Tremor Technologies, the insurtech offering a technology-based programmatic insurance and reinsurance risk transfer marketplace, has launched a next-generation update to its trading platform software, as it looks to “supercharge” reinsurance placement with the Panorama release.

Tremor is the only programmatic marketplace technology provider to gain real traction and place syndicated risk transfer and reinsurance deals with multiple markets on behalf of multiple cedents, with more than $1 billion of limit placed.

Tremor is the only programmatic marketplace technology provider to gain real traction and place syndicated risk transfer and reinsurance deals with multiple markets on behalf of multiple cedents, with more than $1 billion of limit placed.

Now, the insurtech company is looking to gain broader adoption by enhancing its offering based on market feedback, to bring new functionality and compatibility for an increasing range of cedents, markets and brokers.

PanoramaTM is the name of the latest release of Tremor’s risk and reinsurance marketplace platform, with this iteration rolling-out an evolution of the technology based on learnings and feedback gained over the last two years.

Data plays a key role in Panorama, as Tremor stays true to its promise of utilising heavy-weight advanced technology to deliver optimal risk transfer and reinsurance placement outcomes.

Panorama has the same technical foundation, featuring state-of-the-art auction and optimization technology, to deliver users a coordinated, concentrated placement process to drive competition and solve for “the best offers to fully place reinsurance programs without leaving anything on the table,” Tremor said.

Impressively, with Panorama, cedents will now receive 100x more data, as well as more pre-trade insight, helping them to make the best reinsurance purchasing decisions possible, Tremor believes.

“Tremor continues to innovate to dramatically improve the reinsurance buying process,” CEO, Sean Bourgeois explained. “While we celebrated placing $1 billion in 2020, we have much bigger goals for 2021. Panorama provides the ultimate platform to rapidly scale our marketplace, dramatically improving how insurers purchase reinsurance complementary to the broking process.”

At its heart, Panorama is designed to help reinsurance cedents find the best single market clearing price for each layer for each program, in any market, hard or soft.

Tremor said that this efficient placement can reverse the trend of economically inefficient differential pricing and non-concurrent terms being seen in reinsurance today.

“There is a reason billions of dollars a month in U.S. government bonds are auctioned at a uniform clearing price as opposed to dozens of prices and quantities – a uniform clearing price has been proven to be much more price efficient and deliver more revenue to the issuer. Insurers should insist on the same to optimize the pricing of their reinsurance – Tremor Panorama offers technology to ensure competitive uniform clearing prices are found every time,” the company explained.

This is really the promise of advanced technology, put to work intelligently in that critical last-mile of the reinsurance placement process, where efficient and effective matching of risk and capital can help cedents to reap dividends and gain from optimisation and broad syndication of their risks.

