Global re/insurer QBE has again been a beneficiary of improved reinsurance renewal market conditions at January 1st 2026, with an outcome that has allowed the company to further reduce the retentions for its main catastrophe reinsurance tower, with the company citing an “excellent” renewal.

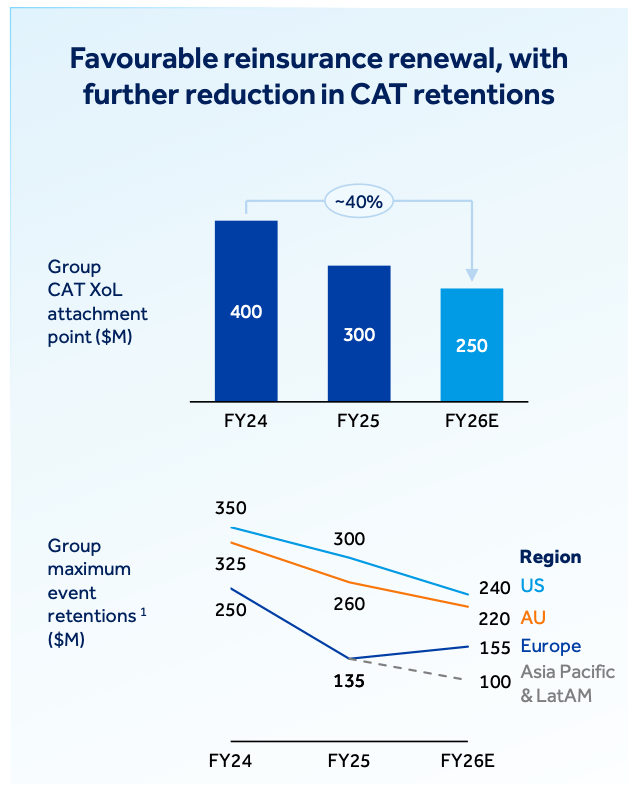

A year ago we reported that QBE’s main catastrophe reinsurance retention has fallen to $300 million, having sat at $400 million the year prior to that.

Now, thanks to another favourable reinsurance renewal outcome, QBE has reduced the attachment of its main catastrophe excess-of-loss reinsurance treaty to $250 million, for the United States and Australia.

Now, thanks to another favourable reinsurance renewal outcome, QBE has reduced the attachment of its main catastrophe excess-of-loss reinsurance treaty to $250 million, for the United States and Australia.

For the rest of the world, the main cat XoL reinsurance treaty now attaches at $200 million, albeit with some differentiation and as low as $100 million for Asia Pacific and Latin America.

The only place where the retention has increased slightly seems to be in Europe, where the catastrophe reinsurance protection attachment is at $155 million, up from $135 million a year ago.

You can see how QBE’s catastrophe reinsurance retention levels have changed in the diagram to the right.

QBE Group CFO Chris Chris Killourhy commented on the January reinsurance renewals this morning, “We achieved another strong and importantly, sustainable reinsurance outcome. Our diversification by region and class of business means we have a highly sought-after proposition in the market.

“Given the support of our strong reinsurer relationships, we were again able to reduce the attachment point of our cat program now to $250 million, that’s a reduction of almost 40% in just two years.

“This is at a time where, in the market more generally, attachment points and terms and conditions are rarely moving. Ultimately, we see this as strong external validation of our approach to portfolio management and the initiatives we’ve executed to reduce problematic exposures.”

The reduction in catastrophe retentions has helped QBE reduce its natural catastrophe budget for the coming year, with it falling to $1.13 billion which is expected to remain sufficient in around 80% of years. That’s down from $1.16 billion last year and $1.28 billion in FY 2024.

