The return of catastrophe bond and insurance-linked securities (ILS) funds appear widely dispersed after the first-half of the year, as ILS Advisers reported a range of -5.1% to as high as +8%.

This once again demonstrates the wide range of strategies in the catastrophe bond and broader insurance-linked securities fund marketplace, as well as showing that performance is as diverse as the range of strategies on offer.

This once again demonstrates the wide range of strategies in the catastrophe bond and broader insurance-linked securities fund marketplace, as well as showing that performance is as diverse as the range of strategies on offer.

For the month of June 2021, the average ILS fund return was 0.32%, according to the Eurekahedge ILS Advisers Index, which was below the historical average of roughly 0.44% for the period.

ILS Advisers highlighted a range of catastrophe loss events around the world during June 2021, the most serious of which, in terms of insurance and reinsurance market losses, was severe convective weather in parts of Europe.

However, as we explained earlier this week, some ILS funds, largely those focused on collateralised reinsurance and private ILS contracts, but also some cat bond funds, may have experienced loss creep from prior period catastrophe events in June, as well as some additional reserving for COVID-19 pandemic related potential losses.

Secondary catastrophe bond market pricing was depressed a little during June, which will have impacted the returns of some cat bond funds, but still this doesn’t appear to have been too significant.

As ILS Advisers reported that pure catastrophe bond funds as a group gained 0.26% in June 2021, while the subgroup of funds that invest in private ILS and collateralised reinsurance outpaced this by gaining 0.35%.

In total, 26 of the ILS funds tracked by ILS Advisers Index were positive for the month June, while 2 were negative.

The range of returns was quite wide, at -0.8% to +2.1% in June, but not as wide as the performance gap for the whole of the first-half of 2021.

Across the entire fist six months of 2021, pure catastrophe bond funds as a group delivered a 1.08% average return, while the private ILS strategies lagged behind somewhat, gaining only 0.79% on average.

Across the first-half of 2021, 19 of the ILS funds tracked by ILS Advisers’ Index were positive, while 5 fell to negative returns for the six months.

As a result, performance ranged from -5.1% to +8.0%, ILS Advisers data shows, clearly reflecting the wide distribution in strategies and also the wide range of impacts felt from losses by ILS funds through the first-half of 2021.

Looking ahead, most ILS funds recoup the majority of their returns during the peak of the Atlantic wind season, so ILS fund returns should be strong over the next few months, loss activity allowing.

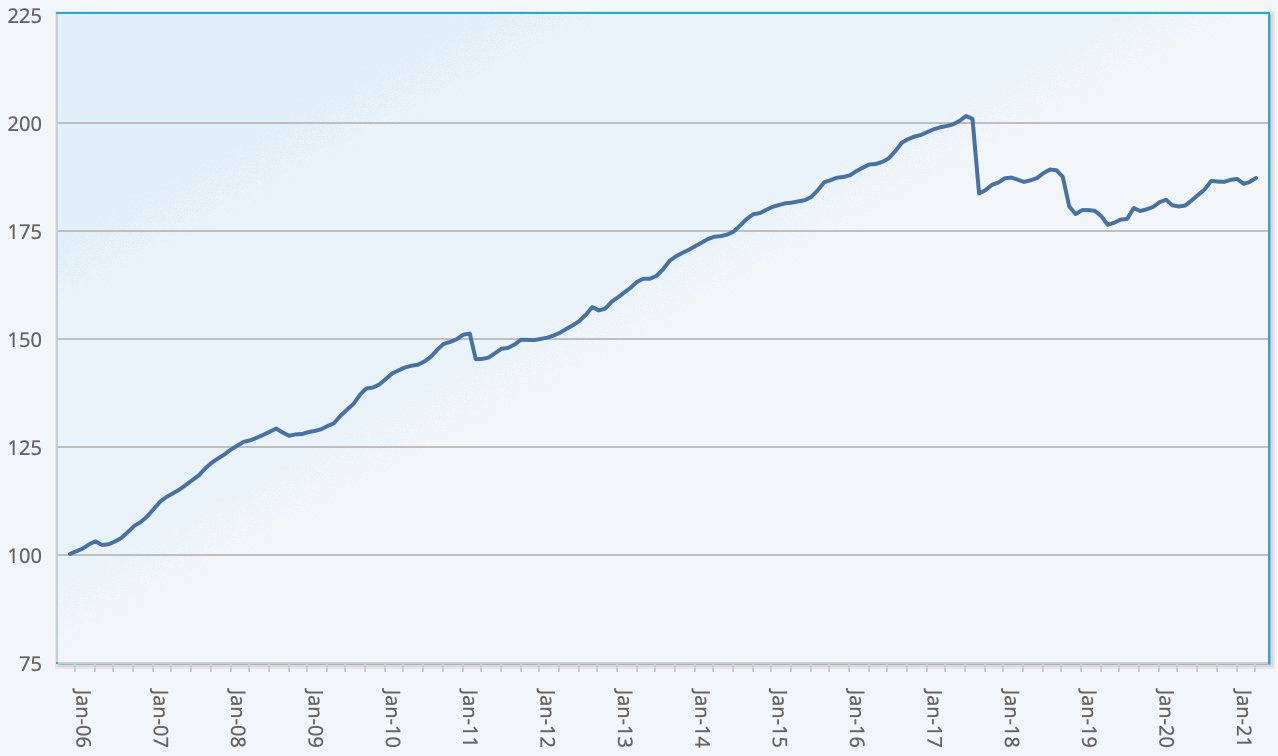

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 28 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.