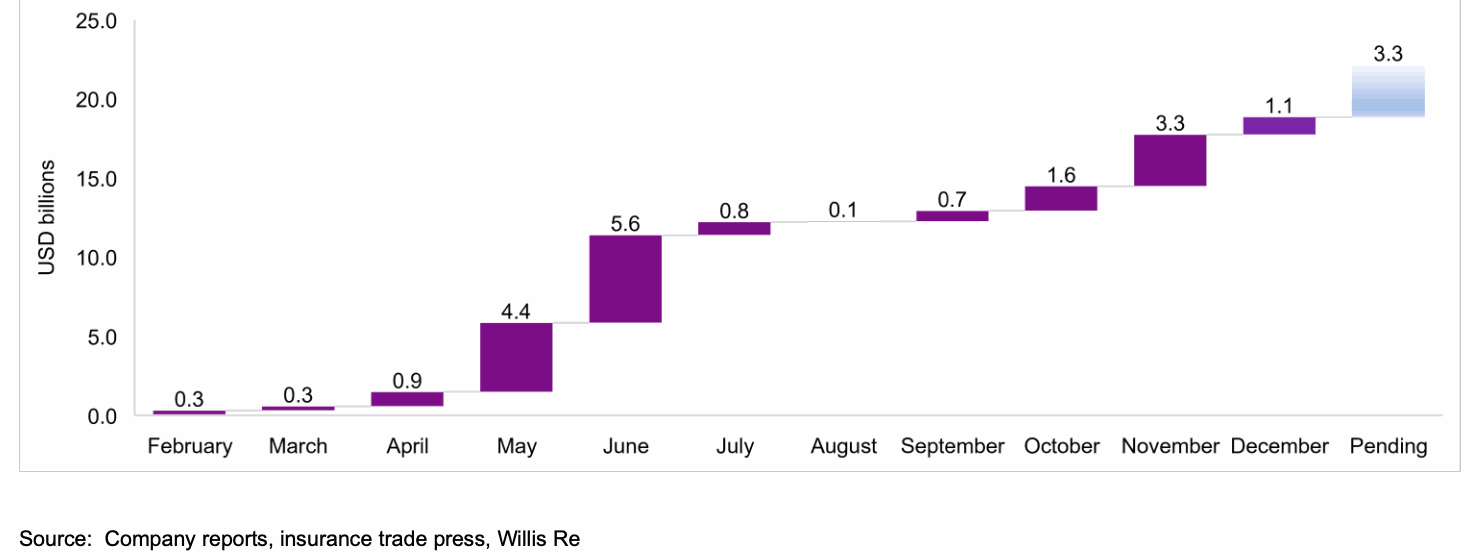

Improved reinsurance market pricing is attracting significant sums of capital, with the latest estimate from broker Willis Re being that $19 billion has already been raised since the COVID-19 pandemic broke out and another $3 billion of capital raises are underway.

This dwarfs the much discussed great reload of the insurance-linked securities (ILS) market at the back-end of 2017, which industry sources estimate saw somewhere between $6 billion and $10 billion of fresh capital enter reinsurance and retrocession during the last few months of that year.

Willis Re said in a recent report that capital raising in the insurance and reinsurance sector has picked up as year-end approaches.

In fact, the reinsurance broker estimates that as much as $6 billion has been raised in the fourth-quarter alone.

This takes Willis Re’s year-to-date tally for fresh capital raising to some $19 billion of confirmed capital raises, with another $3 billion in progress or being considered.

At $22 billion that’s a considerable sum, almost sufficient to completely fill the losses the industry has so far booked from COVID-19.

But this fresh capital is largely being raised for deployment purposes, as Willis Re notes, “Recent capital raises have been largely motivated by the strengthening pricing environment, particularly for reinsurance and commercial insurance lines of business.”

There has, in addition, been some balance-sheet bolstering going on and Willis Re believes this could continues, as pending legal rulings on COVID-19 claims are reached.

But, the broker provides some valuable context on the nature of capitalisation within global reinsurance.

While this seems like a lot of capital, reinsurers have returned to their shareholders three times more capital than they raised in the first half of 2020.

That just shows you how much capital reinsurers have been generating of late, underscoring the continued well-capitalised nature of the sector despite catastrophes and COVID losses.

Which raises the question of how this new capital will affect the market environment?

Looking back, that great ILS market reload at the end of 2017, at up to $10 billion or so of fresh capital, was enough to hold down rates though at the January 2018 renewals, resulting in disappointing reinsurance pricing across a wide swathe of the market.

That great reload was even called the death knell for the traditional reinsurance market cycle, but here we are today in 2020 watching a cyclical firming of rates, even as significantly more capital pours into the traditional side of the industry.

What’s different?

Where the money is flowing to has a lot to do with the industry’s ability to hold up rates this time around.

Many traditional re/insurers are under serious pressure to improve their returns, so sustained firming of rates is really what they need.

At the same time, ILS players are also seeking better returns and more stability in their portfolios, leading to a desire for higher pricing.

It seems clear that traditional re/insurers are banking on setting new baselines of risk adjusted return, enabling a profit to be delivered to their shareholders and the private equity backers who will be asking questions of them if they fail to deliver better performance going forwards.

While the reinsurance cycle may not have completely died, as had been forecast, it is different though.

This is a cycle driven by a fight for survival, as without sustainable profits some in the reinsurance market would have struggled over the longer-term.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.