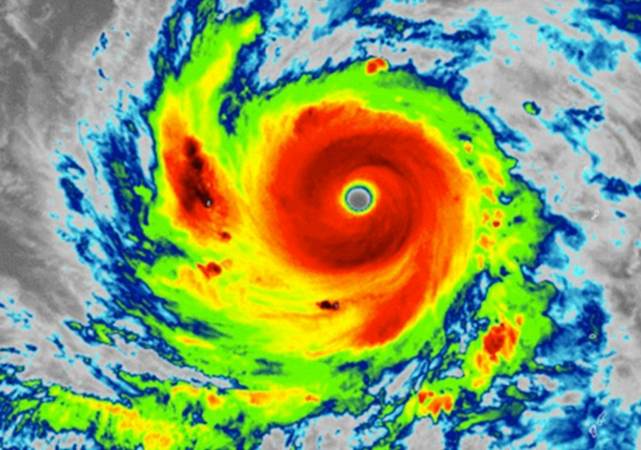

Global reinsurance firm Swiss Re strengthened its typhoon Jebi loss reserves in the last quarter and the firms CFO John Dacey said that the company puts the industry loss from the storm at close to $13 billion now.

Dacey also explained why the company believes the reinsurance industry missed the loss creep that was coming with typhoon Jebi and why the initial estimates were so wrong.

Dacey also explained why the company believes the reinsurance industry missed the loss creep that was coming with typhoon Jebi and why the initial estimates were so wrong.

Speaking during its earnings call last week, Swiss Re CFO John Dacey responded to questioning relating to the hardening of the reinsurance firms reserves for typhoon Jebi that was revealed in its results.

Dacey said that Swiss Re’s share of the Jebi industry loss, which it did not reveal, remained static and the reinsurers loss increased at the same rate that the industry loss from the typhoon had done.

Originally, it was assumed that Swiss Re had taken a roughly 10% share of the industry loss from typhoon Jebi, so with the loss now increasing towards $13 billion (more on that shortly) it’s expected the toll for the company, across reinsurance and Corporate Solutions, is well above a billion.

Dacey discussed the reasons the industry underestimated the loss from typhoon Jebi.

“With respect to Jebi and why this has migrated to an event which we now peg for the industry at something very close to $13 billion, I think there are a couple of specifics,” Dacey explained.

He said that one reason for the recent jump in the loss is that Japanese cedents close out their financial years at the end of March, so attempt to account for losses more fully at that point in the year.

The overlapping of typhoon Trami so close to typhoon Jebi was another issue, Dacey said.

“Trying to disentangle where and the scope of the losses was complicated by the second set of storms,” Dacey said.

In addition, Dacey said that the Osaka earthquake also exacerbated the challenges in loss reporting, as another catastrophe that had caused property damage in the reason and led to some demand surge.

“It was complicated by an earlier 2018 event, which was probably not as well seen in the market,” he explained, adding that “A modest earthquake around the Osaka region resulted in a series of buildings already being adjusted or repaired.”

The impending Olympics in Japan was another factor, creating additional demand that would have driven up claims costs, created demand surge and ultimately inflated loss expenses across the typhoons.

Dacey commented, “What you found is a set of events which combined made it very difficult to estimate what the scale of loss was and the cost of repairs, in this environment, where there’s a whole lot of commercial construction going on across Japan in anticipation of the 2020 Olympics.”

“So getting the surveyors out to both correctly identify the damage and then the repair work begun especially on commercial buildings has been much more complicated than previous times.”

This all aligns with other comments that it is business interruption and contingent business interruption, as well as soaring loss adjustment expense inflation, that has driven the significant loss creep for Jebi.

He believes that the reserves strengthening added in Q1 2019 should now be sufficient to cover the typhoon Jebi loss, suggesting that the latest industry estimate of almost $13 billion is going to be the final from Swiss Re.

“As we work with our primary companies, they are struggling to come to a final number,” he continued. “But we are convinced, at this point in time, that the amounts we’ve added here in the first quarter should, again with the information that we’ve been presented with, leave us in a fairly comfortable position going forward.”

Swiss Re has a property and casualty reinsurance combined ratio target of 98% for the full-year, but unless there is some positive development in the typhoon Jebi loss reserves now set, Dacey said that the company may not hit this target anymore.

Swiss Re’s large loss budget for P&C reinsurance is $1.25 billion for the year and it looks like typhoon Jebi loss creep will eat up a significant amount of that, which gives a good idea of the scale and impact typhoon Jebi has had on the market.

Finally, it’s interesting that Dacey noted Swiss Re now believes Jebi to be a close to $13 billion industry loss event.

It aligns with comments from Arch Capital CEO Marc Grandisson made recently, for one thing.

But perhaps more importantly, Swiss Re’s sigma research team data is often used as a trigger for industry-loss warranty (ILW) contracts.

As we explained recently, Swiss Re’s sigma had recently pegged Jebi’s insurance and reinsurance industry loss at $9.77 billion, which already threatens to tip some ILW’s into loss.

It’s not clear whether sigma itself will update its loss estimate for typhoon Jebi again. But the fact Swiss Re has pegged it much higher at near $13 billion could bring into question the future for some additional ILW’s, we’d imagine.

———–

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region. Please register today to secure the best prices. Early bird tickets are still on sale.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.