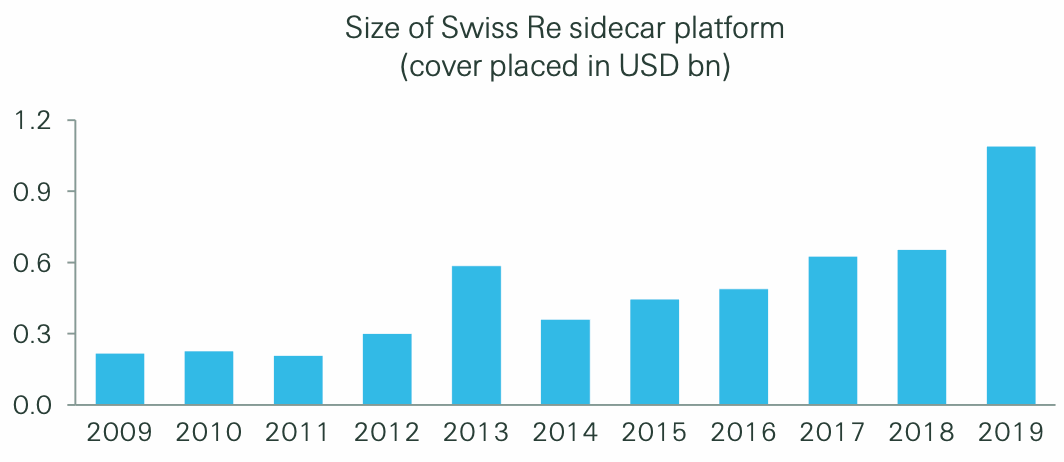

Global reinsurance company Swiss Re has significantly increased its use of alternative or third-party investor capital within its collateralised retrocessional reinsurance sidecar vehicle Sector Re Ltd., taking the vehicles total assets to close to $1.1 billion this year.

In fact, Swiss Re’s sidecar vehicle Sector Re has increased in size by around 60% since 2018, as the structure featured roughly $670 million of collateral as of the end of last year, but had has grown significantly to close in on $1.1 billion in 2029.

It’s all part of the reinsurance firm’s increasing acceptance of third-party capital and increasing use of insurance-linked securities (ILS) structures as a way to augment its capacity and expand its portfolio of natural catastrophe risks.

Swiss Re recently told its shareholders at an investor day that it intends to target growth and diversification within its portfolio of natural catastrophe risks with the use of investor-backed alternative sources of capital playing a key role as an enabler.

The reinsurers’ strategy around the use of third-party capital seems to have shifted in recent years, becoming increasingly open to the use of investors capital as a supportive growth lever, as we’ve seen so many other reinsurers doing.

Now, thanks to this evolving strategy, Swiss Re has attracted an increasing amount of investor capital to its fully collateralised sidecar vehicle Sector Re, growing the amount of cover placed using the sidecar to almost $1.1 billion.

This makes the Sector Re sidecar the largest in the market right now, according to Artemis’ data on collateralised reinsurance sidecar transactions.

This shift in strategy was becoming evident even before Swiss Re published its investor day presentation in recent weeks, which is the source of the above chart on the evolution and growth of the Sector Re sidecar vehicle.

We explained back in October that growth of Sector Re was becoming part of Swiss Re’s strategy, as the company looked to leverage investor appetite for catastrophe risks at the same time as it expands its own underwriting book.

Swiss Re has been ceding a portion of its property catastrophe risks to capital market investors through its long-standing retrocession sidecar arrangements under the Sector Re name since 2007, but the way it has used the vehicle has changed and now it appears to be becoming much more a case of a managed ILS strategy which could grow significantly larger, as the firm expands its catastrophe risk appetite.

Most of the growth of Sector Re appears to have come at the mid-year reinsurance renewals this year, as we understand the vehicle put on most of its expansion to almost $1.1 billion around June and July.

Yes this is still retrocession for Swiss Re, but increasingly the reinsurer appears to be looking on third-party capital from Sector Re as a form of growth capital as well, blurring the lines between what is retro and what is managed capacity, as we’ve seen across the reinsurance market in recent years.

Investors seem to be appreciating this shift, as they have helped the company to expand Sector Re significantly this year. It will be interesting to see how Sector Re is used at the upcoming January renewals and whether further expansion of the sidecar is achieved.

For more details on reinsurance sidecar investments view our directory of collateralized reinsurance sidecar transactions.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.