Selective Insurance Group added $100 million to the top-layer of its catastrophe reinsurance tower at the January 1 2026 renewals, which lifted the top of the tower to cover up to $1.5 billion of losses, while its management said the renewal came with meaningful price decreases.

The expansion of the top-layer could position Selective to make even greater use of the catastrophe bond market in future, as the insurer’s first cat bond is scheduled to mature at the end of this year.

The expansion of the top-layer could position Selective to make even greater use of the catastrophe bond market in future, as the insurer’s first cat bond is scheduled to mature at the end of this year.

So it will be interesting to see if and how Selective opts to renew its cat bond coverage for 2027, given the upper-layer of its reinsurance program might now provide more room for cat bonds to fill it for 2027 onwards.

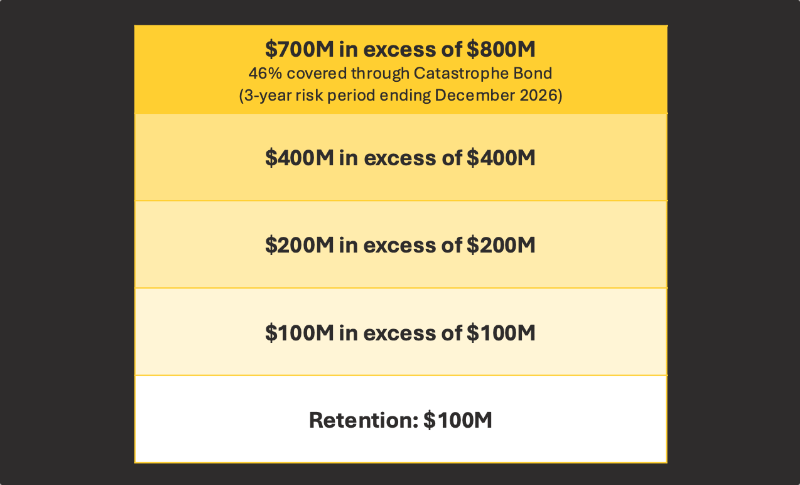

Selective’s 2026 property catastrophe reinsurance treaty now provides coverage from a $100 million retention up to $1.5 billion of losses, up from last year’s $1.4 billion.

The top-layer of the reinsurance tower for 2026 is now a $700 million layer excess of $800 million, where as for 2025 the layer was only $600 million in size.

Selective’s $325 million High Point Re Ltd. (Series 2023-1) catastrophe bond, which the company sponsored in December 2023, now provides 46% of the top-layer reinsurance coverage for the insurer, a slightly lower proportion than the 54% it provided in for 2025 given the layer expansion.

For 2026, the top-layer of the Selective catastrophe reinsurance tower has only been 93% placed, compared to 2025’s 95% placement.

But notably, 71% of the top-layer remains collateralized, suggesting that alongside the catastrophe bond there is also private placements from collateralized reinsurance providers, potentially insurance-linked securities (ILS) funds.

Commenting on the January reinsurance renewal, Selective CFO Patrick Brennan commented, “We successfully renewed our property catastrophe reinsurance program effective January 1.

“Our retention remains $100 million, and we increased our coverage exhaustion point to $1.5 billion from $1.4 billion. Property market conditions are attractive, and we completed the renewal with meaningful risk-adjusted pricing decreases in improved terms and conditions.”

Brennan also highlighted that, “We continue to supplement our main tower with a personal lines only buy-down layer.”

This personal lines specific reinsurance treaty was purchased for the first time for 2025, when it was a 97% placed $20 million excess of $20 million cover.

For 2026 the personal lines-only layer has increased to a 100% placement of the $20 million xs $20 million treaty.

Brennan further noted that, “Our peak peril U.S. hurricane is well within our risk tolerance and 5% of GAAP equity for a 1 in 250-year net probable maximum loss.”

Helping with this is also the fact Selective Insurance Group also has a property excess of loss treaty that covers losses up to $95 million in excess of $5 million retention on a per risk basis.

With the High Point Re catastrophe bond due to mature at the end of this year, in time for Selective’s next reinsurance renewal, it’s assumed the insurer could look to a potential replacement in the fourth-quarter of this year, perhaps sooner.

Selective’s management team has always spoken very positively about the cat bond and the multi-year protection it provided, so it will be interesting to see if they look to expand the contribution the capital markets provides to the reinsurance top-layer for 2027 and beyond.

Read all of our reinsurance renewal news coverage.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.