The insurance-linked securities (ILS) fund sector gained 0.81% on average for November 2025, lifting the group of cat bond and ILS funds tracked by the ILS Advisers Fund Index to an average 11-month return of 10.40%.

November 2025 saw the average returns of the insurance linked securities fund sector falling back slightly, although still delivering well-above average performance for the month.

November 2025 saw the average returns of the insurance linked securities fund sector falling back slightly, although still delivering well-above average performance for the month.

The ILS fund sector had been delivering particularly impressive returns through the peak seasonality period of the US hurricane season, with the ILS Advisers Fund Index having delivered record average monthly returns for each of July through October 2025.

While not a record, November 2025’s average ILS fund performance as tracked by this Index, of 0.81% for the month after 86% of strategies had reported their returns, is still impressive being well above the average even when you take out negative months from year’s when November drove ILS fund losses.

Including the average ILS fund return of 0.81% for November 2025, based on 86% of the ILS funds tracked having reported for that month, the ILS Advisers Fund Index now sits at a 10.40% return for the first eleven months of 2025.

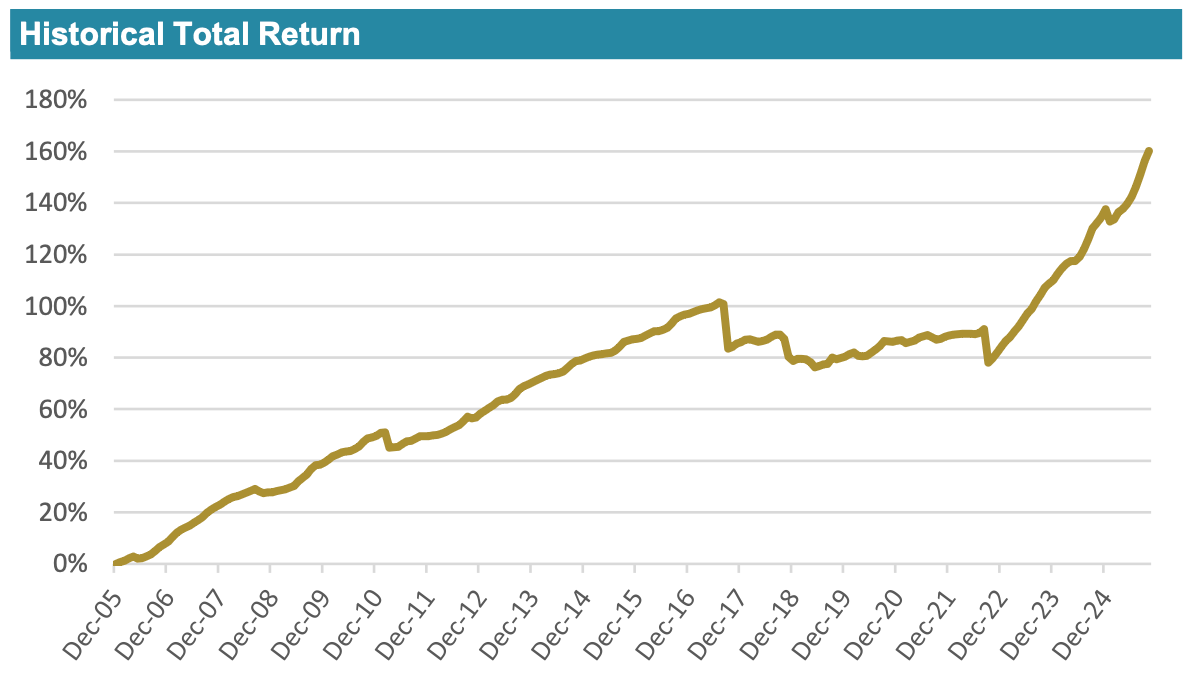

Impressively, this already makes 2025 the third strongest year for the ILS Advisers Fund Index returns on-record after only eleven months, following the record set of 13.90% in 2023 and 13.12% in 2024.

Were it not for the -2.00% return this Index experienced in January due to loss impacts to ILS and reinsurance strategies from the devastating California wildfires, the return year-to-date would have been even more impressive. Although it is worth noting some of that January decline was earned back in later months as the true losses from the wildfires became clearer.

ILS Advisers explained that private ILS fund strategies, so those that invest in cat bonds and other collateralized reinsurance instruments, again led the way with the higher average returns for November 2025.

The private ILS fund segment tracked by the Index returned 0.95% for the month, while the pure catastrophe bond funds delivered a 0.71% gain.

All 31 of the ILS funds that have reported their returns for November so far were positive for the month.

But again, there is a wide dispersion reflecting the range of strategies available in the ILS fund market, with the worst performing fund gaining 0.45% and the best gaining 2.01% in November.

You can track the ILS Advisers Fund Index here on Artemis. It comprises an equally weighted index of 36 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.