The insurance and reinsurance market loss to property lines of business from flooding that struck the Townsville and surrounding area of the Queensland region of Australia in 2019 has now been raised 2% and finalised at A$1.243 billion by PERILS AG.

PERILS, the Zurich-based and industry backed aggregator of insurance market catastrophe losses, had first pegged the insured cost of the Townsville floods at A$957 million back in March 2019, then raised them to A$1.041 billion in May, before hiking them again to A$1.217 billion in August 2019.

PERILS, the Zurich-based and industry backed aggregator of insurance market catastrophe losses, had first pegged the insured cost of the Townsville floods at A$957 million back in March 2019, then raised them to A$1.041 billion in May, before hiking them again to A$1.217 billion in August 2019.

As recently as October the claims from the flood insurance event continued to pour in and the Insurance Council of Australia estimates total claims across property, contents and motor lines of business as $1.269 billion as of January 12th 2020.

At that time there were 2,156 property claims still open, 1,034 content claims open and 117 motor claims yet to be settled, suggesting further for the final cost to rise.

The comparison in the case of the Townsville floods is interesting, as PERILS only factors in property losses to its industry loss estimate.

Which suggests the final tally from the Insurance Council could end up being quite a bit higher than PERILS finalised market loss figure issued today.

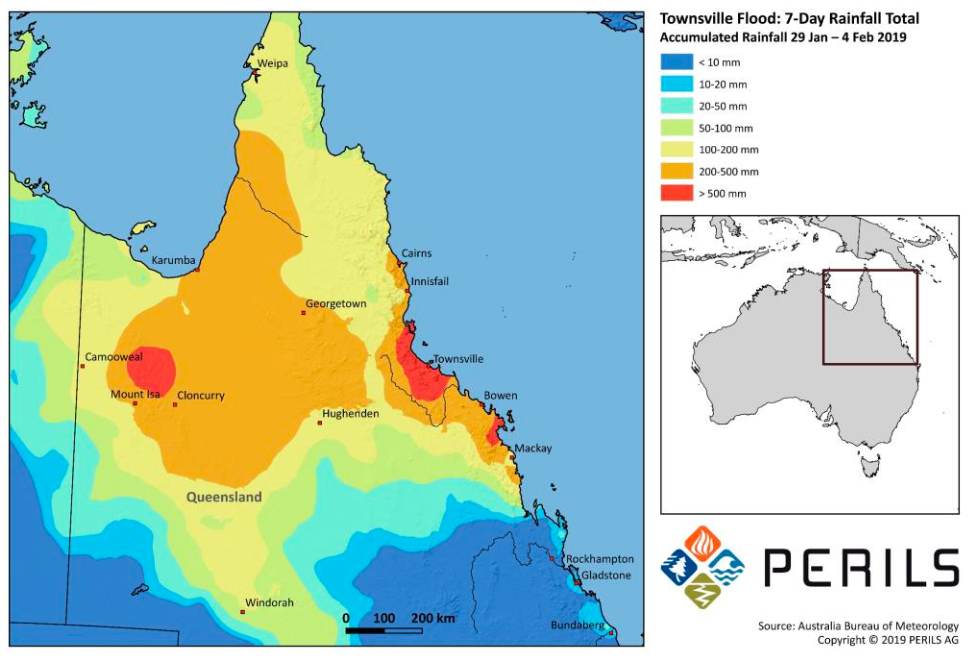

PERILS issued a market-loss footprint graphic for the Townsville floods today, that incorporates rain and flood level information from risk modellers JBA Risk Management and Risk Frontier.

Darryl Pidcock, Head of PERILS Asia-Pacific, commented: “This market loss footprint is another example illustrating the mission of PERILS to increase data availability for natural catastrophe events and to help the market better understand and manage natural catastrophe risks. In the same spirit, we are currently investigating the recent bushfires and hail events in Australia. We will provide further updates to the market using our standard approach and schedule once data collection has been completed.”

The Townsville flood event became the largest flood insurance and reinsurance market loss in Australia since the Brisbane Floods of 2011.

Insurer Suncorp reported that the Townsville floods meant a small payout for the reinsurance firms and any ILS players which backed its natural hazard aggregate program in 2019.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.