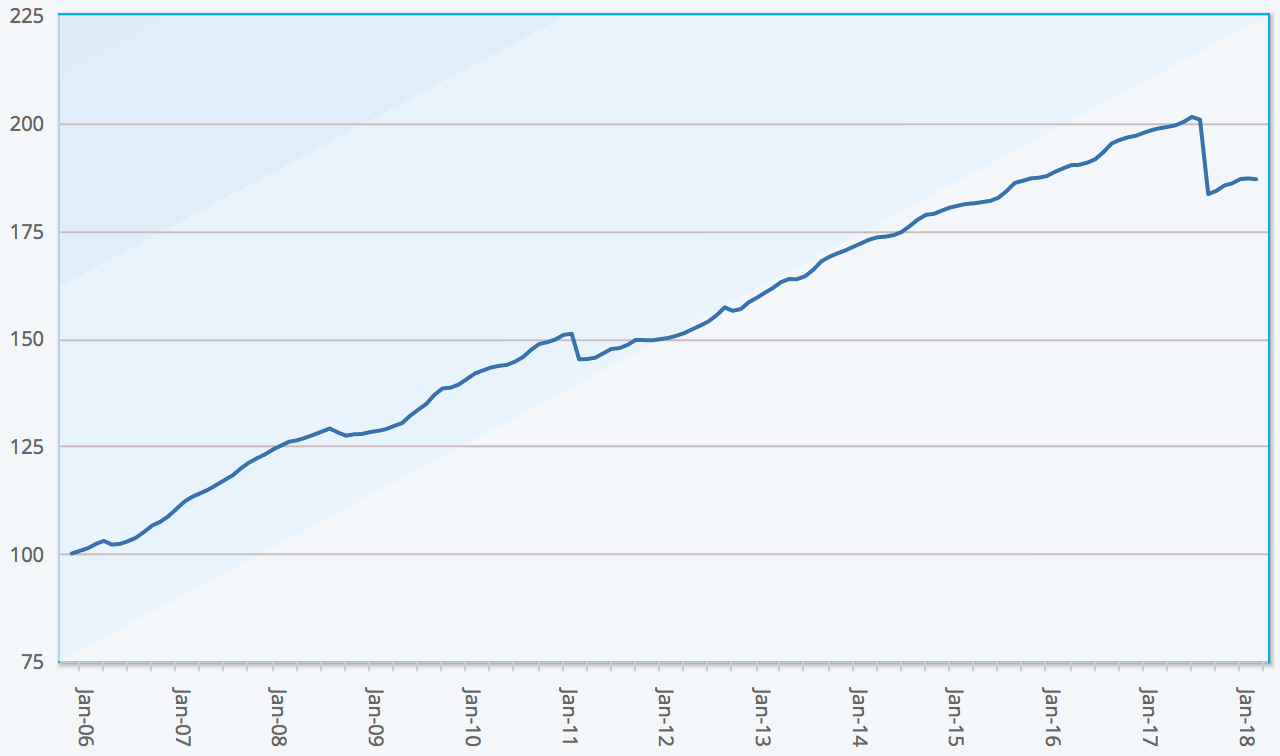

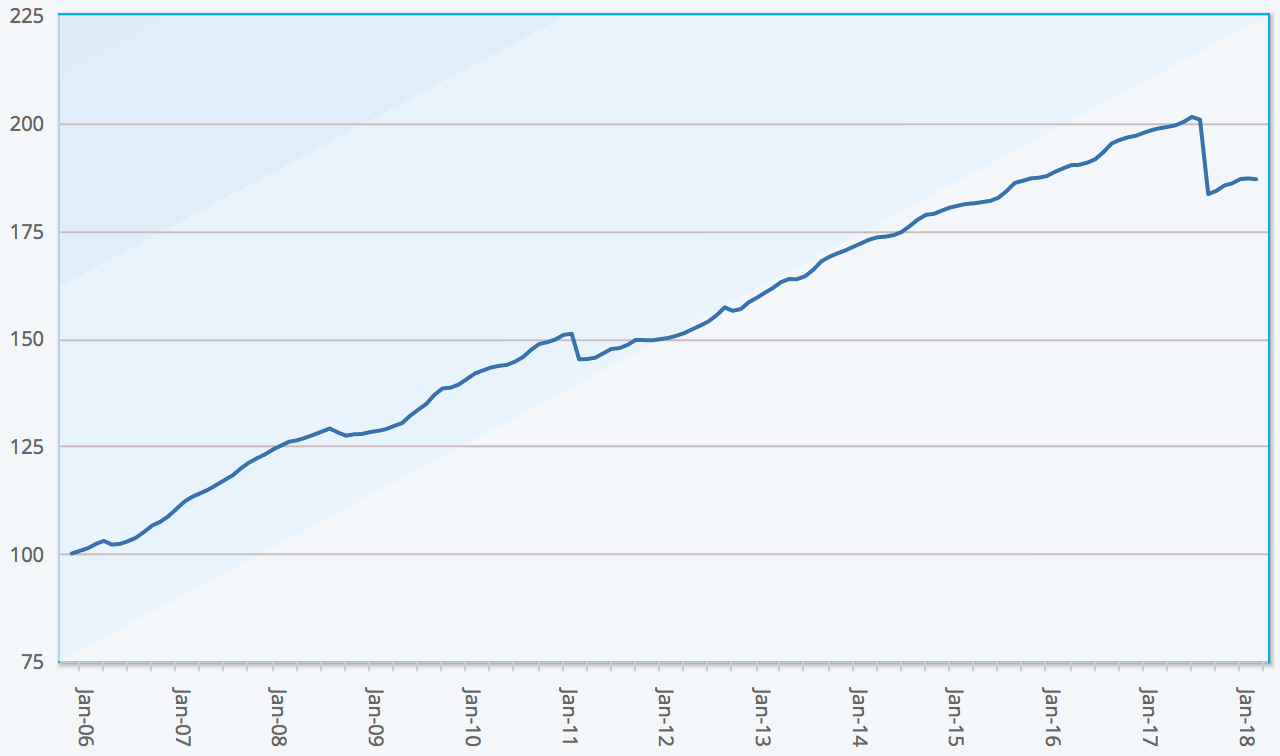

Insurance-linked securities (ILS) and collateralized reinsurance funds have fallen to an average loss of -0.28% for the month of April 2018, the first negative return for an April since ILS Advisers Index began tracking the market in 2006, as hurricane Irma loss adjustments continued.

In April, the performance of ILS funds continued to diverge, with some funds suffering the impacts of worsening loss estimates related largely to hurricane Irma’s impact.

In April, the performance of ILS funds continued to diverge, with some funds suffering the impacts of worsening loss estimates related largely to hurricane Irma’s impact.

The Eurekahedge ILS Advisers Index was down -0.28% for the month, which drags the year-to-date performance of the Index down to just 0.09%, which is the second lowest in thirteen years for this stage of the year.

The impacts of the 2017 catastrophe loss events continued to hurt some ILS funds and collateralized reinsurance investors in April, which is largely put down to increases in loss adjustment expenses (LAE) related to Irma.

In April, only 3 ILS funds reported negative returns though, so the market as a whole was largely up for the month, but the size of adjustments has served to drag down the overall Index performance into negative territory again.

“31 funds represented in the Eurekahedge ILS Advisers Index made positive returns. The difference between the best and the worst performing fund was 19.68 percentage point. Among the 3 negative funds, 2 are private ILS funds,” explained Stefan Kräuchi, Founder of ILS Advisers.

Investments in catastrophe bonds performed well during the month of April, with the pure cat bond investment funds tracked by ILS Advisers being up by 0.25% for the month, while the funds that also invest in private ILS and collateralized reinsurance declined by -0.66%.

In fact it was a pure cat bond fund that was the biggest gainer for the month, with one cat bond investment strategy returning 0.83% for April 2018, while the biggest decline for the month was one private ILS focused fund that declined -18.85% on the back of updated loss estimates, of course this was the Markel CATCo fund which we’ve already covered.

