Florida Citizens lifts reinsurance and cat bond risk transfer target to $4.5bn for 2025

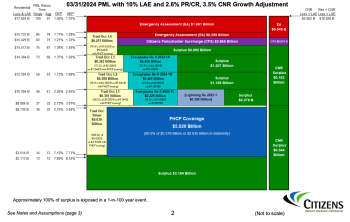

2nd December 2024Florida’s Citizens Property Insurance Corporation, the state’s insurer of last resort, is currently projecting a need to budget for a larger tower of reinsurance and catastrophe bonds in 2025, with almost $4.5 billion of risk transfer being discussed.

Read the full article