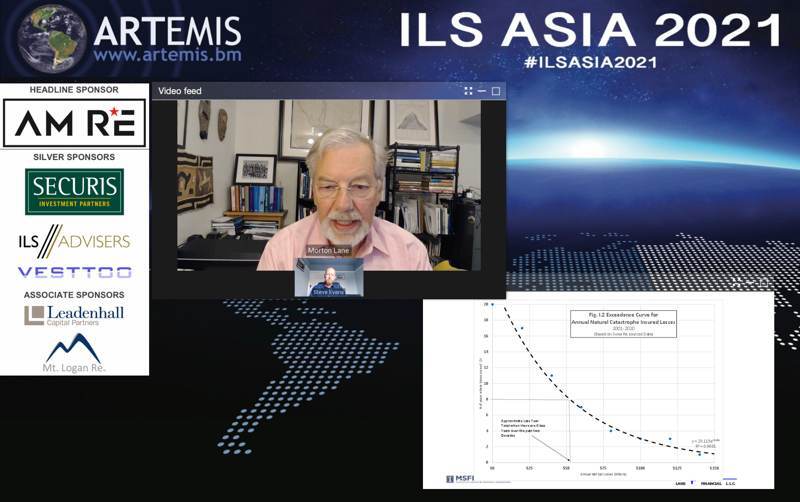

Public market status can add cat bond transparency & efficiency: Lane at ILS Asia 2021

14th July 2021Were the U.S. Securities and Exchange Commission (SEC) to recognise the maturity of the catastrophe bond marketplace and consider it a public market, it would help both the efficiency and transparency of this part of the insurance-linked securities (ILS) industry, according to Morton Lane.

Read the full article