Tremor Technologies Inc., the programmatic insurance and reinsurance risk transfer marketplace provider, believes that through the use of technology such as its own the reinsurance placement process can be made much faster and more accurate, with better outcomes possible for both sides of the deal.

Tremor had a busy 2019, with a number of successful placements of straight-forwards reinsurance, parametric catastrophe swaps and other interesting deals.

In clearing capacity for these deals, Tremor adds efficiency to the capital on offer and makes the placement process both faster and more accurate for both sides, which it believes drives better execution for the ceding company.

Sean Bourgeois, Tremor CEO commented on the companies 2019, “We announced top-line statistics back in December – more than 100 clients signed up on both sides of the market and more than $2 billion in priced capacity. We are proud to have firmly established Tremor as the leading programmatic marketplace for the reinsurance industry in 2019.”

Tremor has been sharing data with the market to help participants understand the real benefits of utilising what is currently the only true technology driven marketplace for reinsurance related risk transfer.

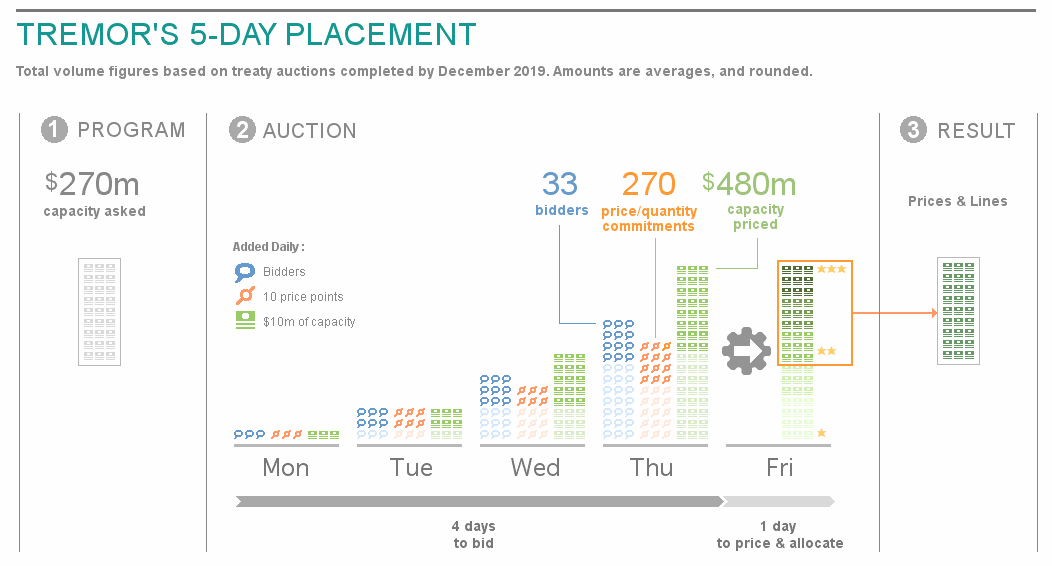

The company shared the graphic below, which shows how cedents using the platform have managed to place their reinsurance treaties in a compressed pricing and placement window, with the overall auction process taking less than 5 days.

Tremor collects bids from reinsurance markets and capital providers in a short, fixed bidding window, which provides visibility of the full range of capacity available, it’s true appetite for the risks on offer, all at different price points.

Then, Tremor’s matching engine matches bids to the risks on offer, identifying the best coverage and market clearing prices based on preferences already defined by the cedent. As a result, the final prices and confirmed lines are all announced within hours of the close of bidding, making for a rapid and efficient reinsurance placement process.

Tremor claims that an average reinsurance placement using its platform gathers significantly more data and insight from the market than any traditional placement does.

A traditionally brokered reinsurance placement results in just a handful of price points collected during the quoting phase, which are used to set firm order terms.

This can result in either an over-subscription of a reinsurance placement, or an unintended short placement, Tremor says.

Where as, by comparison, on average across treaties placed by Tremor so far, the company collected almost 300 individual price and quantity points during the process, which together represent firm commitments from 33 bidders over nearly $500 million of reinsurance capacity.

The difference is stark, especially when you appreciate that the use of technology and a matching engine means effective matching of risk to capital, so no over allotments and a better syndication of the risk.

“Tremor’s proprietary matching engine contemplated the complex price-quantity tradeoffs in these bids to identify prices that precisely cleared the market, every time,” Bourgeois explained.

Tremor says it can guarantee its cedents that they won’t pay too much due to an over-subscription and won’t miss out on coverage due to an unintended short placement.

