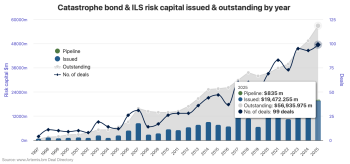

144A catastrophe bond issuance now tracking to first $20bn+ calendar year in 2025

11th November 2025With the pipeline of new 144A catastrophe bonds growing as new deals get launched, the market is now officially on track for the first $20 billion plus calendar year of issuance in 2025.

Read the full article