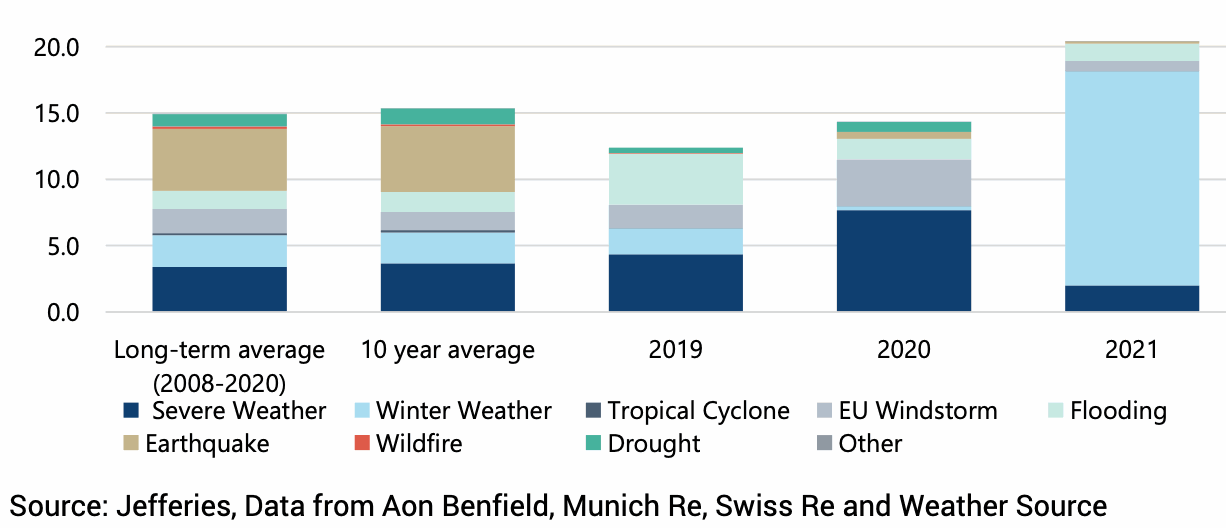

So far in 2021, global insurance and reinsurance market losses from natural catastrophes and severe weather are estimated to be running some 33% higher than the 10-year average, by analysts at investment bank Jefferies.

The majority of the catastrophe loss burden for the first-quarter of 2021 were to be found in the United States, at an estimated $17 billion.

The main drive was of course winter storm Uri and the freezing weather, which Jefferies analyst team attribute to roughly $15.3 billion of the total insurance and reinsurance market hit for Q1.

Around the rest of the world, the analysts have pegged a $700 million estimate on European windstorm related losses and $400 million on the flooding in Australia.

Which means that 2021, for the first-quarter, saw catastrophe insured losses running 33% above the 10-year average and more than 37% above the long-term 2008-2020 average.

“Winter weather losses so far in 2021 have been very high, reaching a level whereby 2021 is already the most costly year in our model for this peril,” the analysts explained.

The increase in estimate for the severe US winter weather to $15.3 billion is quite meaningful, as Jefferies previous estimate for that event had been just up to $12.5 billion.

So year-to-date, insurance and reinsurance market catastrophe losses are running well-above averages, which will show in reporting during the Q1 results season and will use up some of re/insurers buffers, while eroding aggregate deductibles, in advance of the peak peril summer wind seasons.

The major European reinsurers are all expected to report above-average losses for Q1, while Bermudians have been pre-announcing hits large enough to erode a lot of their profit in some cases.

For the insurance-linked securities (ILS) market, there are some catastrophe bond losses to contend with, as well as some impacts to private ILS quota shares and collateralized reinsurance deals.

However, this is all expected to be relatively evenly shared, with the majority coming from major US insurer programs.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.