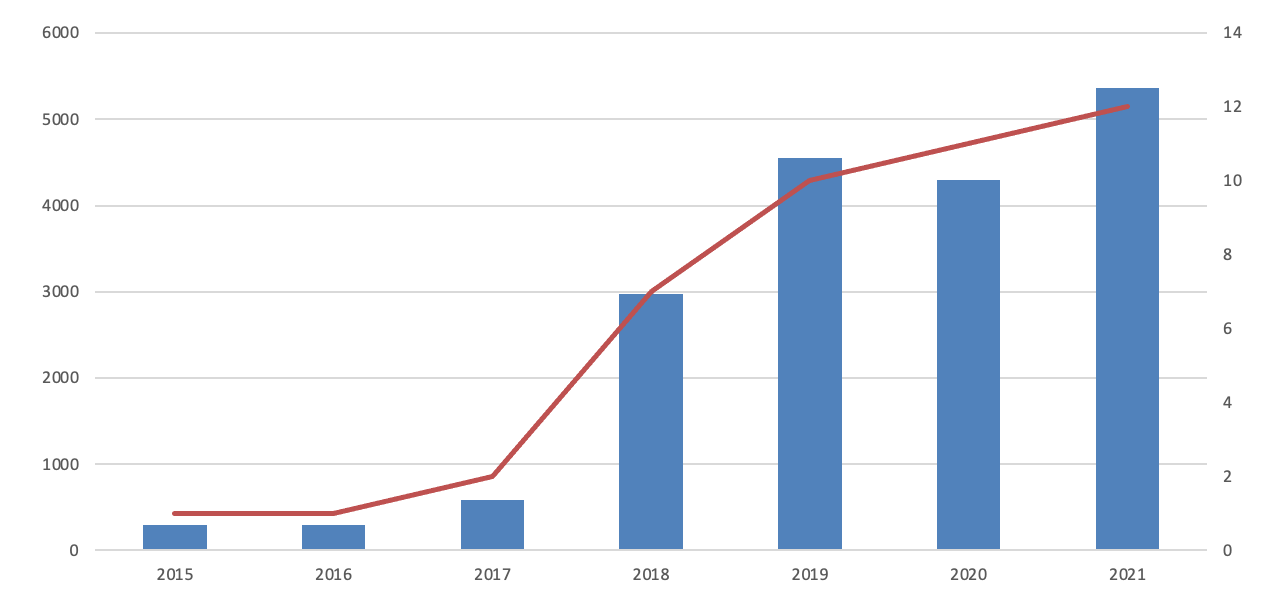

A record 12 mortgage insurance-linked securities (ILS) transactions have completed so far in 2021, taking annual issuance to more than $5 billion for the very first time, as shown by the Artemis Deal Directory.

Currently, mortgage ILS (often termed mortgage insurance-linked notes ILN) issuance is running approximately 18% higher than the previous record of $4.6 billion set in the 12-months of 2019, at a huge $5.4 billion.

After breaching $4.5 billion for the first time in 2019, mortgage ILS issuance declined somewhat in 2020 to $4.3 billion, with analysts warning early in the year that the Covid-19 coronavirus pandemic was expected to slow issuance in this market.

But while total deal volume fell in 2020 by roughly 6% from the prior year, the number of transactions did increase from 10 to 11. And, importantly, despite the year-on-year dip in issuance it did stay above the $4 billion mark for consecutive years, a trend which has persisted and shows little sign of slowing.

The chart below, based on data from the Artemis Deal Directory, shows the growth in mortgage ILS over the past six years. The trend line represents the number of transactions, which has also grown significantly.

Mortgage ILS are an example of insurers using the ILS or catastrophe bond structure to source reinsurance capacity from the capital markets for another peril class.

These transactions have become instrumental to the reinsurance and capital management arrangements of the US mortgage insurance majors and have played a significant role in helping carriers expand their businesses, while moderating exposures.

The first mortgage ILS deal came to market in 2015, followed by another deal the following year, before two deals then came to market in 2017.