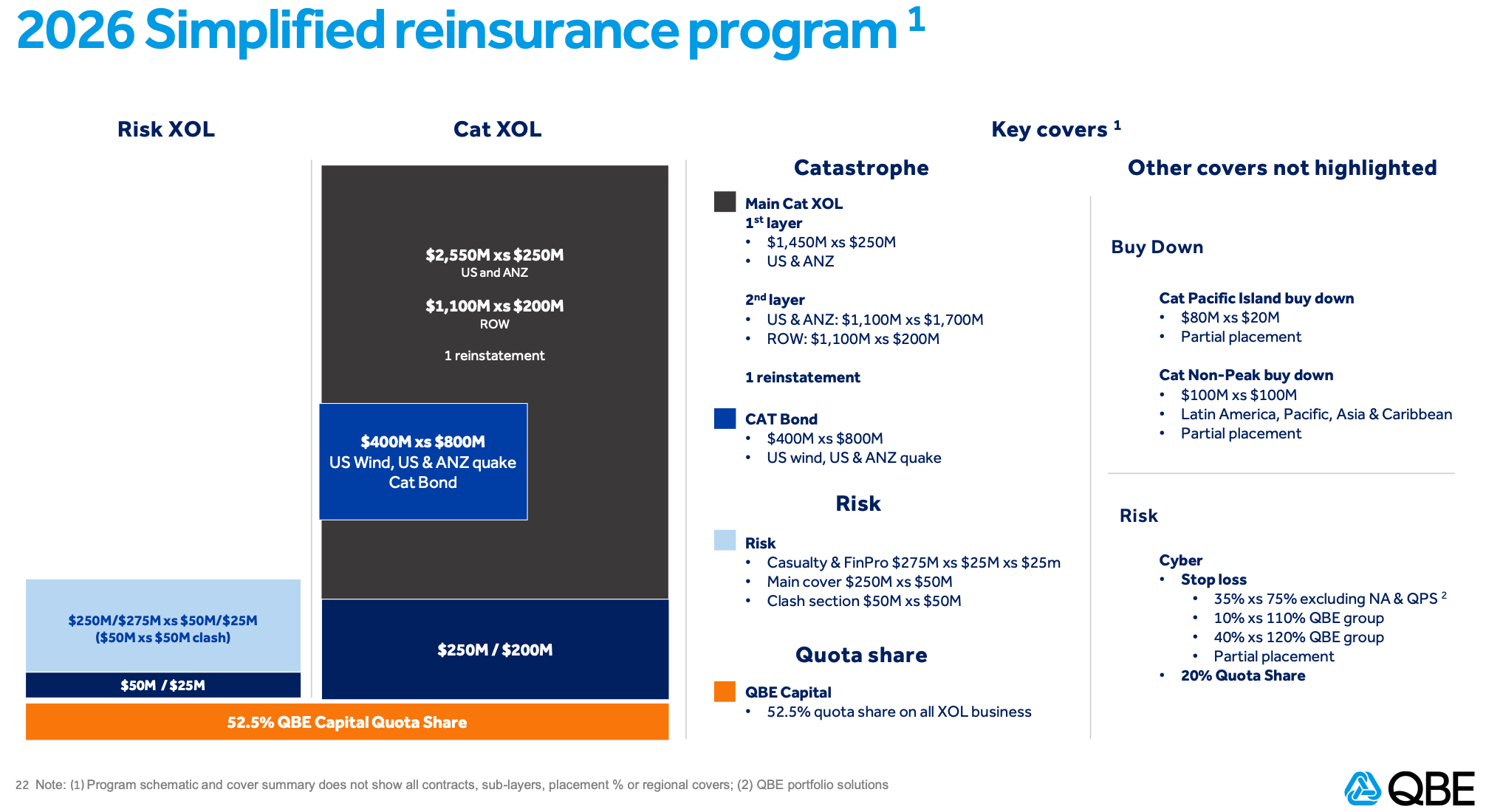

You can see QBE’s simplified diagram of its 2026 reinsurance program below:

QBE said that “greater reinsurance savings are expected based on the recent January 2026 renewal period,” implying costs were down as well as coverage terms having improved again.

The company cited both an “excellent” and “pleasing” outcome, which sets QBE up better for the coming year.

QBE CEO Andrew Horton stated on the reinsurance renewal, “We achieved quite significant savings on the new program, and our cat budget will be a touch lower year-over-year.”

Horton further stated today that QBE’s catastrophe reinsurance costs declined in the mid-teens at the renewals.

Horton also highlighted improvements in large risk reinsurance as well, saying, “Through the recent reinsurance renewal, we’re also able to lower the retention for our risk excess of loss cover. The coverage would generally attach for non-cat large claims of $50 million previously, and in many instances, that is now just $25 million. This will help manage large claim volatility.”

Finally, CFO Killourhy highlighted the recent $400 million catastrophe bond that QBE secured as assisting with its reinsurance renewal outcome for 2026.

Recall that QBE sponsored a deal that secured it $400 million of international peak peril reinsurance from the Bridge Street Re Ltd. (Series 2025-2) issuance back in December, the re/insurers largest catastrophe bond sponsorship yet.

“Most meaningfully for us is the fact that we’re able to secure the reduction in attachment point, and also the cat bond we placed this year just helps us a little bit with bringing down the overall cost of the program,” he explained.

Read all of our reinsurance renewal news coverage.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.