The Texas Windstorm Insurance Association (TWIA) has now secured the reinsurance and risk transfer it wanted for 2023, with its tower placed to the targeted $4.508 billion and $1.2 billion of that provided by catastrophe bonds.

With the overall target set for its reinsurance and funding tower to provide $4.508 billion of protection for the coming hurricane season, TWIA has again put catastrophe bonds at the heart of this, in fact cat bonds are a slightly larger component of the reinsurance than in prior years.

With the overall target set for its reinsurance and funding tower to provide $4.508 billion of protection for the coming hurricane season, TWIA has again put catastrophe bonds at the heart of this, in fact cat bonds are a slightly larger component of the reinsurance than in prior years.

Recall, TWIA has already recently secured a new $500 million Alamo Re Ltd. (Series 2023-1) catastrophe bond, more than replacing a maturing $400 million cat bond from 2020.

In addition, for the 2023 hurricane season, TWIA has reset $700 million of existing catastrophe bonds for 2023, the $500 million of Alamo Re Ltd. (Series 2021-1) cat bonds and $200 million of Alamo Re Ltd. (Series 2022-1).

So that’s the $1.2 billion of catastrophe bond coverage in-force for the 2023 year.

TWIA’s Board heard today that the insurer of last resort has now secured a further $1.043 billion of reinsurance, which was described as traditional, so filling out the reinsurance tower needs for the 2023 wind season.

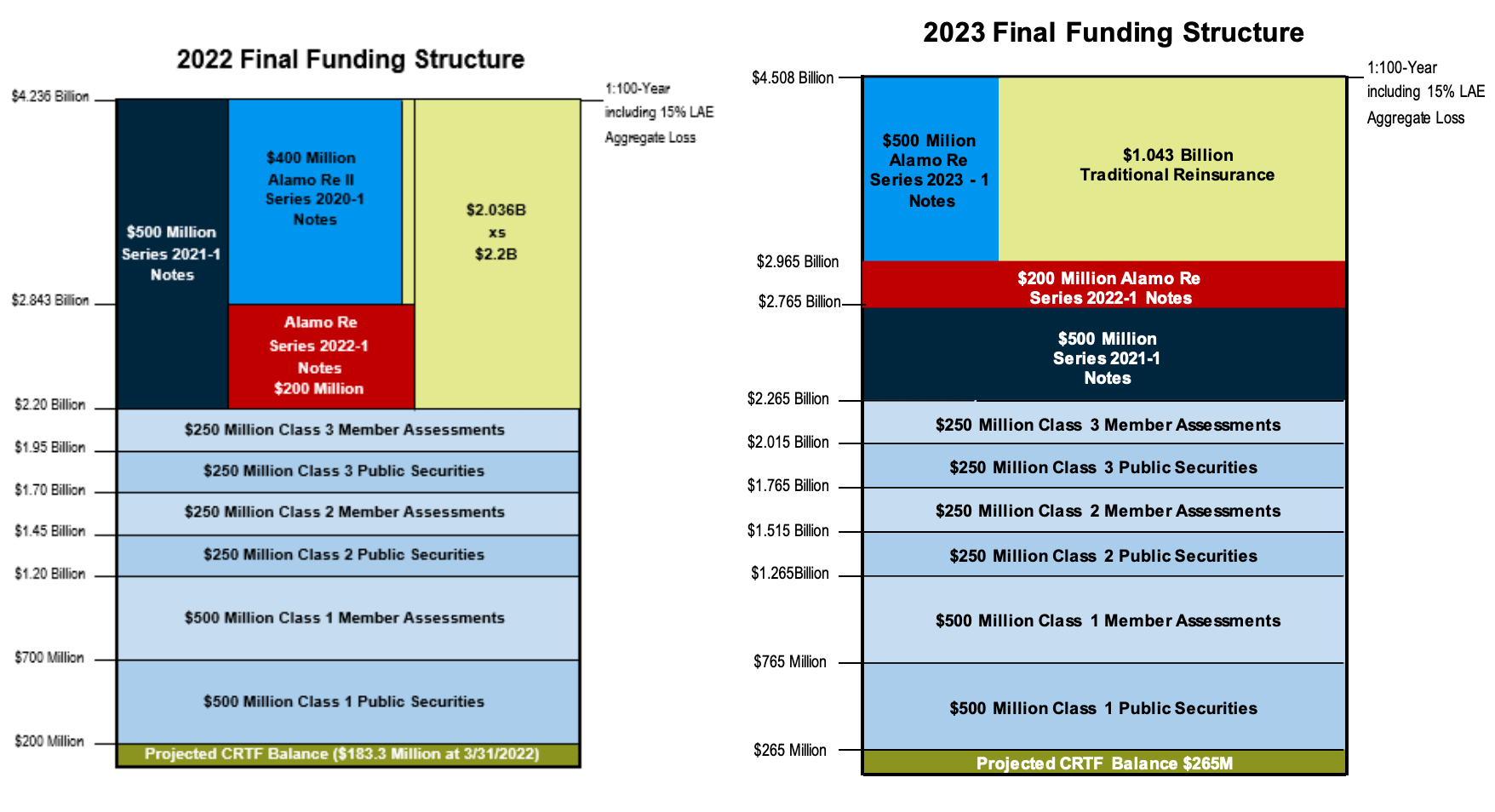

As a result, the risk transfer component of TWIA’s funding tower, which will run from an attachment of $2.27 billion of losses up to the $4.508 billion top of the tower, so roughly $2.238 billion of reinsurance and cat bond risk transfer, has now been secured for 2023, $1.2 billion of it being from cat bonds.

The 2022 reinsurance tower featured $2.016 billion of cat bonds and reinsurance, with $1.1 billion from the cat bond market.

You can compare the TWIA reinsurance and funding towers year-on-year below:

However, it is notable that a TWIA memo seen by Artemis from early May stated that the insurer would pursue that $1.043 billion in both the traditional reinsurance and capital markets.

In fact, the memo stated that, “We are in the process of placing the remaining $1 billion of coverage now, which is expected to include both traditional reinsurance and an additional new catastrophe bond issuance.”

But, it seems that either the cat bond market was perhaps not as receptive as TWIA and its brokers had hoped, or perhaps more likely the traditional reinsurance market showed a stronger appetite and more attractive execution than had been anticipated.

We favour the latter as most likely, given the reports of capital flowing in from the likes of Berkshire Hathaway, capital raises by Everest, as well as property catastrophe risk appetite being seen from the likes of Arch, Ariel, DE Shaw and others.

Of course, it is possible that having already absorbed a $500 million cat bond from TWIA the ILS market’s appetite was not as large, or well-priced, as TWIA and its brokers had hoped. But it seems more likely the appetite of the reinsurers may have been strong enough to bring this risk back to the traditional (or possibly collateralized) side.

TWIA had also considered the use of an industry-loss warranty (ILW) option for the top of its reinsurance tower, as the insurer of last resort considered buying more protection than its 1-in-100 requires for 2023. But its Board rejected that option, as we reported at the time.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.