Jamaica to receive full $150m payout from parametric cat bond after Hurricane Melissa: World Bank

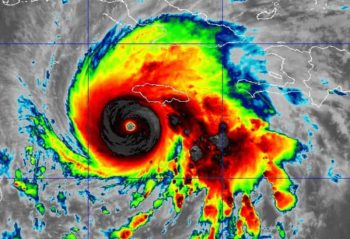

7th November 2025The World Bank has announced today that following the events of Hurricane Melissa, the Government of Jamaica will receive a full 100% payout of its $150 million IBRD CAR Jamaica 2024 parametric catastrophe bond.

Read the full article