Combined, the four deals issued in this period amounted to approximately $1.2 billion. The 2015 and 2016 deals were both sponsored by United Guaranty (then part of AIG) through its Bellemeade Re Ltd. issuance platform.

In 2017, National Mortgage Insurance Corporation (NMI) entered the market for the first time with its Oaktown Re Ltd. platform.

Then, later in the year, the Bellemeade Re platform issued its third deal, which was sponsored by Arch Capital Group after it acquired AIG’s United Guaranty.

The following year, the mortgage ILS market started to gain some real momentum as more sponsors entered the market and deal sizes increased, with mortgage insurers increasingly looking to capital markets backed sources of reinsurance capacity.

In total, seven mortgage ILS deals were issued in 2018, bringing just shy of $3 billion of risk capital to market, so more than double of what had been seen in the previous three years together.

Alongside three Bellemeade Re issuances during the year from Arch Capital and another Oaktown Re deal from NMI, first time sponsor Essent Guaranty entered with its Radnor Re platform, MGIC Investment Corporation issued its first Home Re deal, and Radian Guaranty sponsored its first deal under its Eagle Re platform.

So, from the first deal in 2015 to the end of 2018, total mortgage ILS issuance reached roughly $4.2 billion from 11 transactions, which were brought to market by five different mortgage entities.

In 2019, the $4 billion threshold was breached for the first time, while the number of transactions jumped from seven to 10.

During this period, which is the second most active year ever for the issuance of mortgage ILS, the only new sponsor was Genworth Mortgage Insurance, which entered the market through its Triangle Re platform.

Genworth was joined in 2019 by the other five sponsors, some of which were prolific in the year, including Arch Capital which sponsored four separate Bellemeade Re deals during the period.

Essent Guaranty sponsored two deals in 2019, while NMI, Radian Guaranty, and MGIC Investment Corporation each sponsored a single deal.

The 11 transactions issued in 2020 came from five out of the six sponsors. Arch Capital issued four Bellemeade Re deals, Essent Guaranty issued two Radnor Re deals, Radian Guaranty two Eagle Re deals, NMI two Oaktown Re deals, while Genworth issued a single Triangle Re deal.

So far in 2021, all six sponsors have returned to market to bring the record $5.4 billion of mortgage ILS issuance.

This includes three deals from Arch Capital, three deals from Genworth, two deals from MGIC Investment Corporation, two deals from NMI, and one deal from both Radian Guaranty and Essent Guaranty.

Of course, there’s still the best part of two months to go before the end of the year, and as shown by the Artemis Deal Directory, Radian Guaranty is currently in the process of issuing its second Eagle Re deal of the year, a $484 million transaction, while another transaction is also anticipated imminently.

Should this Eagle Re deal close at this size, then 2021 mortgage ILS issuance would total $5.846 billion from 13 transactions. With time left for further issuances from some of the other sponsors, it’s expected that mortgage ILS issuance will well surpass $6 billion this year.

As of today, so excluding the latest Eagle Re deal we have listed, a massive $18.37 billion of mortgage ILS has been issued from 44 transactions, comprised of 187 tranches of notes.

The Bellemeade Re platform is the most prolific in terms of the number of deals and the overall size of issuance. Since 2015, 17 Bellemeade Re transactions have been issued amounting to more than $7.9 billion. Of this, Arch has sponsored all but the first two deals, or roughly $7.4 billion of issuance.

The second largest slice of mortgage ILS issuance comes from the Radnor Re series sponsored by Essent Guaranty. Six of these deals have been issued since 2018, amounting to approximately $2.7 billion of total issuance.

Radian Guaranty’s Eagle Re platform sits in third place, in terms of the volume of risk capital, as five of these deals have featured since 2018 with a combined size of roughly $2.4 billion.

NMI was the first mortgage insurer to enter the market after the Bellemeade Re transactions, and since the introduction of its Oaktown Re series in 2017, has sponsored seven separate transactions with a combined value of approximately $2.1 billion.

The remaining nine mortgage ILS deals to have featured since 2015 include five from Genworth via its Triangle Re platform, which amount to roughly $1.8 billion, and four Home Re deals from MGIC Investment Corporation, totalling around $1.4 billion.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.