Commenting on the impacts of loss updates, Kräuchi said, “The loss development demonstrates how complicated the series of events were. According to the manager the major reason is the significant increases in loss adjustment expenses (LAE) and late claims reporting.”

Kräuchi explained that LAE can make up as much as 20% of the total losses industry wide and as much as 40% for some carriers, making it a significant driver of the overall magnitude of an industry loss.

Additionally, the Assignment of Benefits (AOB) issue, where contractors and law firms seek direct payment from insurers on behalf of the policyholder can also drive loss estimates higher and result in creep.

“It not only amplifies the claims for the industry but also increases the burden on customers due to the eventually higher premiums charged,” Kräuchi said.

“ILS investors are eventually harmed by such practice as well,” he continued. “It reminds investors again that although ILS are in the hand of mother nature, human factors can play a crucial role.”

Kräuchi noted that there are industry led efforts calling for change in the way AOB is handled and that the ILS sector is keen to find a better way for this to be managed and also understood in the risk models.

So in April 2018, 31 out of the 34 ILS funds tracked by the Index were still positive, but the results of a few were sufficiently negative to drag the Index to a loss for the month.

Overall the impacts of the 2017 hurricanes has been more detrimental to the returns of funds invested in private ILS and collateralized reinsurance, and on an annualised basis year-to-date the private ILS funds now trail pure catastrophe bond funds by 5.49%.

If the more negative ILS funds were excluded from the Index calculation for April it would have been a positive month, so the overall market performance has been overshadowed by some particularly large loss adjustments at specific funds.

Register now for our upcoming Singapore conference. Tickets on sale here.

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.