Property insurance rates are expected to continue hardening through 2020 and into 2021 by AmWINS, as the company believes reinsurance pricing and loss creep have become key drivers, while capacity is not yet showing a sign of returning in abundance to dampen the momentum.

The market continues to move in a range of directions though, as underwriters and program managers juggle the forces of loss cost, capacity, deductibles and coverage, resulting in differentiation across accounts and originators.

The market continues to move in a range of directions though, as underwriters and program managers juggle the forces of loss cost, capacity, deductibles and coverage, resulting in differentiation across accounts and originators.

But the overall trends of a market moving to find a new baseline that better accounts for loss costs, at a time when reinsurance and retrocession are also on the move in hunt of rate, means that many are becoming increasingly bullish about the potential for more persistent firming.

“2019 was unlike any other and this market shift has affected carrier appetites, attachment and limits in a broad fashion,” AmWins Group Inc., the global distributor and servicer of specialty insurance solutions, explained in a recent report.

Adding, “The start of 2020 is no different; these market dynamics could stay with us for the foreseeable future.”

Pricing is moving at some pace now, with early 2020 seeing a positive increase in rates across U.S. property insurance lines, particularly in the commercial, large account and industrial space.

“As we head into 2020, the same market factors from 2019 are still in play, with the ultimate objective to return the book to profitability,” explained Harry Tucker, Executive Vice President and National Property Practice Leader for AmWINS.

The company believes that until underwriting profitability improves, the market will continue to see pricing, terms and conditions moving in a positive direction to the benefit of carriers and capacity providers.

Evidencing this, AmWINS data on property insurance rates shows that, “Early 2020 rate increases have been in the

10%-20% range for non-CAT exposed accounts. Accounts with CAT exposure and poor loss experience are realizing 20%-plus increases, and tougher classes are experiencing even greater increases.”

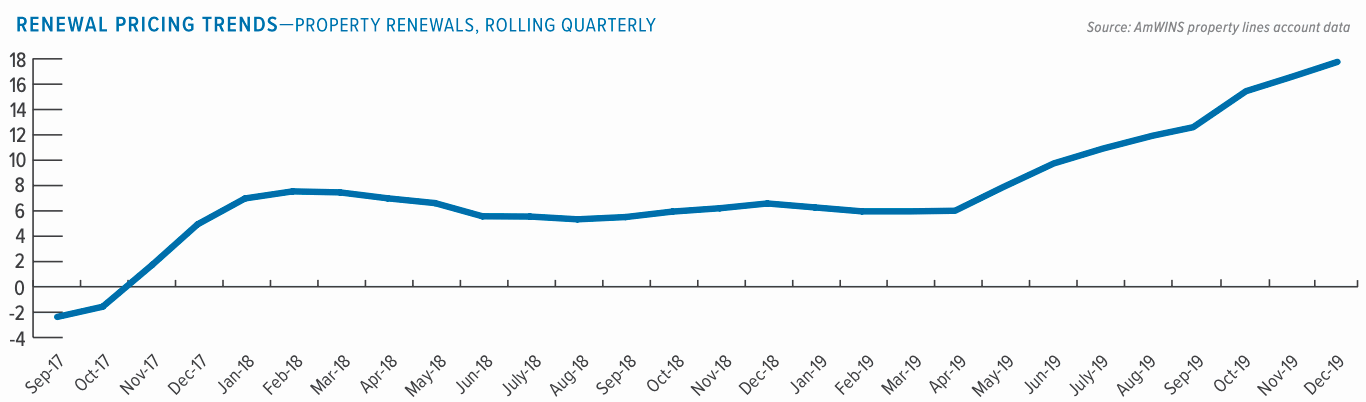

The chart below shows the generally positive trend that has been witnessed since the third-quarter of 2017, right after the severe hurricane loss impacts began in the United States.

Three trends drive this market, AmWINS believes.

First, the trend towards more conservative deployment of limit in the market, which AmWINS says is evidenced by the relatively stable capacity in the market, but the fact underwriters and carriers are being more discerning, which has helped to drive rates.

“Carriers’ conservative limit deployment and a de-risking strategy largely contribute to current tight conditions,” the company says.

Reinsurance pricing is another drive, which we’ve documented at length and is expected to persist through the next few sets of renewals, as this is also driving greater demand for rate in the primary market.

“We had some 1/1 renewals where the carrier was looking for flat pricing and the markets refused to quote without an increase,” explained Rich DiClemente, President of THB Intermediaries, an AmWINS company. “Another issue will be the retro market as the cost of reinsurer protection is up some 15%-20%, which will drive reinsurance costs higher.”

AmWINS says to, “Expect to see a continued increase in reinsurance rates and a reduction in line size this coming CAT season and for direct carriers to pass this cost along to buyers. The extent of rate increases will be better assessed after the larger domestic CAT treaties renew at 4/1 and 7/1.”

The third trend helping to drive the market is loss development, particularly that defined as creep from some of the major catastrophe events of the last few years.

Property insurance, traditionally, was not considered to have a “tail” AmWINS explains, but “loss development, or “loss creep,” is a growing concern for the market” today, the company notes.

“The magnitude of loss creep for virtually every major peak peril loss sustained in the last two years has surprised the market, and losses continue to develop adversely,” the report states.

This has become a significant driver for rate increases, as this loss creep has reduced capacity, trapped insurance-linked securities (ILS) fund capital, dented and surprised reinsurers, plus hurt primary property carriers and enforced higher hedging costs on them as well.

“This is changing how markets view property risk.” AmWINS says. “No longer is it just the “magnitude” of losses that are considered: underwriting assumptions around perils that had traditionally been viewed as attritional, rather than catastrophic, are changing.”

Taking these three factors together, AmWINS believes that, “The property market will continue to see rate increase, discretionary limit deployment and tougher terms and conditions through 2020 and into 2021.”

If capacity and new market entrants remain scarce, AmWINS believes that the firming of rates has a better chance of persisting over the longer-term.

Rate hardening is expected and forecast.

However, we believe, this will be dictated by the finding of a new balance (a pivot point perhaps, on or around which the market can find a new equilibrium), in terms of cost-of-capital, covering loss costs and managing efficient enterprise costs for the market, to ensure sustainable profitability of the full-range of strategies seen.

Given the range of strategies though, this equilibrium or pivot point may be found at different levels for different players and strategies, depending on their capital costs, efficiency of operations, access to originated risks and the strength of their underwriting relationships.

Which strategy finds its pivot-point first could set the future price for the bottom of the market. Whether they choose to keep it there will drive the ability of others to make profits that are deemed satisfactory over the longer-term.

With all stages of the risk transfer market exhibiting firming characteristics, currently everyone is moving in lock-step. It’s possible that could end when someone finds their ideal point around which to pivot from here on.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.