Trapped capital decline means ILS growth is stronger than you think: AM Best

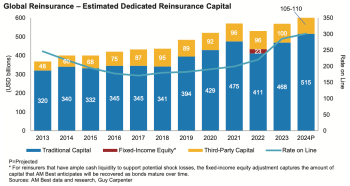

23rd August 2024Over the last couple of years the amount of capital trapped in collateralized reinsurance, retrocession and other insurance-linked securities (ILS) has declined significantly, which makes for a much larger and more impactful ILS capital market than you might think, AM Best rightly points out.

Read the full article