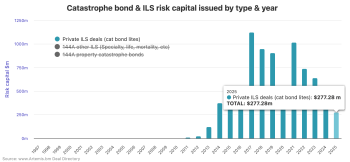

Eclipse Re issues $37.5m 2025-1A cat bond, taking cat bond lite issuance to $334m

22nd July 2025Another private catastrophe bond has come to market recently, as we’ve learned of a new $37.5 million Eclipse Re Ltd. (Series 2025-1A) privately transacted and placed insurance-linked securities (ILS) arrangement, the second such deal from the Eclipse Re transformer so far in 2025.

Read the full article