In renewing its $2.1 billion reinsurance and catastrophe bond program for 2020, the Texas Windstorm Insurance Association (TWIA) paid some 19% more in terms of overall rate-on-line (ROL) compared to the prior year.

Reflecting the hardening of reinsurance rates, particularly in catastrophe exposed property lines that have faced losses in recent years, TWIA’s reinsurance renewal costs were significantly above budget.

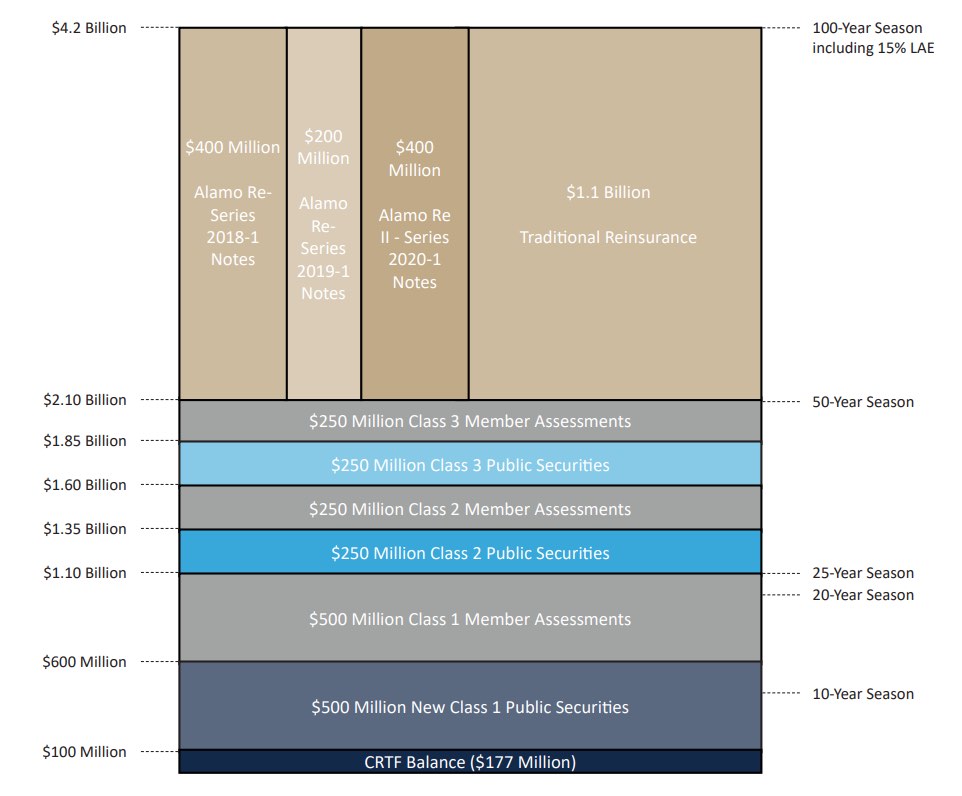

The residual market insurer for the state of Texas had locked in long-term reinsurance protection with a new $400 million Alamo Re II Pte. Ltd. (Series 2020-1) catastrophe bond issuance in advance of its June renewals, to which it then needed to add $1.1 billion of fresh reinsurance from traditional and other markets, including ILS funds, or collateralised players.

Having secured that, taking its overall funding for the 2020 hurricane season to $4.2 billion including its Catastrophe Reserve Trust Fund, member assessments on insurers and pre or post-event debt funding sources, TWIA is as well protected for the year as it was in 2019, but at much higher cost.

At a governing board meeting last week, TWIA executives revealed that the gross cost of its 2020 reinsurance program was $107.5 million, much higher than the budgeted cost of $93.1 million.

It reflects a higher rate-on-line (ROL) paid, as TWIA’s 2020 reinsurance program came at a 5.1% ROL for 2020, compared to a 4.3% ROL for its 2019 program.

“The increase in costs reflects the extremely challenging reinsurance market in effect this renewal season,” TWIA executives said.

As well as its new catastrophe bond and the $1.1 billion of renewed reinsurance limit, TWIA also benefits from continued coverage from two older cat bonds which will have helped it keep the costs down somewhat, given these multi-year instruments were issued before the recent firming of rates.

This $600 million of still in-force catastrophe bonds, made up of $400 million of Alamo Re Ltd. (Series 2018-1) cat bonds and $200 million of Alamo Re Ltd. (Series 2019-1) cat bonds, sit alongside the new cat bond and the reinsurance in TWIA’s tower.

Adding to this $4.2 billion reinsurance tower, TWIA said that it has also secured a $500 million line of credit from J.P. Morgan and Bank of America, which is designed to provide immediate liquidity, if needed, should TWIA have to access the statutory funding layers of the tower after a catastrophic hurricane that struck its coverage area along the Texas Gulf coast.

Breaking down the $1.1 billion of reinsurance limit, TWIA said that 93% is placed with reinsurers rated A or better by A.M. Best, 91% is placed with reinsurers with a policyholder’s surplus in excess of $1 billion, 19% is placed with Lloyd’s syndicates and 40% is placed with reinsurers in Bermuda.

TWIA’s $2.1 billion annual aggregate reinsurance and cat bond program, sitting on-top of its other funding sources, means the insurer is covered for 1-in-100 year storms, which is a mandated funding level for the organisation.

Challenges may come should the funding be severely eroded by a hurricane this year, as replenishing the reinsurance and cat bond aspects of the tower may come with even higher costs.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.