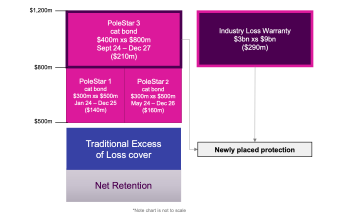

Competitive ILW pricing drives considerable buyer interest at renewal: Howden Re

3rd January 2025Competitive pricing for industry-loss warranty (ILW) protection has driven “considerable interest from a growing demographic of buyers” at the January 1st 2025 reinsurance renewals, according to broker Howden Re.

Read the full article