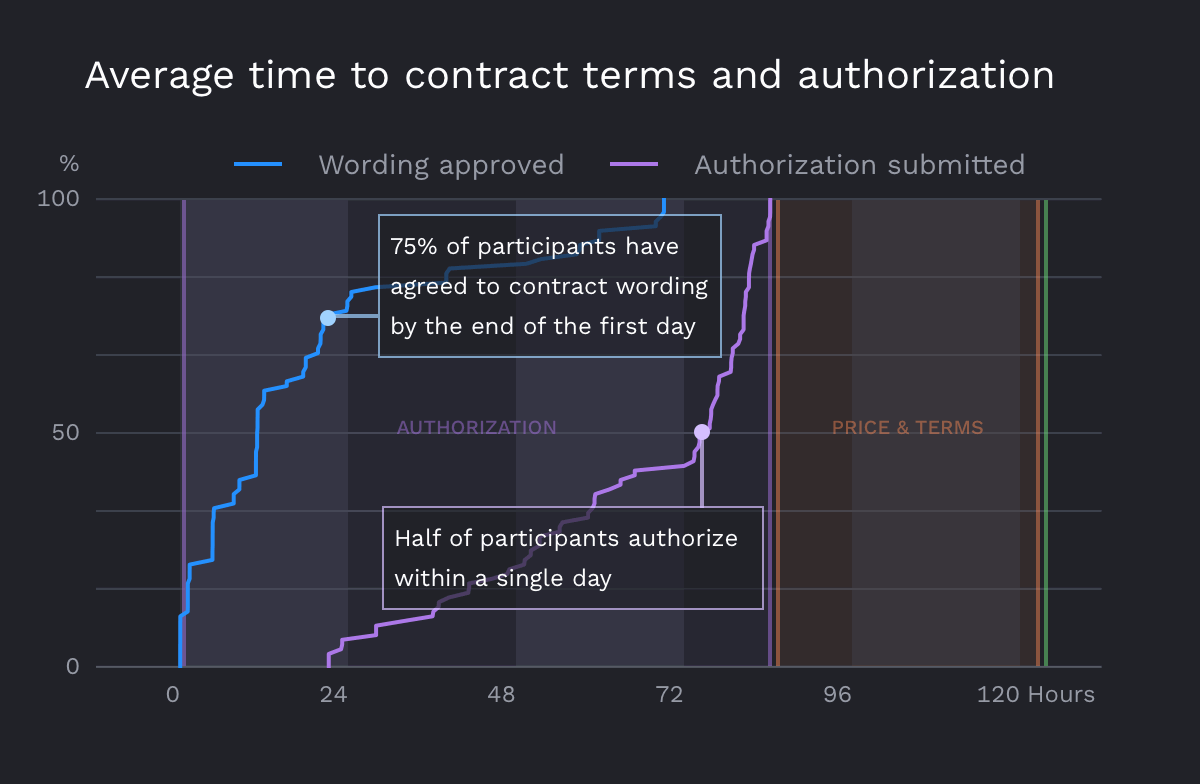

Tremor Technologies, the insurtech operator of a programmatic risk transfer marketplace, has said that on average its reinsurance pricing and placing platform enables cedents to achieve full programs, in authorised capacity terms, in less than 72 hours.

In fact, half of the reinsurers quoting through Tremor’s platform authorise capacity within a day, meaning cedents can get exceptionally fast feedback on the risk appetite and capacity available in the reinsurance market, as well as from participating insurance-linked securities (ILS) fund markets.

In addition, some 75% of markets have agreed to contract wording by the end of the first day.

Given how the end of year renewals are playing out so far, with cedents sometimes waiting weeks for any kind of quote and numerous programs having to be restructured and repriced to get the attention of reinsurance markets, this kind of speed of market feedback seems a world-away from the experience many are seeing right now.

Aggregate market data presented by Tremor makes clear the speed that cedents can access full capacity for their reinsurance program placements using its tech platform.

Of course, speed of response and fast-feedback aren’t always enough to guarantee capacity or price, but they do enable cedents to go to market and quickly understand if their proposal isn’t going to get the support it needs, so details can be tweaked and fresh feedback and quotes sought.

Which is powerful in a market where capacity is limited and where it seems many reinsurance placements have missed the mark on pricing so far, having to be marked up before generating the quoting interest they require.

Tremor explained that its platform enables reinsurers to offer precisely the capacity they want, while cedents can see the market in aggregate and determine a common clearing price for their risks.

The idea is to quickly come to prices and terms that satisfy all markets simultaneously, removing the need for as much time-consuming bilateral negotiation.

“Tremor’s market design enables efficient pricing and allocation of reinsurance programs competitively,” CEO Sean Bourgeois explained.

He continued, “Many 1/1 programs are currently struggling to attract the attention of reinsurers and those that have are finding that there is not enough capacity available.

“Tremor’s design and the technology powering price discovery and allocation provides cedents and their brokers a much more efficient process to attract capacity competitively and complete programs quickly, far ahead of renewal dates.”

In the current, extremely challenging market for reinsurance capacity, utilising technology can make the process easier, faster and more accurate for all sides of the deal.

Cedents can quickly understand the availability of capacity for their reinsurance towers at different levels, while reinsurance markets can provide quotes based on their current risk appetite, with both sides able to benefit from near real-time feedback during this process.

As the January 2023 renewals fast-approach, with quotes still in short-supply and many reinsurance programs looking likely to be placed late and often only partly-filled, it’s an opportune time to look at technology that can solve for some of the issues related to the annual end-of-year capacity rush.

That goes for brokers too, as leveraging advanced placement technology can provide their clients a smoother renewals experience, while also securing optimised pricing and allocation in the market.

It will be interesting to see how cedents make use of technology like this for filling gaps in 1/1 renewals and for retrocession placements as well.

As, after the January renewals, there could be ongoing activity for filling program gaps, in retro and for instruments such as industry loss warranties (ILW’s), as cedents and reinsurers look to secure the protection they need after the main renewal season rush is over.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.