Investor appetite for the returns of U.S. hurricane risk exposed reinsurance remains strong in 2019 despite recent year’s of losses, as issuance of 144A catastrophe bonds that carry exposure to named tropical storms has reached nearly $2.2 billion so far this year.

That’s based on some analysis undertaken by Fitch Ratings using data from our catastrophe bond Deal Directory.

Fitch Rating’s analysis only looks at the ten rule 144A catastrophe bonds issued since the start of the year and that feature exposure to U.S. named storm risk as part of their coverage and trigger.

While these ten rule 144A cat bonds amount to almost $2.2 billion of risk capital issued so far in 2019 that is exposed to U.S. named storm and hurricane risks, we believe that as much as another $283 million can be added from the private cat bonds and cat bond lites also listed in our Deal Directory this year, as the majority of these tend to cover U.S. named storms as well.

So issuance of U.S. named storm and hurricane exposed catastrophe bonds in 2019 so far could be as high as $2.4 billion or so, which certainly signals no shrinking in the appetite of insurance-linked securities (ILS) funds and their investors for this peril.

Fitch notes in its report that while traditional reinsurance capital is expected to remain strong, having proven its resilience to the recent loss years, the ILS sector is also showing a strong appetite for new risk.

“The use of alternative capital has continued to grow in 2019 and the catastrophe bond market has seen large national sponsors driving catastrophe bond issuance along with smaller insurers with high risk property exposure expanding their use of insurance-linked securities,” the rating agency explained.

Continuing, “The continued low interest rate environment, along with the desire of (re)insurance companies to utilize alternatives to the traditional insurance risk transfer market, drove continued growth in new capital from third-party investors.”

While capacity in the ILS market has not grown in 2019 so far, the appetite of investors remains relatively undiminished, although of course not for absolutely all reinsurance-linked investment products and only at a price following the significant catastrophe losses of recent years.

The price (or returns) of ILS instruments such as catastrophe bonds is all important in 2019, as investors are demanding a higher return for their allocations to reinsurance linked investments.

We document the pricing trends in the cat bond and related ILS market in our series of charts and data points on the market, as well as our ILS Market Dashboard.

In particular, our data shows that the spread between average expected loss and coupon has risen sharply in 2019, as too has the average multiple at market of catastrophe bond and related ILS issues that we have the data for.

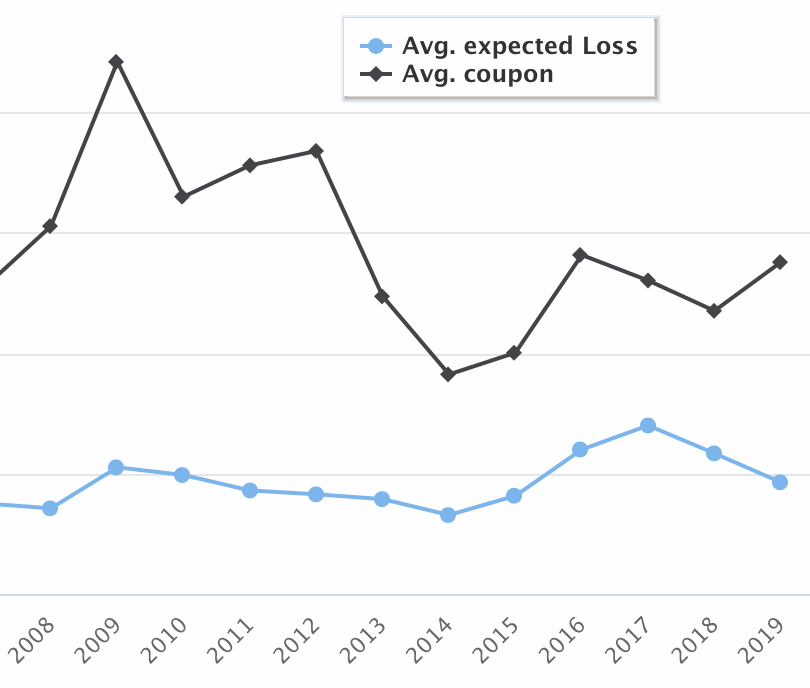

The chart below shows the average expected loss and coupon at issuance of all catastrophe bonds and related insurance-linked securities (ILS) from our Deal Directory on which we have the specific data points.

The chart shows that the spread above the expected loss has widened considerably in 2019 so far, as the average coupon had sat at 3.01% in 2017 and 2.96% in 2018, but has now increased to 4.57% to-date this year.

This is, of course, also reflected in the average multiple at market of catastrophe bonds and related ILS transactions issued and included in our Deal Directory, which has risen from around 2X’s expected loss last year to 3X’s expected loss in 2019.

After the catastrophe losses it is clear that cat bond funds and ILS investors are demanding higher returns, as evidenced by the pricing of recent cat bonds above guidance, or near the top of initial pricing, as well as in our key catastrophe bond market metrics.

Note: Our charts showing the average expected loss, coupon and the average multiple do not contain any mortgage ILS transactions, so are largely based on property catastrophe risk cat bond metrics.

Fitch Ratings says that ILS investors appetite remains strong, “The losses experienced in 2017 have not deterred investors from allocating capital to the sectors as investors continue to view catastrophe (re)insurance as diversifying source of risk.”

This ties in nicely with strong demand being seen from ceding companies looking to access the capital markets for reinsurance and retrocession, which has helped to drive cat bond issuance so far this year.

“Demand for insurance-linked securities (ILS) and catastrophe bonds remained very strong in the first five months of 2019, despite the hurricane activity experienced over the last two years. U.S. wind risk remains the leading peril in the catastrophe bond market, with nearly $2.2 billion of bonds exposed to named storms already issued this year,” Fitch said.

In total we have counted $5.5 billion of catastrophe bond and related ILS issuance so far in 2019, which includes private cat bond transactions and also the mortgage ILS deals.

Subtracting the mortgage ILS transactions, which are significant in terms of issuance volumes this year, leaves us with just under $3.2 billion of catastrophe bond issuance so far in 2019.

While this is still evidence of strong and continuing investor demand, it does fall far below the level of cat bond issuance seen by this point of the last two years, further evidence of the rational slow-down in the market as both ceding companies and investors continue to come to terms with their losses and the still ongoing loss creep.

The latest cat bond to emerge, which we learned of today, is a second issuance this year for the North Carolina International Underwriting Association (NCIUA), a sponsor that has only ever issued cat bonds on a staggered basis as they matured.

Why the NCIUA chose this year to issue two cat bonds is not fully clear, but it may be because issuance conditions are actually very attractive right now, with demand for U.S. property catastrophe risks still high and the improved pricing and returns sufficient to ensure investors are ready to support transactions at a reasonable risk adjusted return.

The higher returns, evidenced in our catastrophe bond market statistics and charts, will go a long way towards stimulating further cat bond and related ILS issuance throughout the rest of 2019.

Additionally, as the recent losses are increasingly put behind the market it’s likely we will see issuance volumes recover to nearer their historical values of the last couple of years.

———–

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region. Please register today to secure your place at the conference. Tickets are now selling fast.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.