A survey of institutional investors allocation preferences for private asset classes shows a “notable” increase in interest in insurance-linked securities (ILS) at this time, according to global investment manager Schroders.

Schroders’ fourth annual Institutional Investor Study shows that, despite the uncertainty and volatility created by the COVID-19 pandemic, investors remain focused on the core benefits of some private asset classes, with diversification a key driver for allocating to alternative investment categories.

In fact, it’s important to take the results of this years survey with the pandemic in mind, as Schroders explained that the 650 institutional investors from 26 locations across the world, who between them are responsible for around $25.9 trillion in assets, were polled this year in April, right at the height of the global coronavirus crisis.

As a result it’s intriguing to see where allocation ambitions lie and the fact insurance-linked securities (ILS) features is a clear message about the level of profile that this asset class commands within institutional markets.

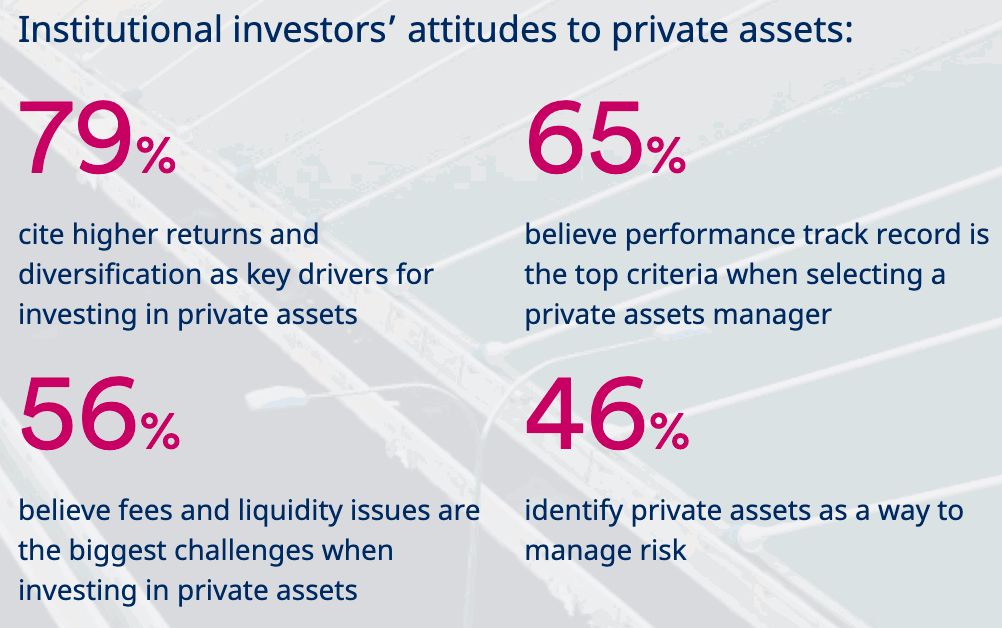

Overall, 79% of respondents said that they target private asset classes because of the diversification and often higher returns on offer, but 65% said that manager track-records are key in private asset investing, while fees and liquidity issues are cited as the biggest challenges by 56% of the investors surveyed.

All of which reflects the need for investors to put significant effort into understanding an asset class like ILS and reinsurance, to help them understand the return profile, the manager landscape and the range of strategies on offer.

Positively though, 46% of respondents said that private assets are seen as a way to manage risk in their portfolios.

The way insurance-linked securities (ILS) and other reinsurance linked assets have performed through the pandemic, demonstrating their lack of correlation with financial market movements in many cases and providing defensive returns at a time when investors really needed them, can only be positive for the sector’s profile going forwards.

Institutional investors in the main expect to grow their overall private asset allocations over the next year, with the majority suggesting private asset classes could make up as much as 14% of their portfolios, Schroders survey shows.

Some investors said that the COVID pandemic situation could slow their allocations to these alternatives, but the majority said that it wouldn’t and some said that the pandemic will likely increase their private asset allocations.

Insurance-linked securities (ILS) is one of the asset classes where investors do see an opportunity for growth, with 7% of investors globally saying they are likely to look to ILS and reinsurance to deploy more capital.

Regionally that increases to around 13% of respondents in the EMEA region.

Interestingly, the survey added a new motivation for investors allocations to private assets this year, saying that 43% of respondents said that a key driver for private asset allocation was, “to capture real value add from the operation of the underlying asset.”

Which is an area that reinsurance and ILS can really deliver, as the underlying asset (the insurance risk itself) is typically so far removed from most other areas of investments that institutions around the globe allocate to, that the value-add is clear, in an additive sense to portfolio construction and returns.

A reminder to the ILS market to keep things as simple as possible and also to ensure transparency and good communication, as investor respondents cited fees (cost and complexity), liquidity issues and the general complexity of private asset classes as the biggest barriers to investing.

Alongside this, the lack of internal resources to dedicate to understanding and allocating to a private asset class is also cited as a barrier.

Most investors expect ILS allocations to earn them up to 7.5% in the next year, although the largest share of respondents said up to 5%, perhaps reflecting the high costs of hedging in some regions of the world.

ILS remains a smaller component of investor portfolios typically, with this year 90% of respondents saying an ILS allocation would be less than 5% of their portfolio, although that’s down from 92% who said the same a year ago.

While capital raising in ILS has not been as easy in recent months, the signs are there that things will improve over the coming months and year ahead, with institutional investors remaining aware of the benefits of the asset class.

It may take some time for confidence to fully return, but with some ILS inflows already being seen the responses to this survey suggest that ILS is only going to become a growing component of sophisticated investor portfolios over time.

Schroders explained that the results of its study show, “Particularly notable increases in interest for real estate debt, infrastructure equity and insurance-linked securities.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.