As per reinsurance broker Howden Re, industry loss warranties (ILWs) are expected to return to more normalised growth in 2026, as the January 1st reinsurance renewals showed rates falling by 10% to 20%.

In its January 2026 reinsurance renewals report, the broker estimated that the ILW segment shrank in 2025 to around US$6 billion.

In its January 2026 reinsurance renewals report, the broker estimated that the ILW segment shrank in 2025 to around US$6 billion.

“After a prolonged period of growth and outperformance, 2025 marked a year of moderated demand for the ILW market as buyers recalibrated their wider purchasing strategies. Limit transacted fell by 10-15% to ~US$6 billion, driven primarily by a significant reduction in higher risk purchases (including state-weighted industry loss products priced at 20-30% gross rates on line),” Howden Re said.

The broker noted that buyers’ rotation into competing retrocession products was primarily a price-driven and nonrecurring reallocation. While there was a slight transition at January 1, 2026, towards substituting ILWs with indexed catastrophe bonds, the extent of this shift was constrained due to the minimal overlap between the two markets.

“Most ILW writers remain unwilling to support similar structures in the private market unless cedents are prepared to pay above the typical US nationwide windstorm minimum GROL of ~6%,” Howden Re said.

As mentioned, Howden Re said that ILWs are expected to return to more normalised growth in 2026, as their appeal for tail protection, at levels slightly below typical index catastrophe bond attachments continues.

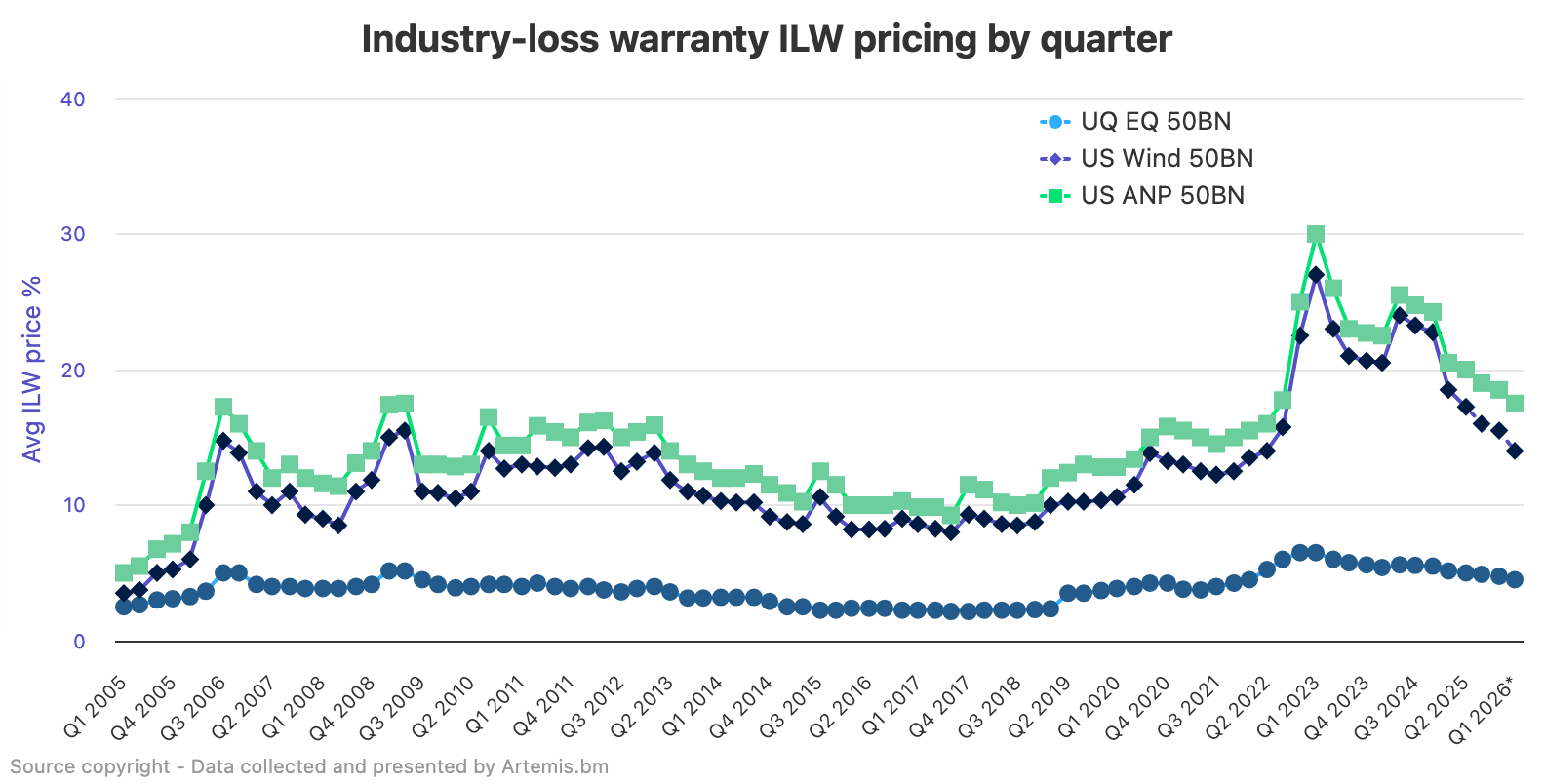

Howden Re continued: “Transactions at 1 January 2026 saw risk-adjusted reductions of around 10-20% (more in some instances) across the US nationwide windstorm occurrence curve, with the lower end of the range typically observed below the US$50 billion attachment point and the upper end above US$100 billion.”

The broker also went on to explain that the US$50-100 billion range saw less softening than expected at the Jan renewals.

However, the firm emphasised that most buyers anticipate further softening within this area through Q1 2026 and Q2 2026.

These ILW price movements as indicated by Howden Re, closely resemble what we have been hearing from our market contacts.

In our ILW pricing chart below (analyse an interactive version of here), the dotted-lines indicate projections for the forward-looking ILW rate environment.

Switching to the international markets, Howden Re outlined that they have even more room to grow, given their low starting base (less than 20% of limit transacted in 2025), the expansion of peril coverage and the emergence of new indices.

With numerous European ILW transactions now encompassing flood coverage, and with the availability of official severe convective storm (SCS) industry-loss reporting for Europe, Japan, and New Zealand, the groundwork is established for increased market participation and future product innovation, as noted by Howden Re.

Indeed, the early bound volume demonstrates this trend, with European windstorm ILWs decreasing by 15% to 20% on a risk-adjusted basis at January 1st, 2026, and even more when non-peak coverage, including flood and SCS, is taken into account.

Howden Re also noted in its report that while buyers continue to seek out protection for non-peak perils, “Expectations for broader coverage within US aggregate ILWs (such as the inclusion of all natural perils) have diminished due to severe convective storm-driven model increases.”

Further stating that, “Expectations for increased traded volume for these products remain high, although bid-ask spreads are still wide at this early stage of the 2026 trading season.”

We hope you find our ILW pricing data useful, as another indicator of reinsurance and retrocession market appetite and rates-on-line.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.