According to reinsurance broker Guy Carpenter the amount of alternative capital in the market, across insurance-linked securities (ILS) funds, collateralised reinsurance structures and catastrophe bonds, shrank by approximately 2.7% in the first-half of this year.

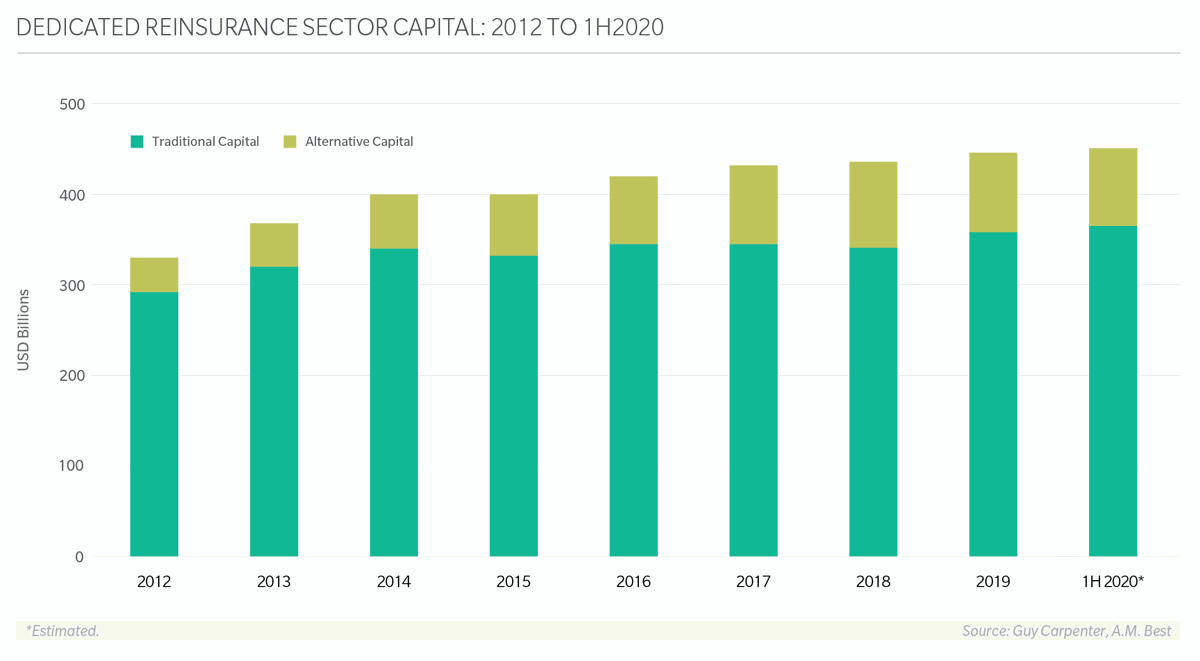

Overall, Guy Carpenter and rating agency A.M. Best estimate that global reinsurance capital rose by 1% in the first-half of 2020, compared to the end of the prior year.

The reinsurance broker notes that there is greater uncertainty around this estimate of reinsurance capital due to the impacts of Covid-19, making it harder to count company funding.

Guy Carpenter notes that recovering financial markets and asset valuations in Q2 have helped the reinsurance market return to overall growth in the period.

But, while the traditional side of the market increased in terms of capital, the alternative side, where the ILS market sits, shrank further by the end of June 2020.

In addition, Guy Carpenter also noted that the reinsurance sector’s capital position has been further bolstered by around US $4 billion of capital raising from public reinsurers in recent months.

At the same time, the reinsurance broker highlights that third-party capital inflows into collateralised reinsurance structures and sidecars have declined year-to-date.

This is down to the current mindset of investors who continue to “assess the uncertainty associated with COVID-19 and prepare for the possibility of trapped capital for a prolonged period of time,” the broker explained.

“Claims from COVID-19 compound the losses sustained over the last three years from a succession of destructive catastrophes and subsequent creep. This is likely to affect insurance-linked securities funds’ ability to raise capital heading into January 2021 renewals,” Guy Carpenter warns.

In addition, the broker said that there is an ongoing reevaluation of the perceived lack of correlation, when it comes to ILS and reinsurance, for systemic, borderless risks such as a pandemic.

On the other hand, catastrophe bonds have been relatively unaffected and continue to see strong investor interest, Guy Carpenter notes.

But the upshot of all of this was a roughly 2.7% shrinkage in available alternative and ILS capital by the mid-point of this year.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.