Insurance-linked securities (ILS) funds, as a group tracked by ILS Advisers and Eurekahedge, have delivered their best single monthly return of the year since January, with the average return across the group of ILS funds reaching 0.24% in July 2022.

The average return of insurance-linked securities (ILS) funds was a positive 0.24% return for July 2022, according to the Eurekahedge ILS Advisers Index.

The average return of insurance-linked securities (ILS) funds was a positive 0.24% return for July 2022, according to the Eurekahedge ILS Advisers Index.

It takes the year-to-date performance for the Index to 0.57%.

The performance of ILS funds was not even again in July, as private ILS fund returns eclipsed those from pure cat bond fund strategies, as the recovery from the spread-widening and selling-pressure was not really underway at pace in July, resulting in another depressed month of returns for the cat bond fund market.

As our new page displaying cat bond fund indices that track just dedicated UCITS structured funds that invest in catastrophe bonds shows, the recovery accelerated in August, leaving July’s returns depressed again.

Spread widening continued through the first-half of July, ILS Advisers explained, although to a lesser extent than in previous months.

Therefore, cat bond investment yields helped to offset price declines in July, while the increasing money market return is now also visible in cat bond performance.

This helped Swiss Re’s cat bond total return index deliver a positive 0.54% for July, even as price returns were down 0.07%, ILS Advisers said.

Because of this, pure catastrophe bond funds as a group delivered positive performance for July 2022, but across the funds tracked this averaged just 0.04% for the month.

Meanwhile, the subgroup of ILS funds that also invest in collateralised reinsurance opportunities and private ILS delivered a return of 0.38% for the month.

Across the ILS funds tracked by ILS Advisers and Eurekahedge, 14 delivered positive returns, while 7 were negative for July 2022.

The spread across those was reasonably wide, ranging from a negative -0.4% to a positive +1.9% across the ILS funds, once again displaying the wide range in risk-return profiles available to investors in the ILS market.

As our catastrophe bond fund index page shows, August saw an accelerated recovery in the cat bond market, so it looks like the month could result in very attractive performance for the ILS Advisers Index, as catastrophe loss activity was also relatively benign with no hurricanes forming.

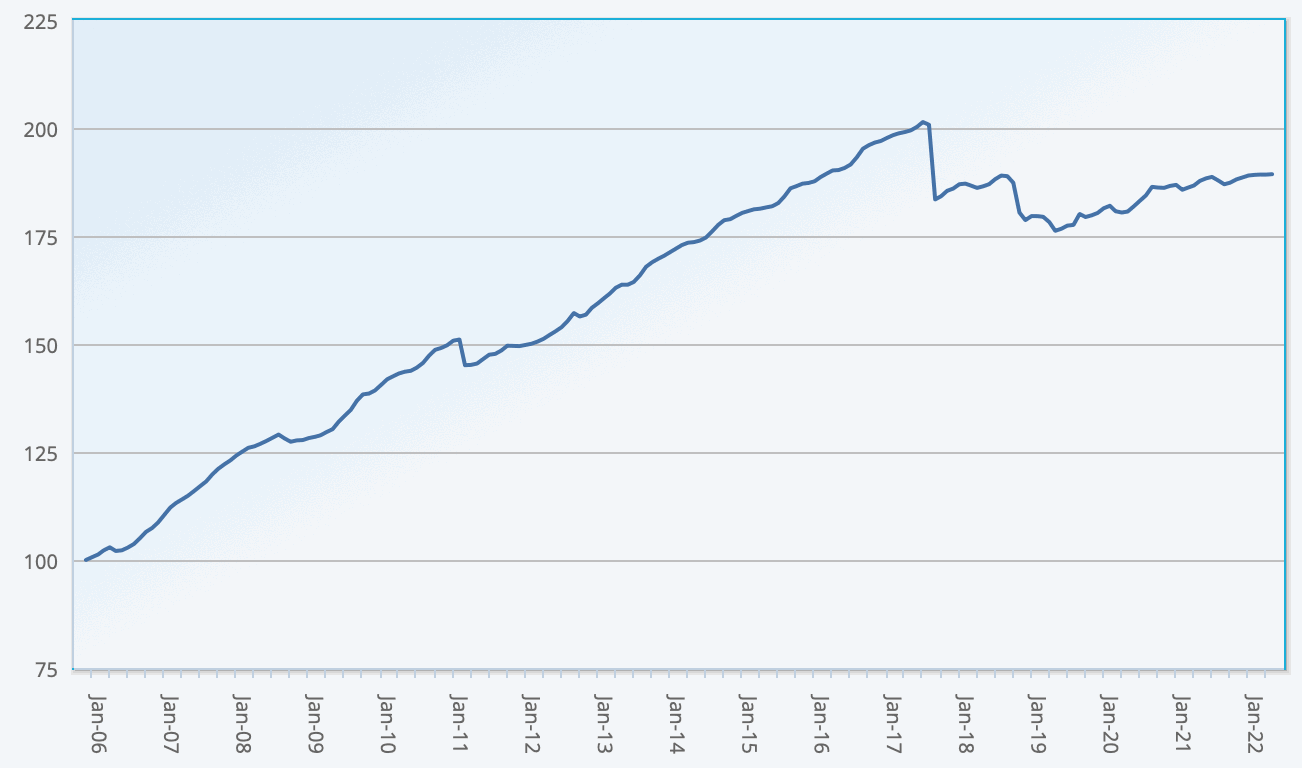

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 27 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.