California wildfires: Subrogation topic raised, as utilities come into focus

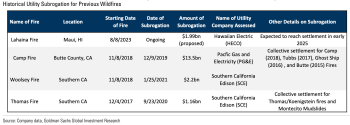

14th January 2025The question of potential recoveries from subrogation of claims has emerged in relation to the ongoing wildfires in Los Angeles and Southern California, with electrical utility Southern California Edison in focus as questions arise over whether its equipment may have caused any of the fires.

Read the full article