High attachments anchor profitability despite renewal property cat rate declines: J.P. Morgan

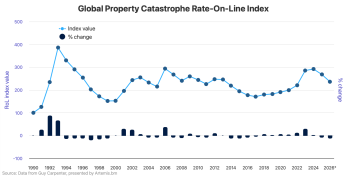

3rd February 2026In the wake of the 2026 January reinsurance renewals, which saw double-digit declines in property catastrophe reinsurance pricing, analysts at J.P. Morgan have highlighted that while attachment points have largely held up, this has driven profitability to be likely better than the pricing levels suggest.

Read the full article