The majority of institutional investors allocating to the insurance-linked securities (ILS) asset class are only expecting returns of up to 5%, confirming that for many, such as pension funds, ILS and reinsurance allocations are not an area where too much risk is being sought to add to portfolios

However, a significant 33% of institutional allocators responding to a survey said they expect 10% or greater returns from the ILS asset class.

However, a significant 33% of institutional allocators responding to a survey said they expect 10% or greater returns from the ILS asset class.

As we explained recently, research from global asset manager Schroders suggests that up to 5% of assets remains the sweet spot for allocations to ILS and reinsurance linked assets.

In fact, Schroders research found that a huge 92% of institutional investors surveyed said their allocations to the ILS asset class are less than 5% of their total asset base.

Because of this, it’s safe to assume that for many of these major investors it is the diversifying nature and low to zero correlation that is seen with investments in ILS, catastrophe risk in particular, that attracts them to the insurance-linked asset class space.

Given where global interest rates, treasury or bond markets, and other traditional asset classes sit currently, with returns low to even negative, it is very attractive for major pension investors to put some of their assets into an asset class like ILS at the lower-volatility end of the scale right now.

Seeing the value of an ILS allocation as a combination of their diversifying nature as well as pure returns makes for stickier money as well, which can be attractive for the ILS manager community.

Schroders, which has its own specialist insurance-linked securities (ILS) and reinsurance linked investments unit Schroder Secquaero, explored the growing trend for large investors to shift their portfolios towards alternatives, in particular what it terms private assets which is where ILS sits for it, as investors such as pensions continue to look for suitably diversifying sources of investment return.

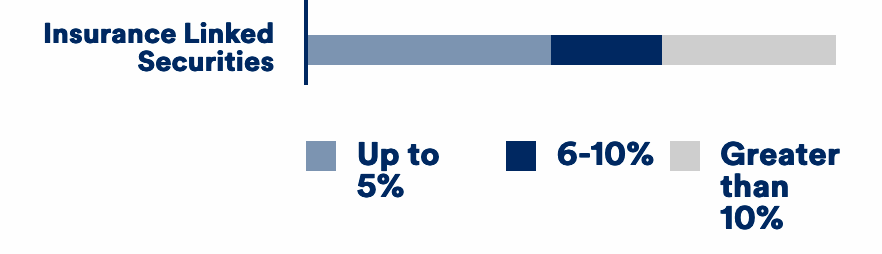

In surveying institutional investors about their allocation habits, to alternatives and private assets, Schroders found that investment return expectations for insurance-linked securities (ILS) are generally lower than other classes, with 46% of respondents saying that they only expect a return of up to 5%.

A further 21% of investors surveyed are expecting returns of between 6% and 10% from their ILS and reinsurance linked allocations, while interestingly 33% expect returns of 10% or higher.

We say interestingly, as of the private asset classes covered by the survey, which include assets such as real estate, private debt, infrastructure equity and private equity, the percentage of investors expecting over 10% is the highest of any group.

In fact and perhaps this is indicative of the way the ILS market is split into strategies currently, as an investment class ILS has the joint highest percentage of investors expecting up to 5% returns, the lowest percentage expecting 6% to 10%, and the highest percentage expecting 10%+.

Which might suggest a gap in the market perhaps, or fewer strategies that sit in the 6% to 10% range. Perhaps something to do with where ILS capital can be put to work most efficiently in reinsurance and retrocession programs.

Of course, it depends on the specific investors surveyed as well, as some are more mature in their allocation to alternatives and may feel that for an asset class where you can lose a lot of money in a particularly bad year it’s worth targeting a higher return.

It’s also perhaps a sign of the increasing range of strategies available, that ILS allocation preferences are quite split. It’s likely also somewhat due to the preferences of investment consultants helping to drive allocations, which as we understand can differ quite wildly and the fact that some investors may be less aware of the full range of ILS fund and investment options available to them.

On the concerns side, investors are generally wary of high valuations and a lack of transparency across private asset classes, as well as the potential to pay higher fees for these more niche and specialist investment offerings.

Fees and the lack of liquidity are also seen as hurdles to overcome, while the complexity of private markets is also seen as a potential barrier to entry to niche investment classes.

Overall diversification remains a strong driver for private and alternative asset allocation across all regions. But in the U.S. higher returns are increasingly being sought, where as regions such as Asia Pacific are looking for steady income sources as well.

Encouragingly, 52% of institutional investors that Schroders surveyed are looking to increase their allocations to private assets in the next five years, while just 14% expect to decrease them.

Schroders notes that while viewed as more complex, institutions are also aware of the attractive premiums offered by private assets and that these are a function of the illiquidity and complexity associated with them. As a result, Schroders says they majority are willing to outsource the expertise required to overcome these challenges and find a way into these niche investment classes.

Also read: ILS allocation sweet spot still seen as up to 5% of assets.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.