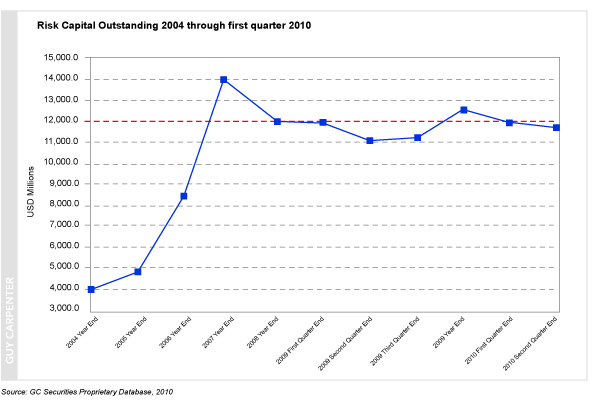

As with any marketplace of this kind the insurance-linked securities market for catastrophe bonds size is denoted by new issuance minus maturing transactions (which leaves risk capital outstanding). As this market is not particularly old (with the first cat bond deal we’ve recorded being in 1994) it saw the amount of risk capital outstanding grow significantly over the first few years. That growth has in recent years slowed.

The reason for the outstanding amount of capital staying pretty level over the last few years is that the amount of issuance has been very close to the amount of maturing transactions. Guy Carpenter have published a very useful graph on their GCCapitalIdeas.com blog which shows the level of risk capital outstanding here (see the graph below).

As you can see the amount of risk capital available in the catastrophe bond market has actually declined in the last few quarters. The reason for this is that transactions issued in busy years have all been maturing close together, and this at a time when issuance is still recovering from the set back the market suffered a couple of years ago.

We’d like to see that graph begin to uptick in the next year as confidence continues to recover and issuers satisfy investors with more diversified deals. Of course the Atlantic hurricane season is going to have a lot to say about that…

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.