Insurance-linked securities (ILS) have once again demonstrated their lack of correlation to global financial markets in proving themselves “largely immune” to Covid-19 related volatility, Dirk Lohmann has said.

Insurance-linked securities (ILS), such as catastrophe bonds and other collateralised reinsurance structures, proved themselves resilient in the face of the Covid-19 coronavirus pandemic, according to Dirk Lohmann, Head of ILS at global investment manager Schroders, who highlighted their evident lack of correlation in a recent article.

Insurance-linked securities (ILS), such as catastrophe bonds and other collateralised reinsurance structures, proved themselves resilient in the face of the Covid-19 coronavirus pandemic, according to Dirk Lohmann, Head of ILS at global investment manager Schroders, who highlighted their evident lack of correlation in a recent article.

Lohmann highlighted that, “Insurance-linked securities have been almost unaffected by the market turmoil linked to coronavirus.”

He explained that Covid-19 has triggered “major corrections in the listed equity, commodity and debt markets” with the majority anticipating a global recession as imminent, if not already begun.

For the global insurance and reinsurance market, both sides of the business are being hit, Lohmann said, “That is to say, they will be facing virus-related claims, and their stock holdings will have traded down significantly.”

Conversely to this, “Insurance-linked securities (ILS), however, have been resilient.”

“The structure of ILS diversifies away from most financial market risks, and the asset class is subsequently uncorrelated to interest rates, stocks or currencies,” Lohmann explained.

Adding that, “This can be valuable, because all of these often move similarly to each other during crises. The performance of ILS largely depends on the occurrence of a loss event, mainly related to natural catastrophes.”

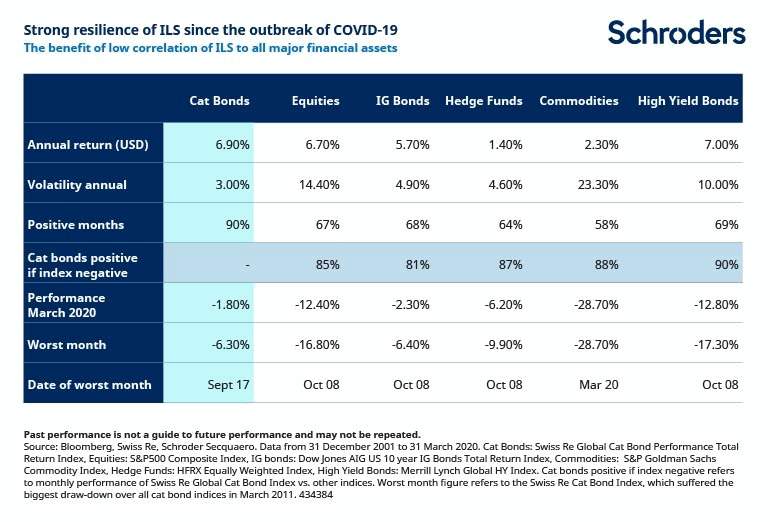

The chart above shows how catastrophe bonds have performed over time, versus a number of financial market benchmarks.

“During the Global Financial Crisis in 2008, ILS was comparatively stable, and so far has behaved similarly,” Lohmann highlighted.

Further explaining that the same should be evident through the current crisis as, “ILS is largely immune to Covid-19 as the majority of the risks transferred via ILS cover natural perils such as hurricanes or earthquakes.”

“There have been questions relating to life-related risks, given the Covid-19 outbreak,” he continued. “While there is life component to ILS markets, it constitutes a relative small – albeit growing – fraction of the whole. The impact of the virus on even those deals is currently expected to be limited.”

Discussing the past performance of the ILS asset class, Lohmann explained, “Compared to other asset classes, ILS have also historically offered investors lower volatility and less drawdown while still delivering attractive returns.”

The chart above from Schroders clearly demonstrates the impressive performance of ILS since the outbreak of Covid-19.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.