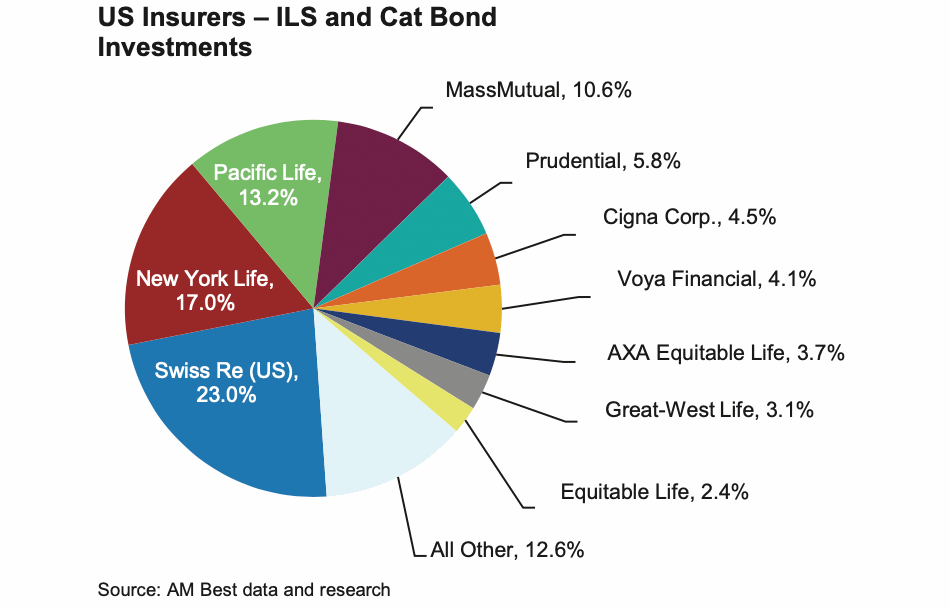

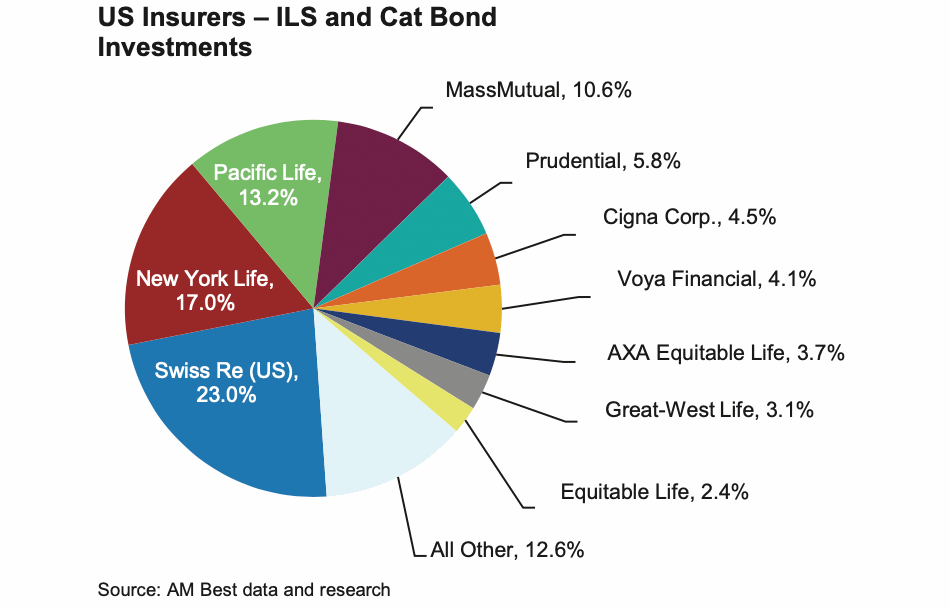

Only around 40 US insurers have catastrophe bond and ILS holdings, AM Best believes, with just five companies account for nearly 70% of investments.

What’s interesting to note is that of the top US insurers investing in cat bonds, the majority are life insurance focused, meaning the question over catastrophe risk correlation is not as relevant.

For years it’s been thought primary insurers with a life focus could invest in cat bonds and gain some level of diversification benefit at the same time.

However, the capital penalties for these investments has not made it that attractive to do this, so uptake of investments into cat risk have been low.

It’s also interesting to note that some of these life insurers have taken to writing some cat risk on the inwards, underwriting side, sometimes even in retrocession, as a way to add diversification to their businesses.

But still, the avenue of adding diversification by investing into catastrophe risk-linked securities has not been opened for life insurers, which we feel is likely the reason for the very low level of investments AM Best has found.

It remains surprising that US regulators haven’t yet relaxed rules to make it more appealing for a life focused primary carrier to invest in cat bonds as a way to add diversification benefits.

It’s been discussed at the NAIC and among regulators for years, but AM Best’s data seems to show no change has occurred to-date.

Swiss Re’s US entities is seen as the biggest cat bond investor by AM Best, but of course that reinsurers strategy has been evolving and it’s now opened up its internal cat bond portfolio to external investors through the launch of a new asset management unit.

“Most of the other investors are life insurers, as mortality risk and catastrophe risk are less correlated,” AM Best explained.

As well as catastrophe bonds, there are investments in financial guarantee ILS and mortgage ILS notes, AM Best said, but no evidence of any broader appetites among these largely life focused carriers.

It’s also worth noting that most of the investments are below investment-grade, mostly NAIC-4 and NAIC-5, while less than 30% are NAIC-1, so this will be another factor that can hold back insurers from investing in cat bonds and other ILS.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.