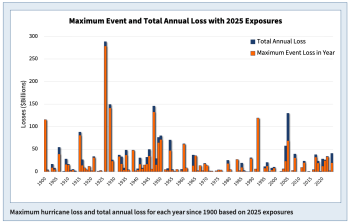

KCC estimates privately insured hurricane Melissa losses at $2.4bn

6th November 2025Catastrophe modelling firm Karen Clark & Company (KCC) is the latest to issue an estimate for the insurance industry loss from recent major hurricane Melissa, pegging the total at US $2.4 billion.

Read the full article