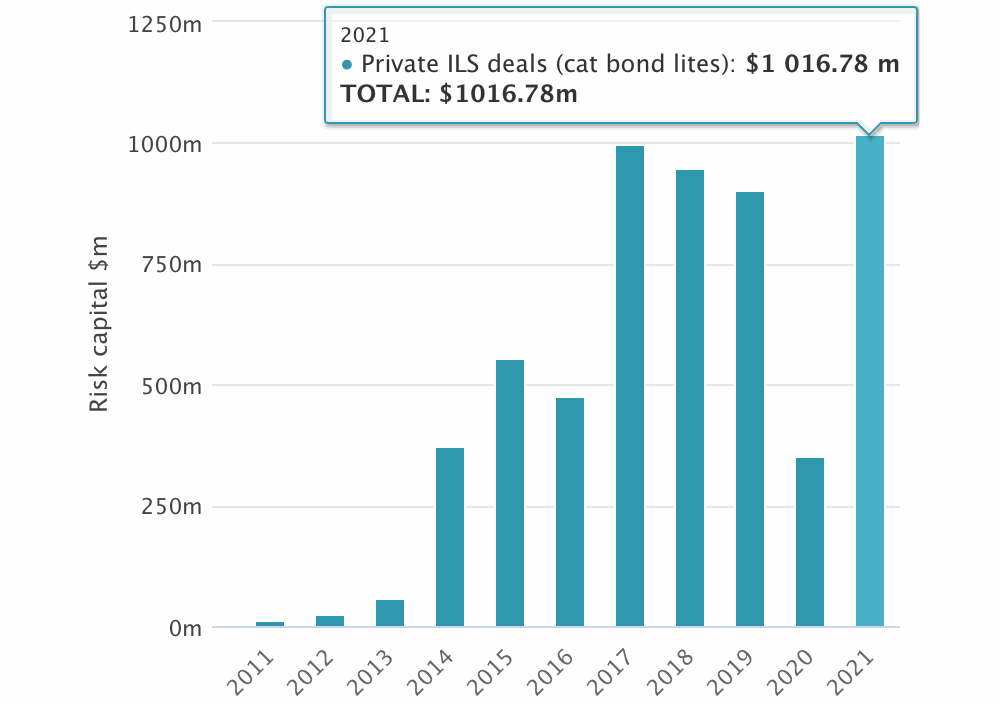

For the first time on-record, annual issuance of privately placed catastrophe bond transactions has surpassed $1 billion in 2021, as these more streamlined insurance-linked securities (ILS) arrangements continued to play an important role for some protection buyers, ILS funds and investors.

Private catastrophe bond activity had declined in 2020, as the annual issuance volume of privately issued and placed ILS deals, also known as cat bond lites, that we tracked here at Artemis fell to just over $350 million.

Private catastrophe bond activity had declined in 2020, as the annual issuance volume of privately issued and placed ILS deals, also known as cat bond lites, that we tracked here at Artemis fell to just over $350 million.

The prior three years were all relatively strong at over $900 million each and the previous record, before 2021, was set in 2017 when 26 private cat bond transactions that brought $997 million of risk capital to market were tracked by us at Artemis.

But, 2021 saw a particularly strong resurgence in the private cat bond market, helped by some renewal transactions, but also by some new transactions coming to light, showing that use of cat bond lites continues to expand, as well as an upsizing of some of the more regular, identifiable deals.

In total for 2021, we tracked just under $1.02 billion of private cat bonds in our Deal Directory, from 30 transactions that were issued during the year and that we had visibility of.

It represents a new annual record for private cat bond issuance, with 2021 the first year we’ve tracked more than $1 billion of these streamlined ILS deals.

You can track cat bond and related ILS issuance by year and type of transaction in our chart.

You can also view details of every private cat bond we’ve tracked by filtering our Deal Directory to see private ILS transactions only.

We listed our first privately placed catastrophe bond or ILS transaction in our Deal Directory back in 1998.

But it was the emergence of the Oak Leaf Re program of private cat bond deals in 2011, facilitated by what was then the Towers Watson Capital Markets team, that really introduced the use of streamlined cat bond issuance platforms, with standardised documentation and simpler issuance arrangements than a full 144A cat bond deal.

Since then, all of the major reinsurance brokers and broker capital market teams, have their own transformer vehicles and special purpose insurers (SPI’s) that can offer cedents and investors a location to transact reinsurance in cat bond form, privately and efficiently.

Private cat bonds are now used by ceding companies that want to transact reinsurance deals with a single, or small group of ILS funds or investors, as well as by ILS funds looking to securitize reinsurance and retrocession deals into a form more suited to a liquid cat bond fund strategy.

They have also been used by ILS funds to transact between each other and by corporates looking to access alternative sources of reinsurance capital.

