The latest catastrophe risk stress testing analysis by the Bermuda Monetary Authority (BMA), of its property and casualty insurance and reinsurance market, shows up some interesting trends in the use of specific types of hedging, reinsurance and retrocession arrangements.

Having surveyed its marketplace based on 2019 data, the results show that the mix of catastrophe reinsurance protection structures used by insurers and reinsurers based in Bermuda had evolved, with quota shares and industry loss warrants (ILW’s) both seeing growth.

The BMA said that re/insurance carriers on the island use a range of reinsurance mechanisms to cede some of their exposures to others in the market and also to capital market investors, which will be largely via established ILS funds or other collateralized reinsurance structures.

The range of instruments used includes traditional property catastrophe reinsurance and retrocession contracts, quota share contracts, insurance-linked securities (ILS) protection (which we assume means securitized instruments such as cat bonds and certain private ILS) and industry loss warranties (ILW) contracts, amongst others.

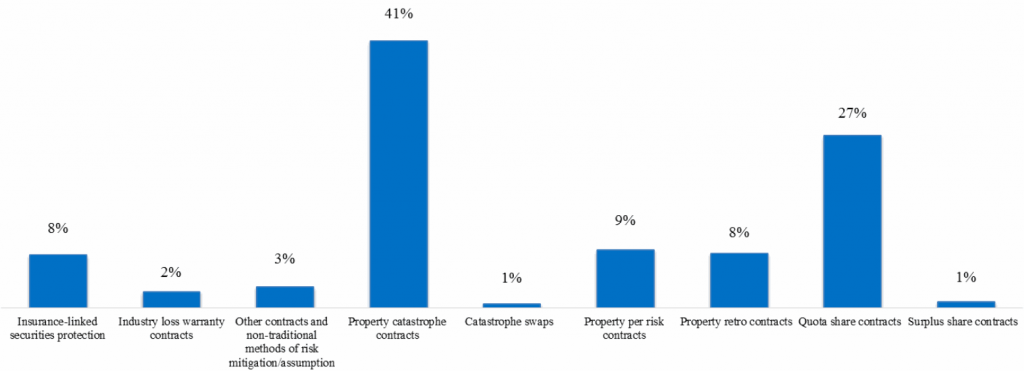

The stress test results showed the following break-down of us of catastrophe reinsurance instruments:

Specific changes noted by the BMA include the fact that property catastrophe reinsurance contracts, which presumably means traditional occurrence and aggregate indemnity treaties, has declined to 41% of the aggregate occurrence limit reported, down from 44% from the prior year’s data.

On the other hand, use of quota share reinsurance coverage has increased by 4% from year to year, at 27% in the above chart, up from 23% from the prior year’s data.

Insurance linked securities protection, at 8% of the limit reported, is flat with the previous year.

Industry loss warranty (ILW) usage though, is up to 2%, a doubling from the 1% of limit reported in the prior year.

Property per-risk contract usage is down slightly, while property retro and catastrophe swaps are both flat.

The stress test data is based on Bermuda re/insurers’ balance sheet positions and aggregated in-force exposures as at 1 January 2020, so do not include risk and protection assumed and acquired through this year.

It’s important to note that the limits of Bermuda’s Special Purpose Insurers (SPI’s) are not included here.

Overall, the BMA’s catastrophe risk stress test report shows that gross loss exposure assumed by Bermuda’s insurers increased by 1.5% (from $191 billion to $193.7 billion).

It also shows that the global share of gross estimated potential loss assumed by Bermuda insurers on the major Cat perils (combined) has also slightly increased by about 0.7%, from $176.0 billion to $181.9 billion.

This underscores the key role Bermuda’s insurance and reinsurance market plays in providing global catastrophe risk protection.

The results also show that the use of reinsurance is widespread in Bermuda, as companies ensure they are protected up to certain return periods.

The BMA explained, “The stress test results demonstrated that the Bermuda insurance market is resilient to potential adverse impacts from various global adverse financial market, Cat and other underwriting loss scenarios. These results highlight the industry’s overall resilience and establish the insurers’ ability to absorb these unlikely potential large losses whilst still having capital remaining to settle policyholder obligations and meet regulatory capital requirements.”

However and perhaps related to the state of the market through 2019 and into the 2020 renewals, the BMA noted that

“the level of reliance on reinsurance has decreased by about 7.1% compared to last year and varies across each peril.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.