At the same time, the reinsurers and alternative reinsurance capital providers using Tremor have what the company terms “unprecedented control over their allocations” as signed lines perfectly match the price and quantity pairs of bids sent through the auction

Jeremy Ginter, Tremor’s VP of Sales and a broking sector veteran, further explaned, “By collecting far more pricing information compared to the typical quote/firm order process used today, Tremor has the capability to programmatically find the right price with the right partners, every time…in a fraction of the time.”

Tremor’s bidding window has averaged less than 4 days for reinsurance placements made to-date, helping to drive down the time to execution of reinsurance deals with the whole placement process seen to take roughly 5 days using its marketplace.

After bids are all collected, the Tremor matching engine (which is proprietary) runs and final allocations can be announced within hours of the biddings close.

As a result, “The average time to price and place a treaty on Tremor was less than 5 days, after which lines are signed immediately,” the company explained.

Traditional brokered processes can take much longer, with 4 to 6 weeks sometimes common for programs final lines and allocations to be identified.

Using rich cedent and capital provider preferences to inform needs and appetites, alongside efficient technology to facilitate the process and match risks to capital in the most optimal and effective way possible, the level of efficiency gained from the process can be significant.

Ultimately this can reduce the cost-of-capital, for both sides. With cedents gaining reinsurance efficiencies, through time saved and better placement execution, while reinsurance markets can make their capacity go further, by ensuring its properly matched to meet their risk/return appetites.

Ginter added, “Tremor can execute the price discovery, firm order terms setting, capacity collection and line allocation phases of the transaction within 3-5 days rather than 3-5 weeks freeing up resources that can be redirected to other important functions within the company.”

The company also noted that, “Everyone benefits from a speedy placement – cedents can finalize coverage quickly, while reinsurers avoid having capital committed for a long time – in Tremor’s placements to date, capital was committed for about a day on average before final allocations were fixed.”

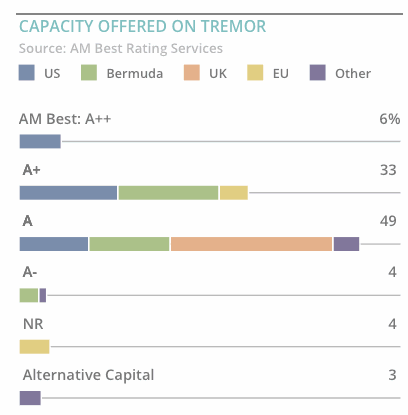

Tremor also helps to democratise access to reinsurance capital, by opening up a wealth of markets to every cedent using the platform to place business.

Tremor also helps to democratise access to reinsurance capital, by opening up a wealth of markets to every cedent using the platform to place business.

Access is democratised on both sides of the market, Tremor says.

Cedents can source bids from a wide range of the world’s highest quality reinsurance capital, with the majority of capacity offered on Tremor being A rated or better, or fully collateralized.

At the same time, traditional reinsurers and alternative capacity providers such as ILS funds are able to effortlessly deploy their capital anywhere in the world.

Tremor helps to create a more level-playing field, but one where both cedents and those markets providing reinsurance capital still have the ability to control the finer details of placements and allocations.

Both sides are able to customise bids and take control of how their placement is run, or how their capital is allocated, making Tremor a marketplace for all, not simply a tool for cedents to access capital through.

Most importantly, technology driven risk marketplaces mean capital and risk can be matched far more effectively and therefore all sides can benefit from increased efficiency, of the placement process itself and this adds efficiency to their business models.

In a world where efficiency is increasingly key and a reinsurance market where frictional cost is widely recognised as needing to come down, technology promises to help the market achieve both, to the benefit of all participants.

“Here at Tremor these statistics excite us – they show how our programmatic trading platform turns an arduous, imprecise process into a quick and accurate one. Tremor opens transactions to the entire market to bring the best capacity to each risk and solicits detailed information about capacity pricing from everyone in order to make oversubscription, short placements, sign downs, and other inefficiencies a thing of the past.

“We look forward to bringing the unprecedented speed and accuracy of Tremor’s programmatic trading to more transactions in 2020 and beyond,” Tremor CEO Bourgeois explained.

Tremor previously explained how oversubscription of placements is adding cost to reinsurance programs and making renewals less efficient.

The company also highlighted how price inflation is both evident and substantial in reinsurance program placements, as the traditional process of a brokered execution often leads to misaligned market incentives.

This latest information shows how technology can aid the placement significantly, to the benefits of the clients and reinsurance capital providers backing deals.

This is real evidence of technology adding efficiency to typical reinsurance market processes, which can ultimately lead to more effective use of capital, reducing the cost of capacity and driving better pricing and program execution for ceding companies.

The company recently completed its latest program placement for insurer W. R. Berkley.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.