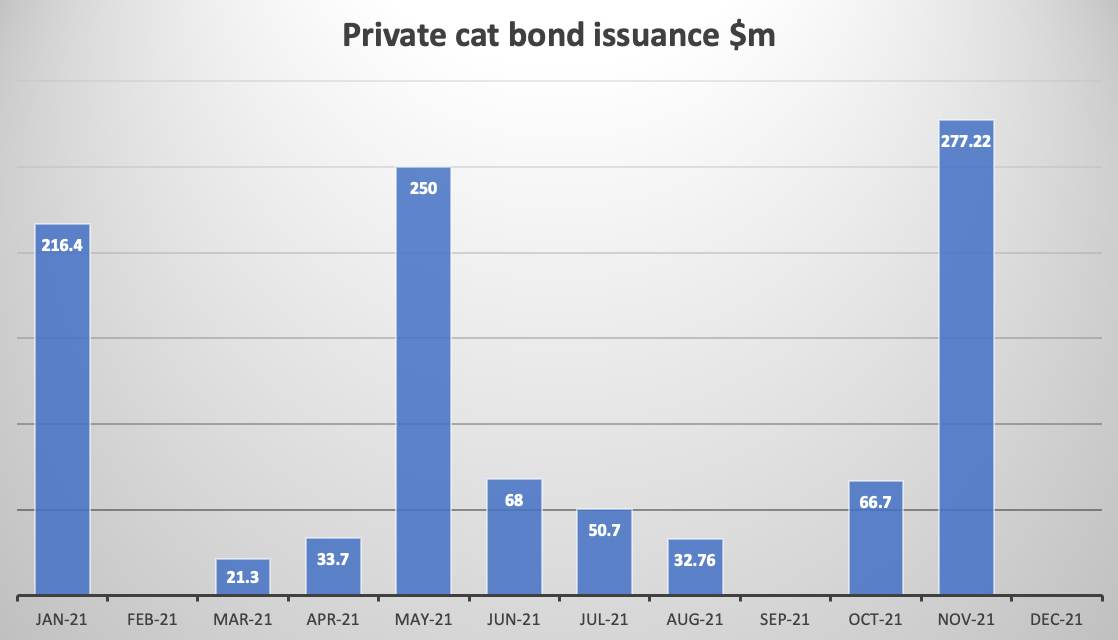

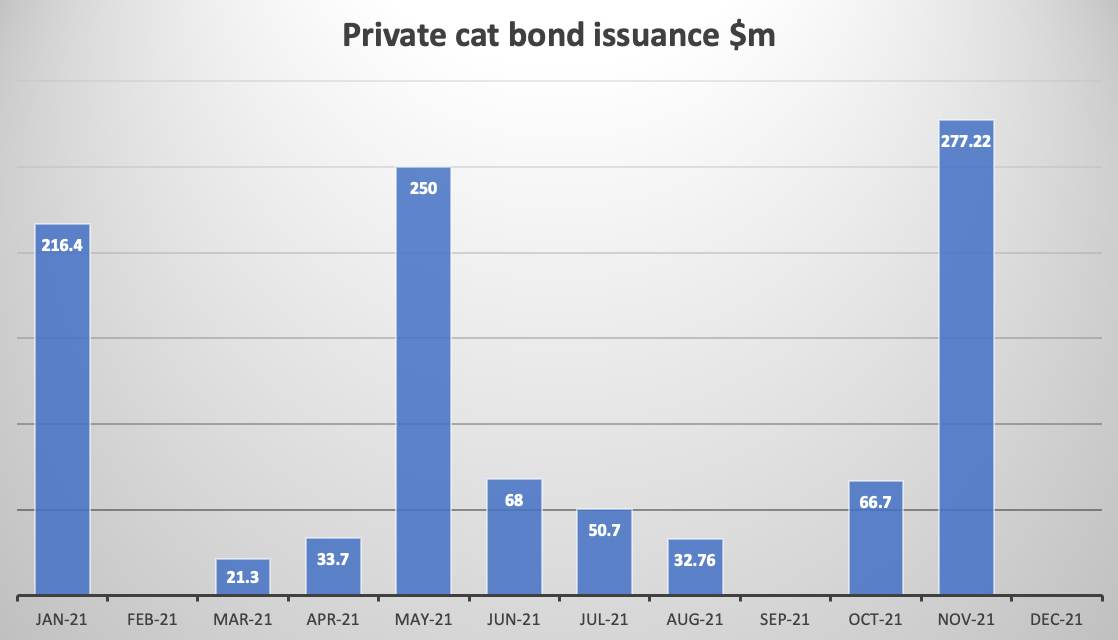

2021 saw interesting dynamics in the market for private catastrophe bonds, with particularly strong issuance in three months of the year, as our chart below shows.

2021 issuance began with a very strong January, with $216.4 million of private cat bonds coming to market from well-known issuance platforms.

Activity was then relatively quiet until May, private cat bond issuance tends to be more concentrated around the reinsurance renewals as you might expect, when a $250 million Aquarelle deal from Artex’s SAC platform was issued.

That transaction was particularly large, as most private cat bonds are below $50 million in size. In fact, it’s quite rare to see private cat bonds larger than $100 million, so a $250 million transaction likely represents a larger sponsor looking to access cat bond market capacity in the most efficient manner possible.

The biggest month of 2021 for private cat bonds was November, as four transactions totalling $277.22 million were issued by the Horseshoe owned Eclipse Re Ltd. platform, taking the annual total to the new record high.

2022 has already started quite briskly for private catastrophe bonds, with so far $64 million issued across three private cat bond deals.

We expect issuance will remain strong this year, as increasingly we hear from protection buyers that are looking for routes to access the catastrophe bond market at lower-cost than a full 144A issuance.

We expect a trend of corporate sponsors being directed to the catastrophe bond market using broker-owned private cat bond platforms as well, as increasing numbers of large corporations are aware of the cat bond market and how it can deliver an alternative and complementary source of disaster insurance capacity, especially for more challenged perils such as wildfire and certain layers of earthquake risk towers.

Update: On collection of additional deal data we’ve now recalculated prior year private catastrophe bond issuance and the total issuance from 2017 has now overtaken 2021, making that the record year at $1.1 billion.

Download our new catastrophe bond market report for more details of 2021 issuance.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.