US primary insurance company Travelers has added an additional $1 billion lower layer to its catastrophe excess-of-loss (XoL) reinsurance treaty at the January 1st renewals, reducing the retention by an equivalent amount to $3 billion while securing $4.675 billion of coverage above that.

Travelers has responded to reinsurance market conditions in recent years, flexing the size of its main per-occurrence and multiple event corporate catastrophe reinsurance treaty that it always renews at January 1st.

For example, in 2024 Travelers grew the catastrophe reinsurance treaty by a significant 76%, from 2022’s $2 billion, to provide $3.525 billion of cover.

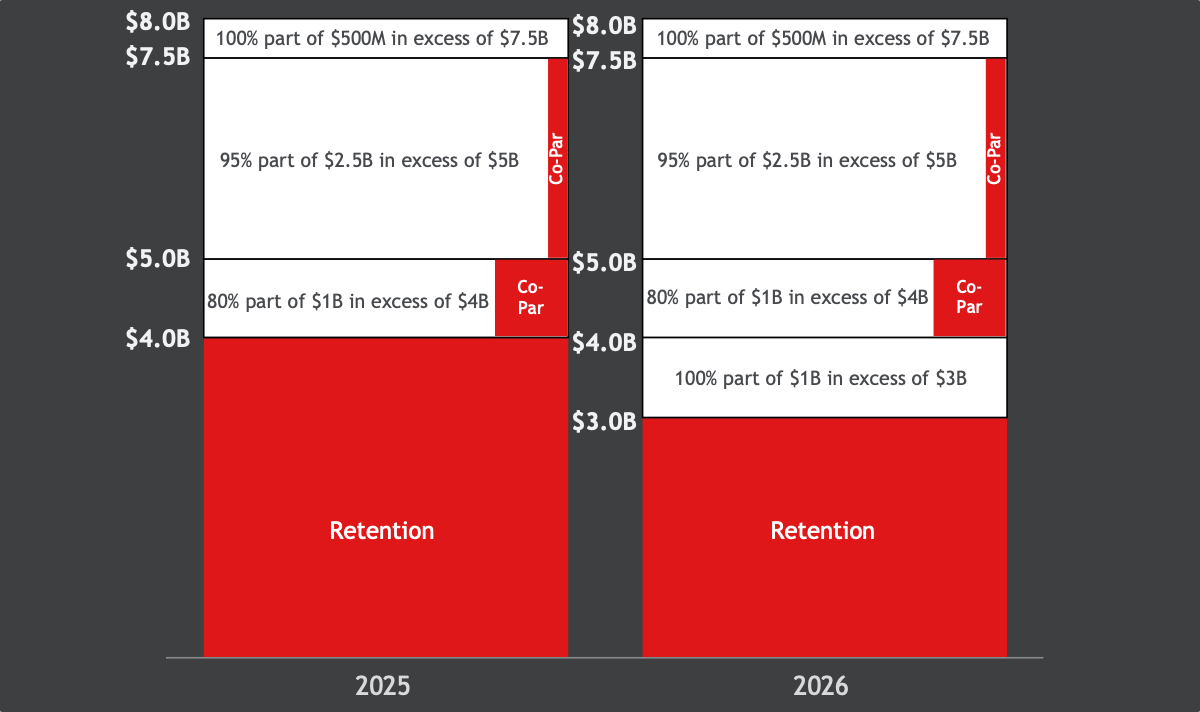

Then, last calendar year, Travelers further increased the amount of protection it received under its occurrence catastrophe excess-of-loss (XoL) reinsurance treaty to $3.675 billion at the January 1st 2025 renewals, but the retention rose to $4 billion as a lower layer was dropped from the placement.

Now, a lower layer has been reinstated and at a larger size, which has added $1 billion of coverage for the company.

That has also had the effect of taking the retention down to $3 billion for the 2026 calendar year, lower than it has been for a few years now, having sat at $3.5 billion in 2023 and 2024, then $4 billion in 2025.

Market conditions and softer reinsurance pricing conditions are likely one driver of this, but in addition Travelers has also grown its book in recent years, so more coverage will have been desirable anyway, we assume.

As a result, Travelers now has occurrence catastrophe excess-of-loss reinsurance in place for 2026, attaching from $3 billion and covering a $4.675 billion majority of losses up to the top of the tower at $8 billion, while with the occurrence deductible this also covers aggregation of losses from multiple events.

You can see a disclosure of the 2026 corporate catastrophe excess-of-loss reinsurance tower versus the prior year below:

Travelers 2026 corporate catastrophe tower covers the the accumulation of property losses arising from one or multiple occurrences, providing for a recovery of up to $4.675 billion across $5 billion of qualifying losses, in excess of a $3 billion retention and with each qualifying loss after the same $100 million deductible as the prior year.

Hence it covers single large catastrophe loss events, as well as an aggregation from events greater than $100 million in loss quantum.

Travelers still has $575 million of reinsurance in-force from its most recent catastrophe bond, the Long Point Re IV Ltd. (Series 2022-1) issuance from May 2022.

That catastrophe bond is scheduled to mature at the start of June 2026, so it will be interesting to see if the insurer returns to the cat bond market in the coming months.

Travelers also has a range of reinsurance protections in-force that it renews at the mid-year, which in 2025 included a reset higher of the attachment point for its Long Point Re IV cat bond.

As a reminder, Travelers elected not to renew its standalone aggregate catastrophe reinsurance treaty back in January 2023, restructuring this corporate cover instead to provide an element of frequency protection.

Read all of our reinsurance renewal news coverage.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.