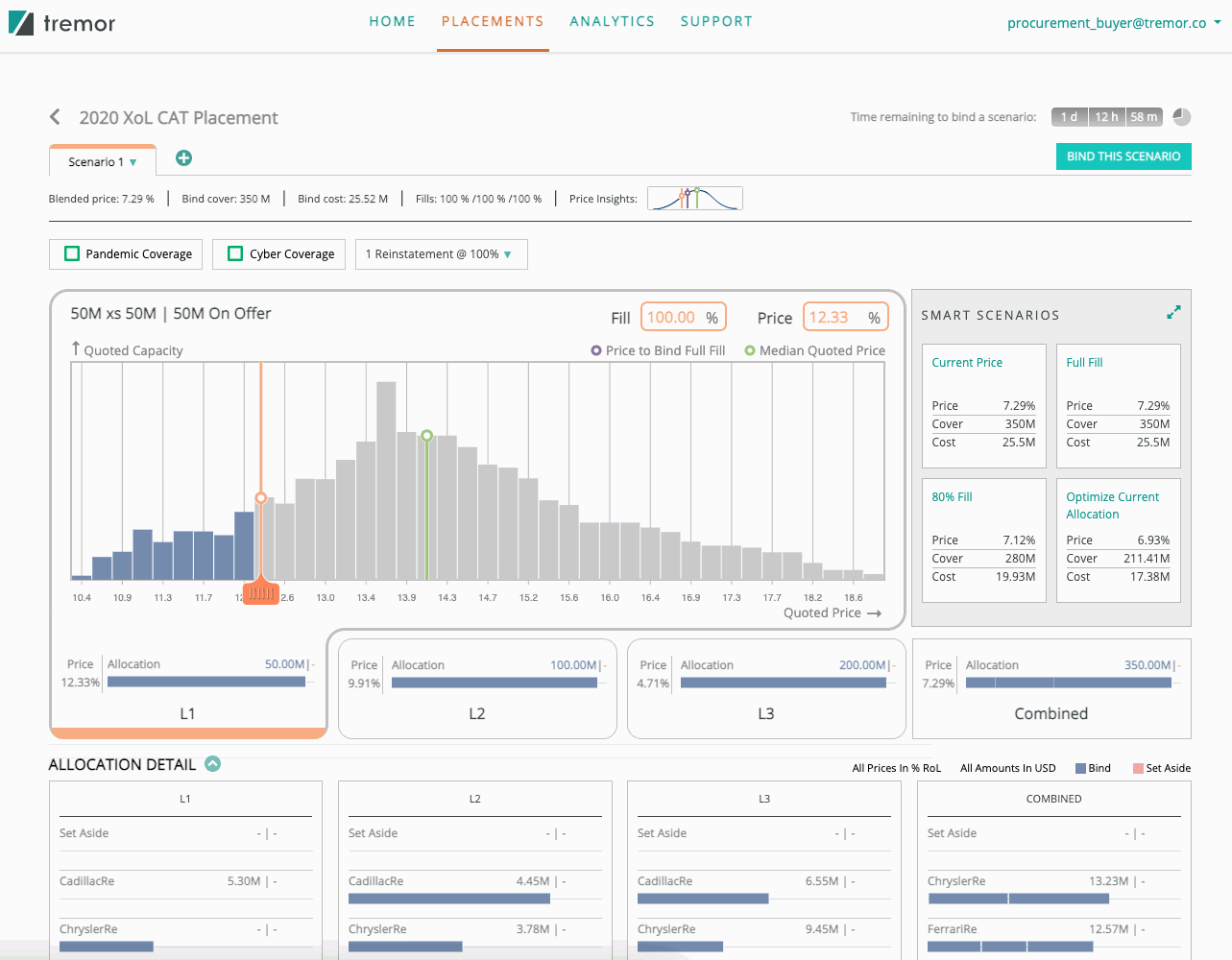

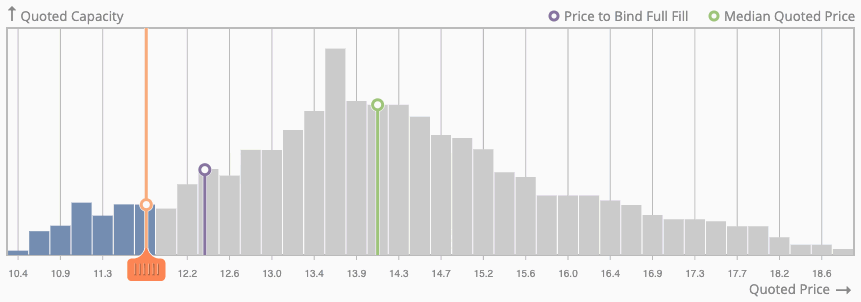

Tremor’s updated marketplace platform features a new Market MapTM which, “collects the entire “order book” from all placement participants – what price each reinsurer is willing to offer at each quantity subject to their own complex constraints.”

This is an impressive feature as it will enable users to see the market, in terms of real risk appetite and reinsurance pricing, providing them with “Real, bindable prices with incredible market intelligence to ensure insurers leave nothing on the table,” Tremor says.

Tremor’s new Panorama release also allows cedents to see their negotiating position before setting the price for their placement, while each individual reinsurer’s bid remains private.

