Potential for cat bond market to double, say ILS NYC 2023 speakers

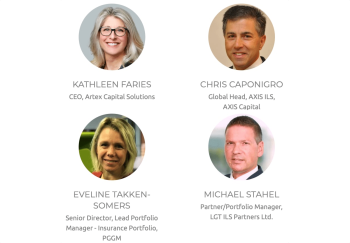

13th February 2023On Friday February 10th, more than 380 attendees at our annual ILS NYC 2023 conference in New York heard industry expert speakers explaining the significant potential for the catastrophe bond and ILS market to reach new heights this year and beyond.

Read the full article