Florida’s Citizens Property Insurance Corporation looks set to continue rapidly growing its exposure, with its policy count likely to near record levels again in 2023, according to President and CEO Barry Gilway.

Having significantly downsized its exposure through the last decade, the current trends in the Florida property insurance market are forcing increasing numbers of policies to the insurer of last resort.

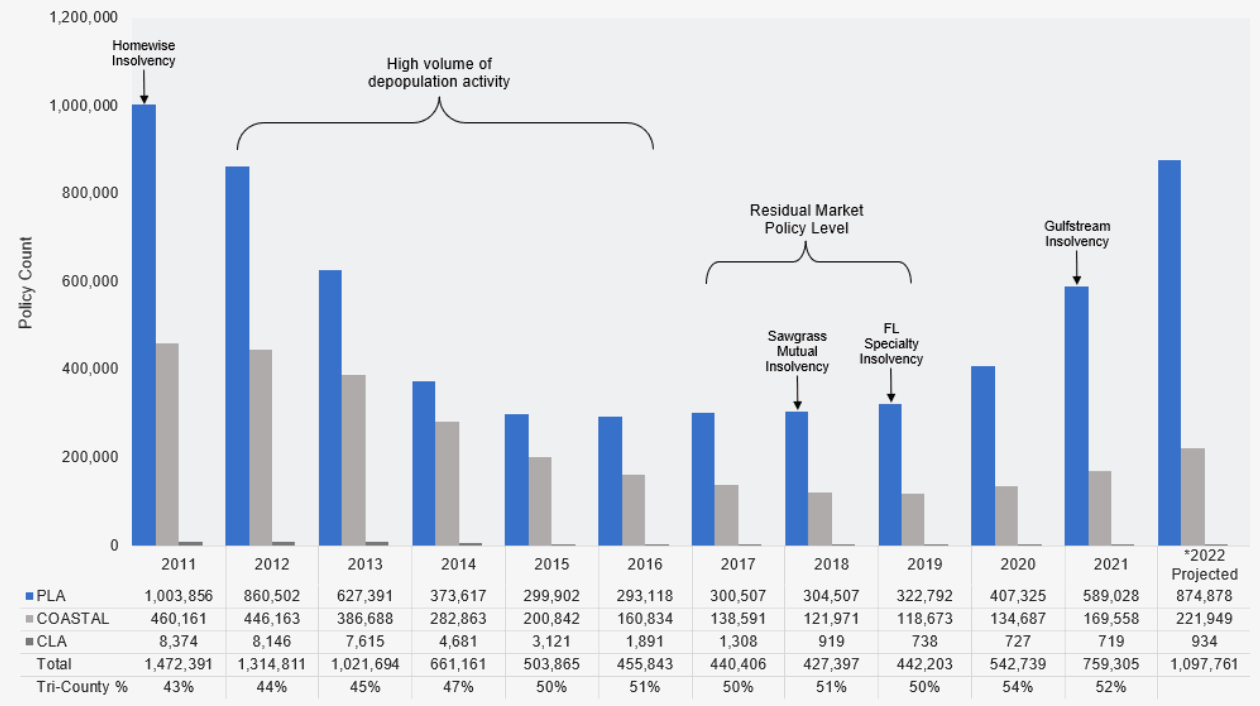

Citizens policy count had previously reached a peak of almost 1.5 million back in 2011.

At that time, the Florida property insurer of last resort had almost $520 billion in exposure on its books.

At that time, Citizens was only buying a relatively small reinsurance program as well, with Florida insurance consumers thought to have been on the hook for a massive $24 billion in assessments that would have been added to their monthly premiums for years, had the state been hit by a 1-in-a-100-year storm at the time.

Fast-forward a few years and Florida Citizens had dipped to only 427,000 policies in force as of 2018, after its depopulation efforts saw a significant number of property insurance policies turned back to the private markets.

Smaller Florida focused property insurance carriers, backed by ample low-priced reinsurance at the time, took policyholders private, while we also saw some insurance-linked securities (ILS) capital assuming policies from Citizens as well.

The chart below (from April) shows Citizens policy count over just more than a decade.

When the above chart was published in April 2022, the forecast for year-end was for Florida Citizens to have close to 1.1 million policies in-force.

But, given the still challenging state of the Florida property insurance market, and the fact more insurers have failed, while the expectation is others will continue to shed policies, the growth of Florida Citizens is expected to speed up and continue.

At a Board meeting yesterday, Barry Gilway, President and CEO of Florida’s Citizens Property Insurance Corporation, explained that now 1.2 million policies is expected to exceeded by the end of this year.

Citizens reached 937,835 policies in-force by Friday July 8th, with $322 billion of exposure.

Gilway explained at yesterday’s meeting, “By year end 2022 we will exceed 1.2 million customers. That is about a 300% increase in company size in less than three years.”

Looking further ahead, Gilway said a reasonable forecast would be for Citizens to have 1.55 million policies by the end of 2023, while a worst-case scenario might forecast up to 1.9 million, according to charts seen by Artemis.

Of course, this is going to require Citizens to buy a lot more reinsurance and catastrophe bonds, or issue a lot more in traditional financing such as bonding, or retain a significant amount more risk, once again raising the assessment risk for all Floridians should a major hurricane occur.

Florida’s property insurers are losing roughly 25% to 35% of their surplus each year, Gilway told the Citizens Board meeting yesterday.

“The reason is clear – it is the ongoing financial problems for most private insurance companies,” he explained.

“These results are unsustainable,” he said, adding that insurers operating in Florida only have the choice of increasing their capital, which is hard in the current environment and given their performance, raise their rates, which they have done but it isn’t sufficient, or reduce exposure, which is the logical final choice.

And that results in more policies flowing to Florida Citizens, hence the significant growth expectations at the insurer of last resort.

Reinsurance is one significant drag on the ability of Florida insurers to write more business, with Gilway estimating that “The average domestic company reserves 35-50% of every premium dollar for reinsurance.”

The hardening reinsurance market is exacerbating the situation for Citizens, as not only could it not secure the reinsurance it wanted at the renewals, the higher costs of risk transfer are driving more policies to it as well.

Gilway highlighted the importance of global reinsurance capital to Florida.

“This market is reinsurance,” he told the Board, “This is not a market that is well-capitalised, it really runs on reinsurance.”

With reinsurance costs so high and availability of reinsurance capital limited, this has put the Florida property insurance market into a particularly challenging position at the renewals.

For Citizens, with such significant growth expected, the challenge will be managing exposure without placing too much risk on the shoulder of taxpayers.

While the insurer of last resort has always sought to reduce risk of assessments, through financing, risk transfer and reinsurance, it may be unavoidable with such rapid policy growth.

If market conditions improve and risk transfer, in reinsurance or catastrophe bond form becomes more accessible, we could see Citizens buying a much larger tower again, in order to cover some of the growing exposure it is assuming.

Of course, it will likely also present an opportunity for take-outs, or depopulation. But in order for that to be attractive to capital providers, the systemic issues at the heart of Florida’s property insurance problems, of litigation, fraud and loss creep, really need to be solved.

Should those issues get fixed, then we could see a resurgent appetite to assume Florida property insurance risk, with opportunities for ILS capital to get more involved again.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.