This allows reinsurers to compete without holding back, driving competition and enabling a true expression of risk appetite and also enabling capital efficiencies to be leveraged.

Tremor says this allows cedents to answer questions such as: Where is the market’s pricing midpoint, “the market consensus”?; Can I fill my program at pricing better than “market”?; Is there plenty of opportunistic capacity available that I should consider before setting my final price?; Is there capacity available just beyond the price I want?; and What is the likelihood I can bring the market to the price I want?

That’s powerful, as these questions have not been answerable at all for many in the past, except perhaps those with the greatest competitive advantage and pricing insight, so perhaps only the largest global players.

Even they may not have been able to see clearly every opportunity they could have had to more efficiently place their risks with capital.

Another key feature launched with Panorama is that cedents can now compare real pricing for contract options in real time using Tremor’s platform.

In addition, relationships can be expressed within Tremor’s platform, with more flexibility for cedents to retain control of individual assigned lines by reinsurer, taking into account long term relationships, credit quality and more, all as part of the binding process.

Importantly, this puts cedents truly in control of their own placement, while still allowing them to see the entire market for their risks.

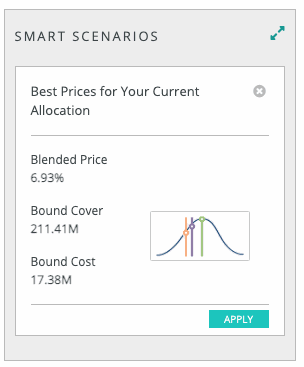

There’s more, as Tremor has also added Smart Bidding, so cedents can leave it to the technology to solve for the optimal outcome for their reinsurance placement.

There’s more, as Tremor has also added Smart Bidding, so cedents can leave it to the technology to solve for the optimal outcome for their reinsurance placement.

The platform can now, “solve for a number of common scenarios to save insurers time to find optimal pricing and placement under a range of conditions powered by Tremor’s matching engine,” the company said.

While additional Smart Scenarios also allows cedents to set up scenarios for price, fill, term selects and allocations to compare and contrast across each option, and then walk through the scenarios to adjust them for the optimal reinsurance buying solution.

That’s a compelling option and a great way for cedents to get more comfort in using technology for their reinsurance placements, as they can try out scenarios and demo them to executive teams before event hitting the live marketplace.

You can still bind your reinsurance placement with a single click using Tremor, once you’ve tailored all your options and preferences, with prices and allocations selected being final and delivered for contract wording signature.

Panorama continued to offer rich quoting to reinsurers and ILS markets, with quotes blind, sealed and held private, so that reinsurance markets can be as competitive as they like, without concern that their market strategy becomes public.

For brokers, Tremor works closely with them on placements, ensuring that brokers expertise in advisory and structuring of programs is maintained.

Tremor explained, “Our role is to manage the technology that optimizes pricing and placing of programs so that nothing is left on the table as insurers seek a full fill of their program. Panorama offers brokers valuable features to help their clients take advantage of advances in online trading of reinsurance. Panorama is the perfect complement to the value brokers add – Tremor already has a technical integration underway with Lockton Re and more broker partnerships are expected soon. For cedents, using Tremor and their broker together delivers a powerful placement experience, 1+1=3!”

Summing up this Panorama release, Tremor said, “Tremor has been focused on delivering real value through technology to the reinsurance market since launching its marketplace in 2018. Optimizing for a uniform clearing price while allocating limit subject to reinsurer constraints was a challenging problem to solve, requiring a team with a deep understanding of market design, economics, game theory and computer science. Tremor solved this problem in a robust way in 2018 and is now proud to release further advancements to its original platform to perfectly suit market needs, without requiring participants to conform to standardize their submissions or data, duplicate the entry of information into yet another system or learn how to use complicated new software which adds dubious value, if any at all.

“Tremor believes that new reinsurance technology must dramatically improve the speed, quality and competitiveness of reinsurance placement execution with measurable, real results perfectly suited to market needs – Panorama delivers this in every dimension.”

Tremor has made a video demo of Panorama available to view here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.