While it’s not essential to invest in the insurance-linked securities (ILS) asset class for decades to achieve expected returns, it is important that investors time their entry into the space, according to Morton Lane, President, Lane Financial LLC and Director, MSFE Program, The University of Illinois in Urbana-Champaign.

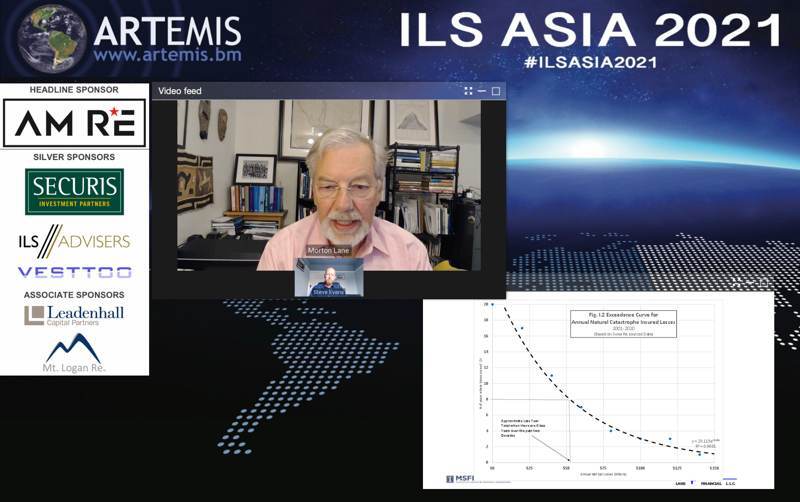

As part of our virtual ILS Asia 2021 conference, held recently in association with our headline sponsor AM RE Syndicates Inc., Lane examined the past two decades of traditional 144A catastrophe bond issuance to determine if investors got what was expected.

As part of our virtual ILS Asia 2021 conference, held recently in association with our headline sponsor AM RE Syndicates Inc., Lane examined the past two decades of traditional 144A catastrophe bond issuance to determine if investors got what was expected.

His analysis, which can now be viewed in full on-demand, shows that in general, returns and losses were in-line with expectations.

However, this doesn’t necessarily mean you need to be in the asset class for two decades to achieve the expected returns.

“I don’t think you need to stay in for 20 years, but I think the longer the better. The more important question is when do you enter,” said Lane.

It’s well understood that the best time to enter the ILS asset class would be when the reinsurance market is hardening, a period characterised by rising rates and the tightening of terms and conditions as carriers exhibit underwriting discipline.

“And in fact, I think that message has got through to investors to the point where hard markets that we might have expected to persist, are disappearing quicker because that’s the time that people do invest. That gives you that extra layer of comfort to protect you against losses,” continued Lane.

Adding, “I think if I had done this analysis for sub periods of five years, I would have got a distribution of returns that would have obviously averaged in the 5% area, but probably none of them would have been in negative territory.”

Lane’s comments on fading hard markets brings to mind the significant level of capital raised in 2020 ahead of expected firming at January 1st, 2021, and also the fact catastrophe bond issuance reached new heights in H1 2021 on the back of a record breaking full-year.

Clearly, insurance and reinsurance-linked returns have been very attractive to investors in recent months, but there are signs that rates are beginning to level off and over the last quarter or so, there’s been evidence of price softening on cat bonds.

Commenting on this, Lane said that he thinks the hard market we’ve seen is starting to fade.

“If there’s no losses in this wind season or no big events, I fully expect we’ll be in neutral territory as far as pricing is concerned,” he said.

Lane went on to note that even if we do go back to neutral towards the end of this year, it’s still a higher baseline than in 2015, 2016 and 2017, given the increases witnessed over the past few years.

“And I would suggest if you’re considering entering this market, maybe because it’s neutral you don’t put all of your money in that you ostensibly could allocate to it, but you put some in and get to know the market. And then, as and when conditions change and present themselves, put in more as time goes on,” said Lane.

You can watch this session of ILS Asia 2021 on-demand here.

As well as the on-demand playback, we will be archiving every session from our online and virtual ILS Asia 2021 conference over on our YouTube Channel in the coming weeks and audio versions will also be uploaded to our podcast which you can subscribe to here.

Thank you to all of our valued sponsors, details of which you can see below. Please email us to discuss sponsorship of future Artemis events.

Our Headline Sponsor:

|

Our Silver Sponsors:

|

|

|

|

Our Associate Sponsor:

|

|

For all enquiries regarding sponsorship opportunities of future Artemis conferences please contact [email protected].

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.