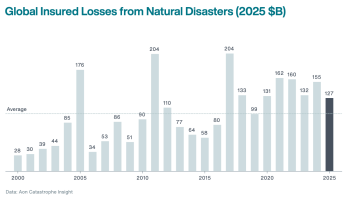

Extreme weather losses in Australia costs insurers $3.5bn in 2025: ICA

23rd January 2026New data released by the Insurance Council of Australia (ICA) shows that the total cost of extreme weather events that impacted Australia throughout 2025 resulted in almost $3.5 billion in insured losses, stemming from 264,000 claims.

Read the full article