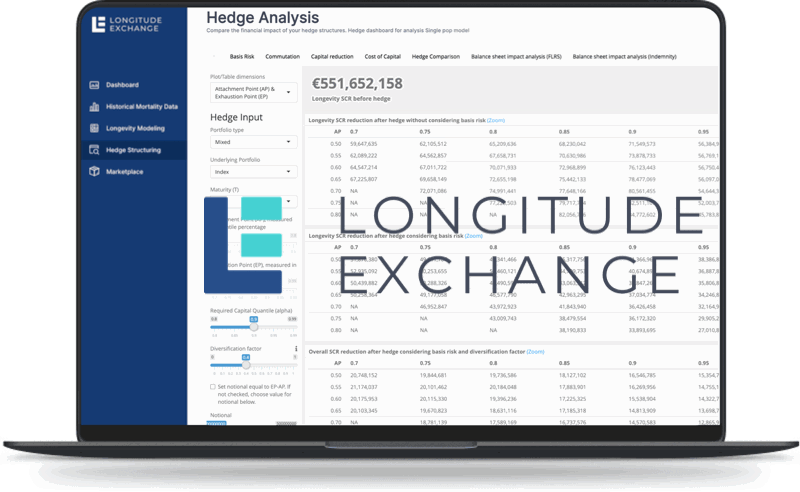

Zurich and Pacific Life Re deliver £1.6bn bank pension longevity swap

2nd May 2023Global insurer Zurich and life, longevity and annuity focused reinsurance firm Pacific Life Re have delivered a £1.6 billion longevity swap arrangement for the UK’s Yorkshire and Clydesdale Bank (YCB) Pension Scheme.

Read the full article