Allstate’s pre-tax cat loss for current aggregate year slows to reach $2.174bn after July

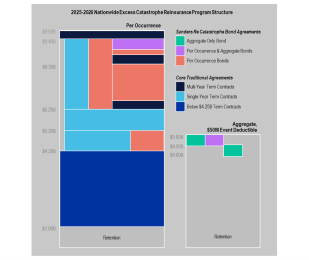

21st August 2025A quieter July in catastrophe loss terms resulted in US insurer Allstate only reporting $184 million in pre-tax impacts from severe weather events, which has lifted the total for the current annual aggregate risk period for its catastrophe bonds to $2.174 billion so far.

Read the full article